Parliament is set to resume sitting on Tuesday, June 6, 2023, after going on recess in March.

This will commence the Second Meeting of the Third Session of the Eighth Parliament of the Fourth Republic.

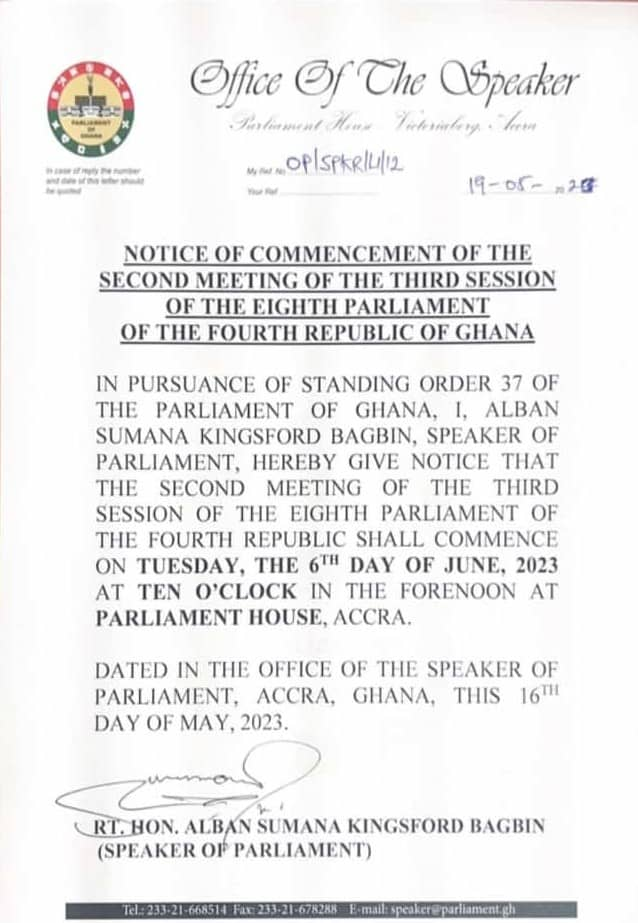

In a statement sighted by JoyNews and signed by Speaker of Parliament, Alban Bagbin, Members of Parliament are expected to be seated by 10:00am at Parliament House, Accra.

Before its break for the Easter festivities, the House passed into laws some three bills.

The bills are the Excise Duty and Excise Tax Stamp (Amendment) Bill, 2022, the Income Tax (Amendment) (No. 2) Bill, 2022, and the Growth and Sustainability Levy Bill, 2022.

The trio, which were passed under certificates of urgency, are projected to complement the government’s efforts to raise more than GH¢4 billion annually.

The Excise Duty (Amendment) Bill, which will impose a 20 per cent tax on cigarettes and e-smoking devices, as well as sweetened beverages, spirits and wines, is projected to rake in about GH¢400 million annually, while the Income Tax (Amendment) Bill will generate about GH¢1.2 billion.

The Growth and Sustainability (Amendment) Bill, which will replace the National Fiscal Stabilisation Levy that currently imposes a levy on companies operating in selected sectors, is also projected to raise about GH¢2.2 billion.

Finally, the National Fiscal Stabilisation Levy itself replaced the National Reconstruction Levy, 2001 (Act 597) and the National Reconstruction Levy (Amendment) Act, 2005 (Act 687), which imposed a 1.5 per cent non-deductible levy on profits before tax of all companies, except rural and community banks.

The House also approved the Ghana Revenue Authority Bill, 2022.

Below is the full statement: