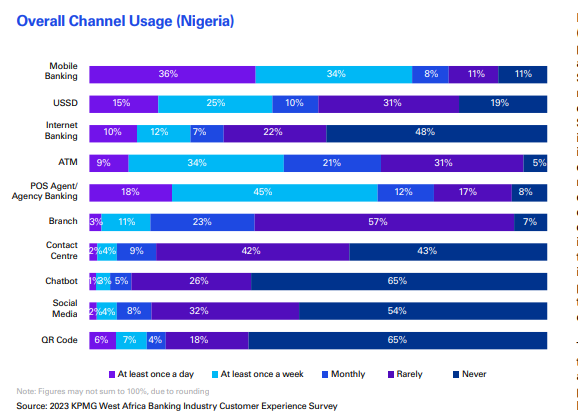

Nigeria is leading Ghana in terms of the frequent use of digital channels, the 2023 KPMG West Africa Banking Industry Customer Survey.

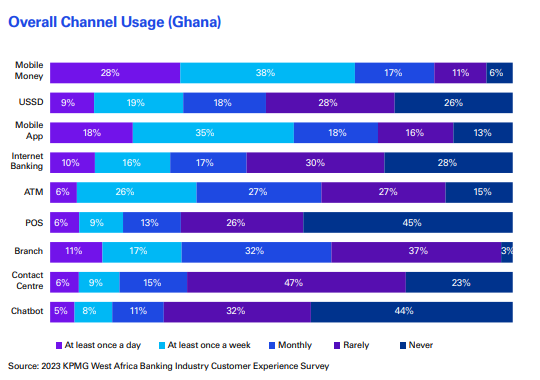

For instance, 70% of customers in Nigeria use their mobile banking app at least once a week compared to 53% in Ghana.

Again, 43% of customers in Nigeria use Automated Teller Machines weekly, as against 32% of Ghanaian customers.

In terms of USSD, 40% of customers in Nigeria use to transact banking through that medium, compared with 28% Ghanaians.

The research is KPMG West Africa’s inaugural combined customer research—the 17th consecutive edition in Nigeria and the 4th in Ghana. It highlights diverse value-seeking behaviours across customer segments.

Regarding online banking importance, 78% of corporates and 52% of Small and Medium Enterprises in Nigeria said the ease of use and variety of features of their bank’s online platform is very important to them, as against 61% of corporates and 44% of SMEs in Ghana.

KPMG explained that the evolving digital landscape in West Africa is dramatically altering its financial ecosystems.

Mobile connectivity has soared, exceeding 100% in Ghana and Nigeria. This surge has sparked a profound shift in the payments sector.