The Minority caucus of parliament has predicted that it would not come to them as a surprise if the government sought an International Monetary Fund (IMF) “bailout” to support the fiscally-challenged economy.

The Minority made the prediction in a statement they released as a reaction to the government’s mid-year budget, a day after it was presented to parliament by the Finance Minister, Ken Ofori Atta.

In the statement signed by the caucus’ ranking member of the Finance Committee of Parliament, Cassiel Ato Forson, the Minority said the country was reeling under a ” high level of public debt”.

“Given the fiscal challenges confronting the country and the high level of public debt, it would not come as a surprise if Ghana seeks a “bailout” from the IMF less than two years after exiting a similar programme that the current administration proudly touted as an achievement,” the statement stated.

They also pointed to the introduction of additional taxes as ” an indication of the troubling times”.

“The Mid-year budget clearly showed that the public finances are in dire straits and the resort to additional tax measures is an indication of the troubling times that we are in,” the statement said as part of the conclusions drawn by the minority.

Below is the full statement:

MIDYEAR BUDGET REVIEW – RESPONSE OF THE MINORITY. INTRODUCTION

Good morning ladies and gentlemen of the media and welcome to this encounter at which we will carry out an assessment of the state of the Ghanaian economy and put forward our position on the Mid-year review budget presented by the Finance Minister yesterday.

When President Akufo Addo took over the reins of government in January 2017, he promised to turn the fortunes of the Ghanaian economy around and improve upon the livelihood of the average Ghanaian.

After almost three (3) years of his four (4) year mandate, he is still in the business of sloganeering and the implementation of economic policies that do not translate into improving the standard of living of Ghanaians.

He appears rather obsessed with churning out macroeconomic indicators that have little or no bearing on the hardships confronting Ghanaians. These indicators in any event stem largely from the work done by his predecessor, President John Dramani Mahama.

1.1 Despite the lofty and flowery talk, in the last two and half years, the Ghanaian economy has been largely characterized by:

❖ a rapidly deteriorating standard of living of the average Ghanaian;

❖ increasing hardships with periodic rises in the prices of goods and services.

❖ increasing cost of utilities, particularly, energy, water and petrol;

❖ businesses struggling to keep up with their operations due to the high cost of doing business; ❖ the collapse of businesses with the accompanying job losses;

❖ the still-developing private sector struggling to create and sustain jobs;

❖ the adoption of tax regimes that are stifling production and aggregate demand;

❖ a high rate of debt accumulation due to the government’s insatiable appetite for borrowing;

❖ increasing external vulnerabilities and exposures that culminated in a rapid depreciation of the cedi during the first quarter of the year.

The stability of the cedi is on a life support system which cannot stand the test of time;

❖ unprecedented failure of government flagship policies and programmes that have consumed a considerable portion of public funds;

❖ public financial management maneuverings which have often delivered cosmetic deficit numbers.

Ghanaians are suffering under the leadership of the NPP government that benefited greatly from the positive gains they inherited from the John Mahama led administration.

