The International Monetary Fund (IMF) has commended the Bank of Ghana (BoG) on its dollar accumulation programme aimed at rebuilding the international reserves of the country.

According to the IMF, the BoG has made some significant progress in improving its position since Ghana signed up to the IMF programme in 2023.

This is what JOYBUSINSS has picked up from persons close to the IMF Mission who were in Ghana for a one week visit to review Ghana’s half year Economic Data.

The IMF Staff also believed that the BoG has kept a prudent monetary policy stance that has helped to sustain a rapid reduction in inflation.

The Staff also held the view that the required measures have been instituted by the BoG to strengthen and preserve financial sector stability, including the “implementation of banks’ recapitalization plans”.

Reserve position of Ghana

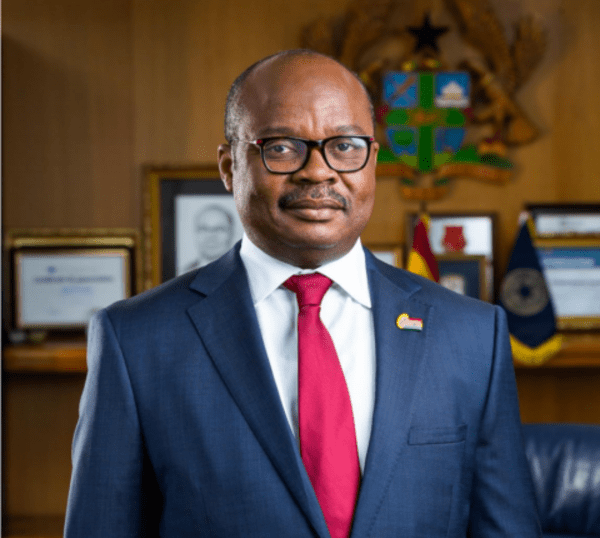

Governor of the BoG, Dr. Ernest Addison speaking at the launch of the SME Growth and Opportunity Summit in Accra on July 16, 2024 revealed that Ghana’s International Reserve position has improved substantially.

“It has reached US$6.59 billion at the end of April 2024. This actually represents 3 months of import cover, compared with US$5.91 billion (2.7 months of import cover) at end-December 2023”, he announced.

Dr. Addison at a separate event also revealed that the BoG has added 700 million dollars to their reserves for this year.

Why the visit

JOYBUSINESS has learned that the visit was at the request of the IMF Executive Board to get some update on Ghana’s Economic Data, after it passed the country second review.

Sources say the data used for the second programme was up to May 2024. The IMF, therefore wanted latest numbers on the economy up to the middle of 2024.

The team also wanted to establish whether Ghana was on track, and also get update on the outlook for the economy in the near future. The IMF staff is expected to update on the Board on the made under the programme.

Concerns

The IMF Staff expressed concern about Ghana’s high food inflation, despite the progress made in reducing overall inflation.

The team also raised some concerns about payments being made to the Independent Power Producers and its impact on BoG’s Reserves.

The IMF Board has noted the medium-term outlook remains favourable but subject to downside risks—including those related to the upcoming general elections.

“Sustaining macroeconomic policy adjustment and reforms are essential to fully and durably restoring macroeconomic stability and debt sustainability, especially during the upcoming electoral period, while fostering a sustainable increase in economic growth and poverty reduction”, the IMF Board warned.

READ ALSO: