The Minerals Income Investment Fund (MIIF) in 2023 defied all odds and the global economic downturn with a stellar financial performance in 2023 recording a net profit of GH¢409 million from GH¢205 million in 2022.

The Fund also recorded an increase in revenue from GH¢323 million in 2022 to GH¢456 million in 2023.

According to the Chie Executive Officer of MIIF, Edward Nana Yaw Koranteng, MIIF is currently evaluating its assets including the Government of Ghana’s equity interest in mining companies which should place the Fund’s total Assets Under Management (AUM) to around $1.5 billion by end of 2024.

“MIIF’s assets under management may increase to $ 1.5 billion by end 2024, as it begins a revaluation of assets including the Government of Ghana’s free carried interests” he said.

He also added that the growth trajectory of the Fund is attributed to the hard work of the team at MIIF grounded in the vision of the president, Nana Addo Dankwa Akufo Addo to ensure that Ghana garners more value from its minerals.

The main sources of income for the Fund are royalties and dividend payments. Ghana has seven royalty paying minerals with the potential for 15.

Prior to MIIF expanding the royalties net, gold was contributing about 99% of royalties.

The Fund since 2022 has successfully expanded the royalties net by working to include hitherto non-paying minerals such as medium scale gold, sand winning and salt.

Royalties from quarries, limestone and silver have increased significantly with the expansion premised on two major initiatives by the Fund – the establishment of an inter-agency framework and task force in 2022 made up of Ghana Revenue Authority, GRA, Minerals Development Fund, MDF, Ghana Standards Authority, Minerals Commission and the Economic and Organised Crime Office, EOCO.

This framework is part of the strategic thrust of MIIF to enhance the collection of royalties, expand the royalties net and streamline communication on royalty payments from non-gold mining companies.

The second initiative by MIIF in this regard is the development of an in-house geo mapping, tracking and monitoring system which allows a real time view of mining activities from selected mines and quarries across Ghana. This allows tracking of mining companies and payment of royalties on time.

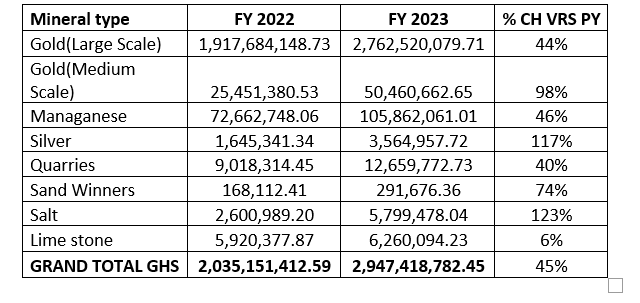

The table below illustrates the growth in royalties following the implementation of the initiatives in 2022 which saw, silver, salt and sand winning paying royalties for the first time.

MIIF’s investments are aligned with industrial policy and premised not just on increasing equity holdings for Ghana but towards the development of the entire value delivery system connected to each single mineral type, said Mr Koranteng.

Major investments by MIIF

MIIF has invested over $40 million in the Chirano and Bibiani gold mines under the Canadian and Franfurt listed Asante Gold Corporation. This investment by MIIF has increased Ghanaian interest to circa 45% making it the only large-scale gold mine with significant Ghanaian interests currently.

The Fund through its investment in the UK and Australian listed Atlantic Lithium is now the third largest shareholder in Atlantic Lithium globally and working on finalising a 6% stake in the company’s Ghana tenements including the Ewoyaa project mine which increases Ghana’s stake in Ewoyaa to 19% on the back of a negotiated 13% free carry for Government of Ghana at a value of $27.9 million.

According to the Chief Investment Officer for MIIF, Bubune Sorkpor, MIIF has also invested $300 million in the development of the Ada Songhor Salt project under Electrochem Ghana.

“Industrial salt is one such mineral if well-developed across its value chain could generate at least $1.0 billion in direct revenue every year.

The Ada acreage of 41,000 acres is the largest in sub-saharan Africa and the investment will push it to become the biggest producing facility in Africa.

The Walvis Bay in Namibia which is the largest in sub-Saharan Africa at 16,700 acres produces circa 950,000 tons per annum with Ada having the potential to produce 2,000,000 tons per annum”, said Bubune Sorkpor.

Leverageing the Capital Markets

In 2023, MIIF executed an MoU with the Ghana Stock Exchange (GSE) with the view to establish a practical framework to set forth the procedures to create an alternative asset class and promote the trade in minerals securities on any of the GSE’s markets.

In line with this MoU, MIIF shall endeavour to have all investments listed on the bourse. In this vein, Electrochem shall be listed on the GSE by end of 2025, Atlantic Lithium and Asante Gold have been listed thereby giving Ghanaians the opportunity to directly participate in these investments.

In view of the opportunity to leverage the GSE, the Fund is developing a gold backed ETF with the support of the GSE and IC Securities. This will be the second listed ETF after the ABSA South Africa New Gold ETF which has been trading on the GSE for at least four years.

The MIIF gold backed ETF will provide the opportunity for Ghanaians and Pension Funds to invest in actual gold backed instruments and also create an alternative to government backed securities.

Enterprise Development (The MIIF Small Scale Gold Mining Incubation Program)

The Chief Technical Officer and Head of Operations of the Fund, Kwabena Barning reiterated the CEO’s position of investment along the entire value delivery process by emphasising the need to formalise the small-scale gold mining sector by supporting the small scale gold miners under a program called the MIIF Small Scale Mining Incubation Programme.

The Small-Scale Mining Incubation Programme (SSMIP) is an enterprise development initiative designed to support the growth of the small-scale gold mining sector. The licensed small-scale sector contributes up to 40% of the total gold output of Ghana and employs more than 10% of the working population.

The MIIF Small-Scale Mining Incubation Programme will be in the form of equity investment in the form of capital support, mining equipment, gold traceability mechanisms, imbuing beneficiary firms with corporate governance principles, exacting responsible mining methods to forestall environmental degradation as well as the provision of a ready offtake market through the MIIF Gold Trade Desk for the licensed miners.

According to Mr Kwabena Barning, “This initiative will be the most revolutionary in artisanal mining in Africa”.

Mr. Koranteng emphasised the belief that the SSMIP has the potential to triple the small-scale output which is currently around $2 billion a year.

The objective of the SSMIP is to develop the creation of Ghanaian mid-tier gold mining companies, which would lead to the formalisation of the sector with an attendant impact on eradicating illegal mining. In addition, this programme plans to move beneficiary companies from their artisanal status to high performing junior mines that can be listed on the Ghana Stock Exchange. The pilot phase of this project has begun with an initial investment outlay of $30 million over the next two years with a plan to cover over 100 companies within the next eight years.

The MIIF Gold Trade Desk

MIIF commenced the operationalisation of its Gold Trade Program in August 2023 with a strategic goal of integrating its investments along the whole value chain of commodities invested.

Trade has attracted total inflows of $719 million into the Ghanaian economy between August 2023, and July 2024 through its Gold Trade Desk. Out of these inflows, MIIF has traded foreign exchange amounting to US$531 million over the period with Bulk Oil Distribution Companies (BDCs) in support of the Government’s gold for oil programme.

Source; Myjoyonline