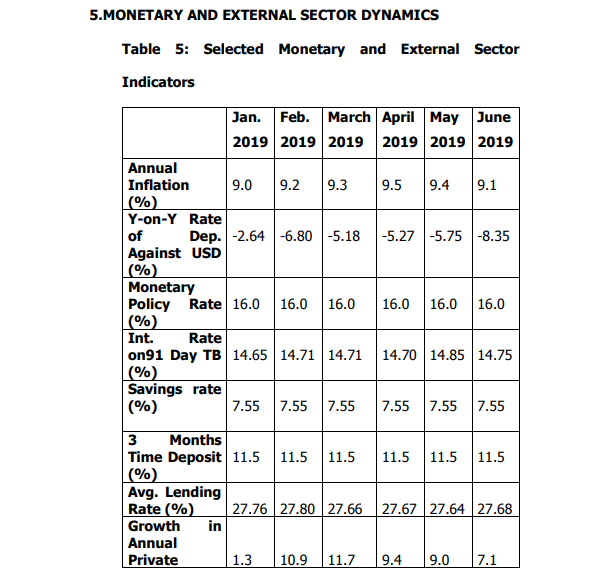

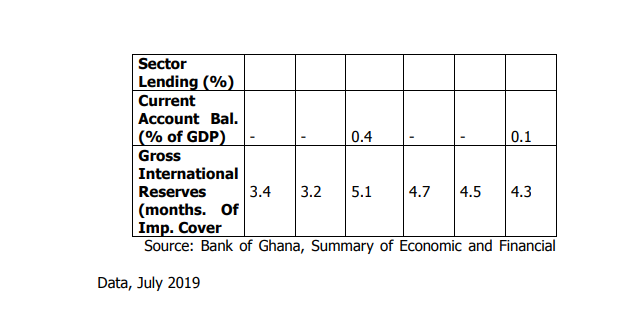

1.2 We intend to touch on all sectors of the economy, i.e. economic growth; the fiscal, monetary, and external sectors; and the public debt situation.

ECONOMIC GROWTH AND REAL SECTOR DEVELOPMENTS

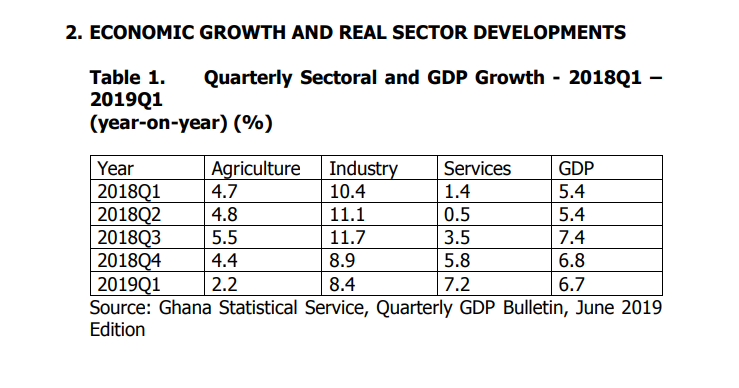

2.1 Overall growth of the Ghanaian economy during the first quarter of 2019 was 6.7 percent driven by the industrial sector (oil) which grew at 8.4 percent, followed by the services sector, 7.2 percent and the agricultural sector, 2.2 percent.

Apart from the services sector which showed an increase in growth from 5.8 percent in the last quarter of 2018 to 7.2 percent in the first quarter of 2019, all other sectors saw a decline in growth.

Surprisingly, after all the money spent on the so-called “planting for food and jobs” growth in the agricultural sector has not seen any significant change, from the first quarter of 2018 to the first quarter of 2019 and in fact growth declined from 4.4 percent in the last quarter of 2018 to 2.2 percent in the first quarter of 2019.

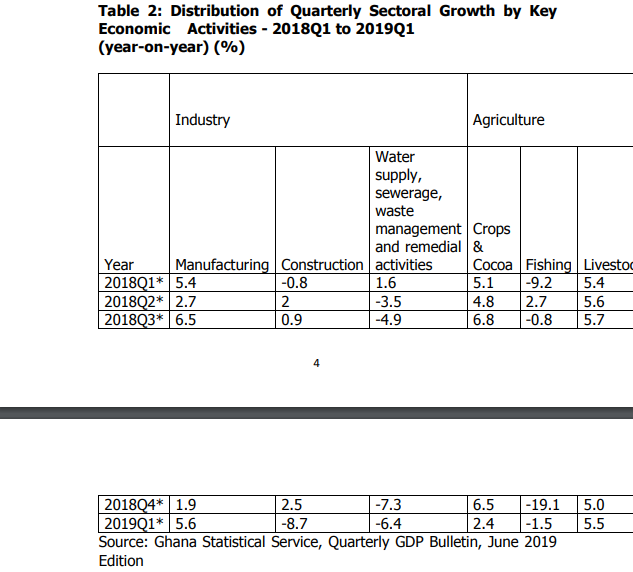

2.2 Distribution of the sectoral growth by key economic activities portrays some worrying developments.

i. Despite the promise by the President to make Accra the cleanest city in Africa, water supply, sewerage, waste management and remedial activities have been experiencing negative growth rates in the last four quarters. It is not surprising that every corner of the city has become a dump site with the city getting flooded after just thirty minutes of rain.

