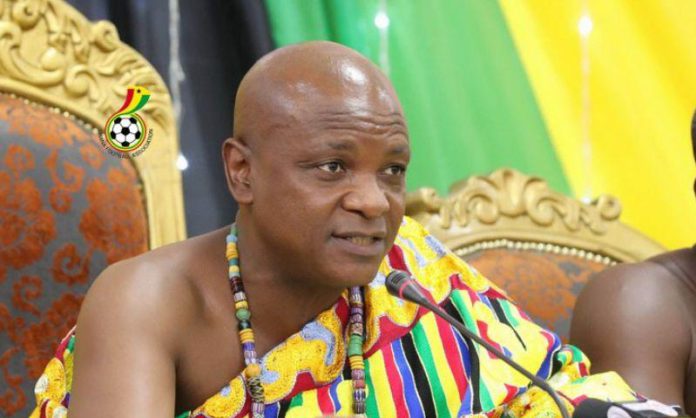

The Agbogbomefia of the Asogli State, Togbe Afede XIV, has supported the position of individual bondholders who are crying for an exclusion from the Domestic Debt Exchange programme.

According to him, the Individual Bondholders Forum’s (IBF) proposal of some fiscal measures to help government save ¢83.5 billion is in the right direction.

Togbe Afede XIV has backed this move expressing the belief that cutting costs to some expenditure projects will help save revenue for the economy.

“There is so much room, I believe, for cutting expenditure. And that is where I think we should be looking at first of all,” he explained.

He added his voice when the Individual Bondholders’ Forum led by convener, Senyo Hosi, petitioned him in his office on Thursday.

During the courtesy call, Senyo Hosi explained that “Togbe the matter is an eye red matter and for someone who has led the capital market and being one of the players who birthed the capital market, besides your royal place as the Agbogbomefia of the Asogli State, you are a pioneer in this industry, I do not want to believe this is your voice and the destination you assured us when your voice was heard back then.

“So we are here to petition your office, to petition you as an individual and the state of Asogli not to sit by and watch the lives of 6.5 million people devastated and subjected to shackles of penury. So our plea here is very simple, the steps being taken by the government are unsustainable and very unnecessary.”

The IBF’s Technical Committee has already issued a statement was issued by the Government of Ghana-Individual Bondholders’ Forum Technical Committee on the Exclusion of Individual Bondholders from the Domestic Debt Exchange Programme.

Providing some more recommendations, the IBF said that the budget provision for the energy sector shortfall of ¢23 billion should be revised downwards by ¢3 billion through the reduction of transmission losses, technical losses, and administrative inefficiencies.

It also stated that government must maintain the 2022 capital expenditure level by reducing the non-Annual Budget Funding Amount (ABFA), Municipal and District Assembly budget and foreign finance of Capital Expenditure by 50 percent.

“Cap the subsidies on the premix petroleum at ¢200 million thereby reducing the budget by ¢150 million. Owing to the wanton abuse of this subsidy, provide discount coupons to registered fisherfolks for the purchase of premix”.

The IBF also advised government to pursue the recovery of lost fund through financial irregularities of Municipal Development Agencies in the Auditor General’s Reports from 2015 to 2022. That exercise, the IBF, say could bring in ¢13.9 billion.

In the oil and gas sector, the group stated that oil production has dropped from over 200kbpd to below 160kbpd yielding a revenue loss of more than $300 million (3.6bn) in 2022.

“The government should, as a matter of urgency, review the regulatory and fiscal environment to encourage existing producers to ramp up production and develop new fields”.

“Government should exercise its right under the Aker petroleum agreement (Deepwater Tano) to repossess the block or compel the immediate commencement of development by the contractor. This field has the potential of delivering up to 100kbpd yielding over GHS5.6bn per year to the government,” it added.

To increase revenue, the IBH urged government to expedite reforms to enforce property taxes.

It suggested that “with landed properties of circa 2,200,000 in Ghana (Ghana Population and Housing Census 2021), we anticipate that achieving an average annual rate of ¢1,000 per property at a collection efficiency of 50%, will yield the government over ¢1.1 billion in revenue”.

“Rise above politics and fully enforce the VAT invigilation that saw the rise of VAT revenue by 1000% in some cases. This assumes a 15% over the 2023 estimated VAT collection of ¢23.7 billion,” the statement said.