The Insurance Brokers Association of Ghana (IBAG) has warned of a growing trend where non-professional institutions, particularly financial institutions, are selling insurance products, often resulting in poor client experiences and tarnishing the industry’s image.

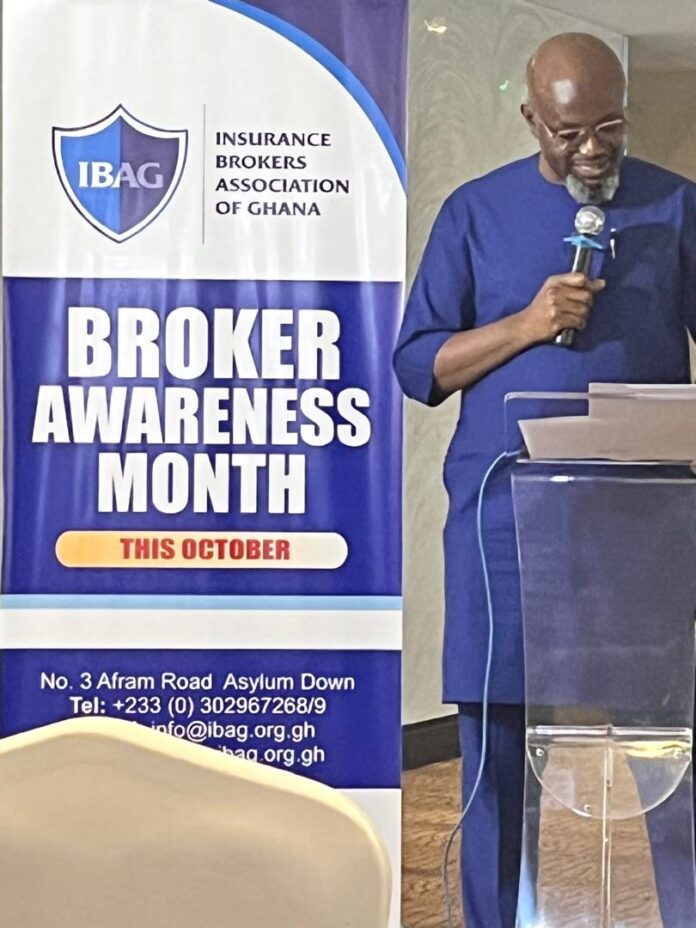

Speaking at a media interaction with Senior Editors in Accra, Shaibu Ali, president of IBAG, emphasized the crucial role brokers play in the insurance ecosystem.

Mr Ali said despite the professional guidance clients of insurance brokers receive, their services are at zero cost to those who use brokers’ services.

Mr Ali has attributed the negative experiences of clients of insurance companies to the public’s penchant for sidestepping insurance brokers in their dealings.

“Many of the negative experiences clients face, stem from dealing with non-insurance institutions. It’s easy to sell a product, but when it’s time for claims, the problems arise,” the IBAG President explained.

“This is why we need your support in educating the public to ensure they buy insurance from the right sources.”

IBAG, which was established in 1988 with a membership of up to 102, represents professional intermediaries such as brokers, reinsurance brokers, loss adjusters, and technical service providers.

These brokers act independently, representing the interests of clients rather than insurance companies, unlike agents.

They play a vital role in simplifying insurance for individuals and businesses, particularly in light of the current economic challenges.

IBAG called on the media to help educate the public to seek insurance only from licensed and authorized brokers.

IBAG has designated October as a month for raising awareness about the role and relevance of insurance brokers.

The association believes that a well-informed public, guided by professional brokers, is key to ensuring financial security and adequate protection against potential risks.

The event, attended by senior editors and media executives, was aimed at fostering stronger ties between IBAG and the media, ensuring accurate dissemination of information regarding insurance policies, claims processes, and the importance of using licensed brokers.

“We see the media as a strategic partner in educating the public about the relevance of insurance brokers. Your role as influencers and decision-makers is critical in helping us promote insurance penetration and ensure consumers are well-informed,” said Mr Ali.

The association stressed the need for public awareness of the value brokers add by guiding clients through purchasing the right insurance, ensuring smooth claims processes, and negotiating on behalf of clients—at no extra cost to the insured.