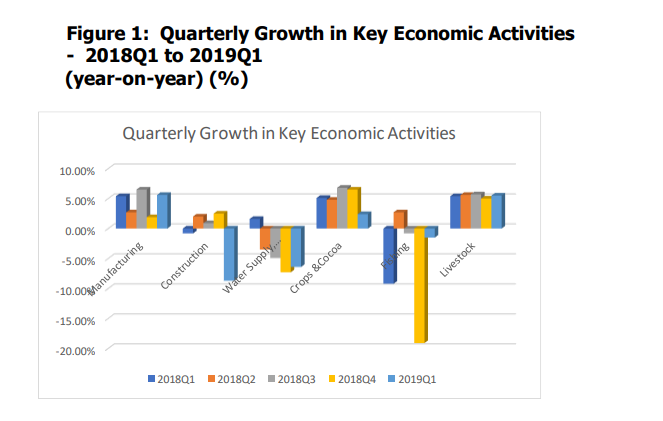

ii. Construction saw a negative growth of -8.7 percent during the first quarter of 2019. The contraction is attributable mainly to the -20.00% -15.00% -10.00% -5.00% 0.00% 5.00% 10.00% Quarterly Growth in Key Economic Activities 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1suspension of contracts by the Government, and the Government’s failure to honour payments for work done by contractors. This has led to significant job losses.

iii. Fishing has also seen negative growth rates in the last three quarters resulting in the worsening of the livelihood in our fishing communities. The increasing cost and diversion of premix fuel is adversely affecting fishing activities.

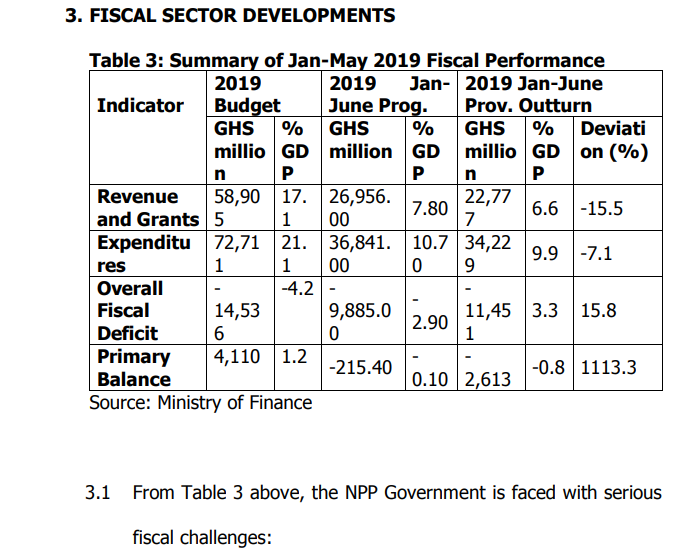

i. Revenue and grants through the first six months of the year was 15.5 percent below target. Key sources of revenue all fell below target: personal income tax by 7.0 percent, customs NHI levy by 18.9 percent, customs GetFund levy by 22.5 percent, import duties and levies by 20.6 percent, luxury vehicle levy by 78.5 percent, yield from capping policy by 53.1 percent, ESLA by 31.0 percent, and grants by 60 percent.

ii. Expenditures on the other hand exceeded its target by 4.2 percent.

iii. These developments resulted in the widening of the overall fiscal deficit to 3.3 percent of GDP as against a programmed target of 2.9 percent of GDP and a programmed 2019 budget deficit of 4.2 percent of GDP.

iv. The primary balance deficit was 0.8 percent of GDP as against a programmed deficit of 0.1 percent of GDP. 3.2 The programmed budget deficit target for the 2019 fiscal year of 4.2 percent of GDP was set when Ghana was preparing her last Budget under the IMF programme and to officially exit the programme.

3.3 The 4.2 percent deficit target was to demonstrate to the Fund that the Government was capable of mobilizing resources 8 domestically to effectively manage Ghana’s public finances after its exit from the IMF programme, and to boast investor and market confidence.

3.4 This trajectory of fiscal challenges will continue till the end of the year making it almost impossible to achieving the deficit target.

