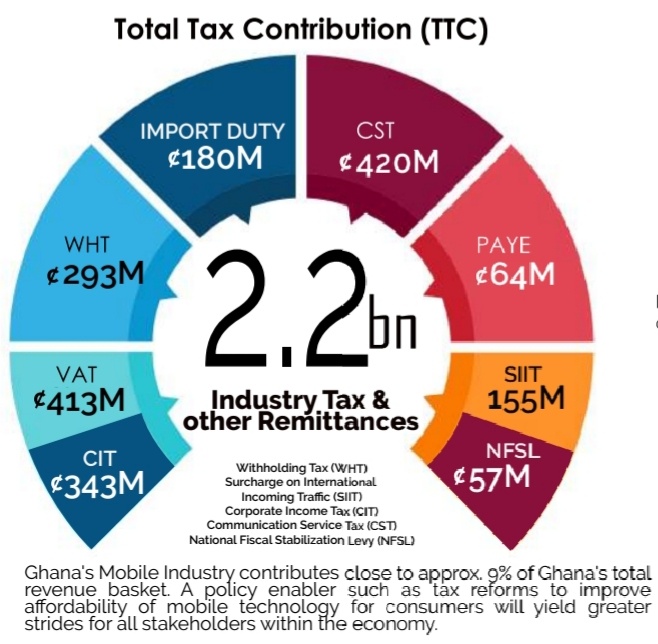

Data on the contribution of telecoms operators to national development indicate that every years telcos pay GHC2.2 billion in taxes, which is almost 9% of Ghana’s annual total revenue basket.

Out of the total, Communication Service Tax (CST) tops with GHC420 million, following by Value Added Tax (VAT), GHC413 million; Corporate Income Tax (CIT), GHC343 million, Withholding Tax (WHT), GHC293 million and Import Duties GHC180 million.

The rest are Surcharge on International Incoming Traffic (SIIT) GHC155 million; SIIT is the quantum of six cents per every minute of call that comes from overseas into the country. Telcos pay that to the National Communications Authority (NCA), who are, by law, allowed to spend it and report to the Finance Ministry.

There is also the pay-as-you-earn (PAYE) tax, which stood at GHC64 million and finally the National Fiscal Stabilization Levy (NFSL), which is GHC57million and paid by only MTN Ghana as the only telco that makes profit after tax in Ghana so far.

NFSL was introduced in 2013 as a way of government appealing to some leading companies in the country to help stabilize the economy over a period of 18 months, ending December 2015. But successive government keep renewing it.

MTN has been appealing for a relief from the NFSL for many years now, but the current government has rather extended it for another five years in their 2020 budget.

The telecoms chamber noted that, in spite of the heavy tax burden, the telecom industry continues to commit investible funds into capital expenditure to meet customer service quality and experience need.

Telcos provide 6,500 direct jobs, and over 1.6 million indirect jobs, contribute 2% of GDP, and invest GHC628 million capital expenditure every year.

The Chamber however holds that some policy enabler such as tax reforms to improve affordability of mobile technology and services for customers, will yield greater strides for all stakeholders in the long-term within the economy.

Currently, telcos in the country wield 37 million active voice SIMs, out of which and whopping 26 million also do data and 13 million are mobile money customers. In terms of coverage, they 87% 2G, 85% 3G and a meager 6% 4G.

This year, a chunk of the telecom spectra license will expire and government will be giving them a renewal fee to pay if they want to continue providing services in Ghana.

Already, some operators and other industry players have invested heavily into 4G spectrum and are yet to recoup their investment, as the market inches fast towards saturation level.

Industry players have always argued that the price of spectrum, as it relates to the nature of the Ghanaian telecoms market, population size and other factors, is very high. But the regulator has always stood its grounds on maintaining the prices that telcos complain about.

The Telecom Chamber believes that going forward, “appropriate spectrum management framework [by the industry regulator] will provide needed clarity for more funding into existing and new technologies such as 4G, which requires policy support to grow.

The Chamber is proposing a technology neutrality policy, where telcos are allowed to re-farm existing used spectrum to deploy higher technology, instead of always having to go buy new spectrum from government to deploy new technology.

They believe that would allow telcos to invest their scarce resources into deploying the technology to benefit all stakeholders, including government, in the long-term, rather than paying huge onetime license renewals fees to the state.