The Member of Parliament for Ningo-Prampram has advised the Ghana Revenue Authority (GRA) to take into consideration the opinions of stakeholders over the implementation of taxes in future.

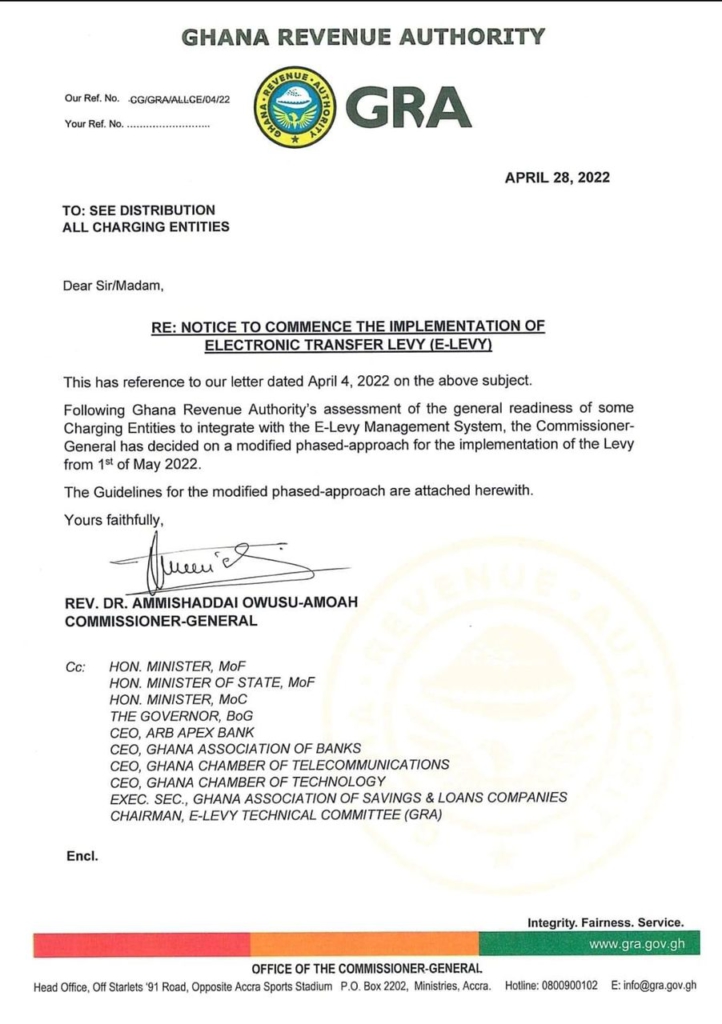

Mr. Sam Nartey George’s caution comes after the GRA on April 28, revealed that it would not be able to fully implement the Electronic Transfer E-levy from May 1.

The GRA says the operationalization of the E-levy will be done in a modified-phased approach.

ALSO READ:

- No thank you – Charlotte Osei’s response to ‘juicy offer’

- Duncan-Williams, Otabil, Nana Konadu, others commiserate with Heward-Mills [Photos]

- Akufo-Addo, Mahama mourn with family of late former First Lady at one-week celebration [Photos]

The Authority came by this decision following an assessment to test the general readiness of some charging entities to integrate with the E-Levy management system.

Before its recent decision, Mr. Sam Nartey George had pointed out to the Authority that it was not ready to fully implement the levy on May 1. But the GRA disagreed.

In view of GRA’s rescission, Mr. Nartey George in a tweet told the Authority: “next time take technical advise when it is given.”

“When you rush, you would crush,” he added.

Dear @GhanaRevenue, next time take technical advice when it is given. When you rush, you would crush. Cheers. ? pic.twitter.com/32N9sleM7D

— Sam ‘Dzata’ George (@samgeorgegh) April 28, 2022

According to the Ningo-Prampram MP, the Application Programming Interface (API) and the security architecture have not been made available to the telecommunications companies (Telcos).

“I can speak on authority that as at close of day as late as 11:00pm last night (Wednesday), when the Commissioner-General for the GRA says all the APIs have been given to all Electronic Money Issuers (EMI) is incorrect. At least two APIs are still outstanding,” he said.

“Critical amongst the two is the reversal API. The GRA at the last technical meeting admitted that because all the robustness tests have not been done for the system, there’s a possibility of downtimes where when you place a call to the API to do all the checks before a tax is applied or not applied, and it’s possible that you will not get the checks done in real-time.”

He stated that this is likely to create problems, including the likelihood of sparking confusion at Mobile money vending points.