3.5 The fiscal pressures that will drive up the fiscal deficit emanate from the following:

a) additional expenditure pressures from the $700m owed independent power producers (IPPs). Ghanaians will soon see the return of “dumsor” if government fails to settle the debt owed the IPPs;

b) the loss of government revenue of over GHS 1 billion following the adoption a number of populist fiscal measures shortly after Ghana officially exited the IMF program following the granting of a waiver on some performance criteria by the IMF Board;

c) the nonperformance of the unproductive luxury vehicle tax;

d) a distortion of revenue inflows as a result of the decoupling of the NHIL and GetFund component of VAT;

e) expenditure pressures emanating from the increase in the wage bill through the appointment of a large number of political operatives by the President and debt service cost resulting from reckless and excessive borrowing.

According to government’s public finance statistics, Ghana’s wage bill and debt service cost as at the end of first quarter of 2019, stood at about 93 percent of total revenue and grants and is projected to reach 95 percent by the time the midyear budget.

f) accumulation of arrears from the non-settlement of government indebtedness to contractors. Our projection, based on governments own fiscal data, shows that if the trend continues, the accumulation of arrears alone will reach 30 percent of GDP about GHS 100 billion)

g) the predominance of government’s expenditure on consumption. For the first quarter of 2019, expenditure on goods and services constituted about 17.5 percent of total revenue and Grants while domestically financed capital expenditure was just about 5 percent of total revenue and grants;

h) the proposed revenue assumptions at the time of the 2019 were unrealistic and will fail the test of time.

3.6 The proposed financing options for 2019 will severely compromise the government fiscal position. These proposed financing operations were as follows:

a) Government guarantee for GNPC to borrow about $250 million to finance energy projects;

b) leveraging mineral royalties as collateral to borrow $200 million;

c) securitization of GETFund revenues to borrow $1.5 billion;

d) the $ 2 billion from sinohydro deal

3.7 Technically, these financing options cannot be treated outside the fiscal and will add to the deficit because they are either treated as explicit or implicit contingent liabilities and once they crystalize, government will have to honour payment accordingly.

3.8 The Fiscal outlook remains challenging with the fiscal deficit likely to exceed the Fiscal Responsibility Threshold of 5 percent of GDP. We should expect a fiscal deficit level of 5±2 percent of GDP.

3.9 Let me put it on record once again that we did indicate that one of the main drivers of depreciation of the cedi when we issued a statement earlier was fiscal risk as a result of government policy inconsistencies which is sending a whole lot of negative signals to the investor community.

3.10 Investors form rationale expectations based on past experiences. They are aware that government recently announced unsustainable policies which exert intense pressures on its fiscal position and lead to severe liquidity constraints. These eventually pose challenges for government in honoring its obligations to investors.

3.11 It is unfortunate that less than a year after Ghana exited the IMF programme, our public finances have been severely derailed, and we are at the risk of losing our credibility. Investors are expressing mixed feelings and reactions. It is a mark of policy inconsistency that government to announce a contractionary fiscal stance and yet assumed the path of expansionary fiscal policy.

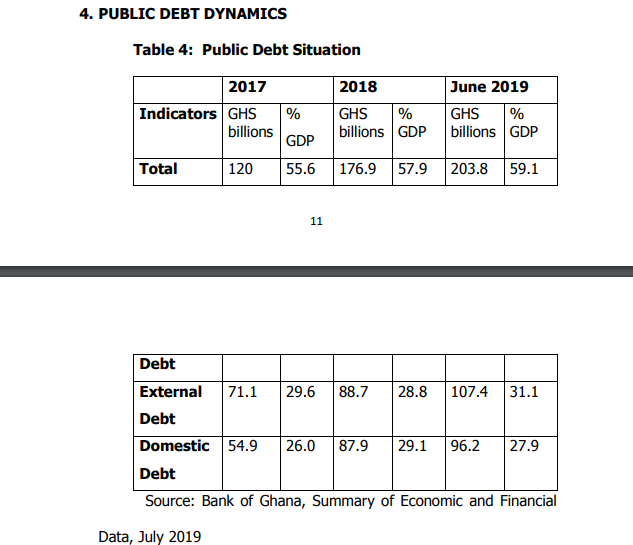

4.1 From the Minister’s presentation yesterday, it came to light that our public debt has risen sharply from GHS 120 billion as of December,2016 to GHS 204 billion as of June,2019 representing an increase of about GHS 84 billion in the last two and half years under President Akufo-Addo. This has brought the debt to GDP ratio to 59.2 percent from 55.6% in December,2016 even with the benefit of a rebased economy.

