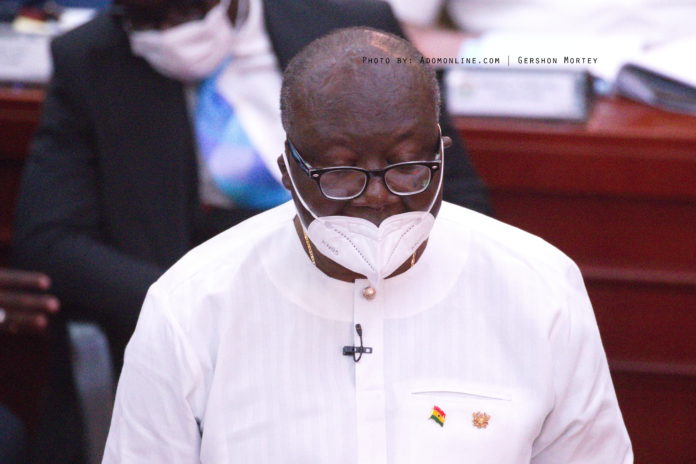

There will be a staff visit of the International Monetary Fund (IMF) to the country next week, the Minister of Finance, Ken Ofori Atta, has announced.

He said the meeting would afford the government and the IMF staff the opportunity to discuss a raft of measures being undertaken by the government to restore the economy from the recent shocks.

Chief on the agenda would be what the Finance Minister described as the “elephant in the bag” being the country’s rising debt stock.

Answering questions from the media after announcing measures to cushion the public against the myriad of challenges that have arisen as a result of the COVID-19 pandemic and the recent Russia-Ukraine conflict, Mr Ofori-Atta said “we will consider the issues by tapping into their knowledge and our knowledge to think through and see how to reprofile the debt to give the fiscal space for the future.

“So it is going to be such a positive engagement using the knowledge they have and what we have to look into the future”.

Debt stock

At an emergency Monetary Policy Committee meeting earlier this week, it was revealed that the country’s public debt stock increased to GH¢351.8 billion which is 80.1 per cent of Gross Domestic Product (GDP) at the end of December 2021, compared to the GH¢291.6 billion which was 76 per cent of GDP, at the end of December 2020.

Of the total debt stock, domestic debt was GH¢181.8 billion, which is 41.4 per cent of GDP, while the external debt was GH¢170 billion, representing 38.7 per cent of GDP.

No IMF programme

On the issue of whether the government will go to the IMF for a programme in view of the challenges bedevilling the economy, the Finance Minister once again ruled that option out.

“We have told you already that we are not going there. We are not going to the IMF.

“But we have also told you that we have incredibly good relationship with them. We will continue to rely on their stock of knowledge and advise and we will continue to tap into that”.

There have been calls from various quarters for the government to take a programme with the IMF as part of efforts to salvage the economy from its current position but the government remains adamant as it is focused on its own home-grown policies to return the economy back on track.

Economic challenges

There have been growing price pressures on the back of increasing fuel prices and a steep decline in the value of the local currency, the Ghana cedi.

While inflation peaked at 15.6 per cent in February this year, the cedi lost about 14.6 per cent of its value to the US dollar last week, according to Bank of Ghana data.