4.2 Surprisingly, the government has “cosmetically” posted a positive primary balance for two consecutive years at a time when the public debt has ballooned to GHS 204 billion. This has clearly exposed this cosmetic approach to fiscal accounting.

4.3 We project that based on government’s appetite for borrowing and the current trend, our public debt will reach GHS 220 billion by the close of the 2019 fiscal year, representing about 62% of GDP. This would mean that in three years, President Akufo-Addo would have added GHS 100 billion to the public debt. We wish to stress that this only represents what has been added since 2017.

In all, President Akufo-Addo has borrowed about GHS 160 billion (not what is added to the public debt) since 2017 with part of it used for debt reprofiling. The public debt would exceed the projected GHS 220 billion, once draw-down begins for a number of loans approved by Parliament. This rapid increase in the public debt level means that we have reached a point of debt unsustainability, a fact confirmed by the World Bank Country Director. This also is at variance with what the President and his party told the people of Ghana in opposition. They created the impression that they could govern the country without borrowing and that even if they borrowed at all, the funds would solely be channeled into capital investments.

After adding GHS 84 billion to the public debt, President Akufo-Addo cannot point to any significant capital investments made over the last three years. Almost all of the borrowed funds have gone into consumption related expenditure.

6.KILLER TAXES In the run up to the presentation of the mid-year budget yesterday, several stakeholders within the Ghanaian economy including business associations called on President Akufo-Addo to review several taxes and avoid the imposition of new ones. These calls appear to have fallen on deaf ears because contrary to expectations, President AkufoAddo through the Finance Minister, slapped increases on three taxes that form part of the ESLA and the Communication Service Tax.

Under the ESLA increments, an average increase of 25% was imposed on the Power Generation and Infrastructure Support Levy, Road Fund Levy and the Price Stabilization and Recovery Levy. This means that 16 once they come into effect, consumers will be paying almost GHS 1 on petrol and diesel and GHS 1.7 on 14kg cylinder filled with gas.

If these increases create frustration and Ghanaians wish to vent through phone calls or on social media, the Mid-year budget has made that expensive as well following the imposition of a 50% increase in the Communication Service Tax from 6% to 9%. These measures will send shock waves through many households and businesses as this will only further compound the excruciating hardships Ghanaians are already going through.

These taxes will add on to a raft of taxes imposed by President AkufoAddo despite his promise not to do so in opposition.

These include;

• The 5% backdoor increase in VAT couched as NHIL and GETund Levies

• The Luxury car tax of between GHS 1,000 and GHS 2,000

• 3% VAT flat rate scheme which has the cascading effect of making businesses pay as much as 20% VAT 17

• The extension of the National Fiscal Stabilization Levy which should have been scrapped in 2017 in compliance with the sunset clauses in the enabling legislation

• The retention of the Special Import Levy beyond the sunset clause

• The failure of the NPP to reduce corporate tax from 25% to 20% as promised

• Already, fuel prices have gone up on 23 different occasions

CONCLUSIONS

5.1 Given the fiscal challenges confronting the country and the high level of public debt, it would not come as a surprise if Ghana seeks a “bail out” from the IMF less than two years after exiting a similar programme that the current administration proudly touted as an achievement.

5.2 The Mid-year budget clearly showed that the public finances are in dire straits and the resort to additional tax measures is an indication of the troubling times that we are in.

5.3 The populist policies adopted by President Akufo-Addo have come full cycle and are throwing all the gains made from the fiscal consolidation prior to the coming into office of the NPP government, out of gear. It has become obvious that the NPP has no intention of keeping their promises to Ghanaians when it comes to borrowing and the public debt, the imposition taxes, fuel price adjustments and the resolution of the general hardships facing the people.

5.4 The mid-year budget presented by the Finance Minister only offers gloom and portend very difficult times for all Ghanaians. There is therefore the need for the Akufo-Addo government to change course or they will plunge the economy into much bigger challenges.

CASSIEL ATO FORSON RANKING MEMBER, FINANCE COMMITTEE OF PARLIAMENT