President Nana Addo Dankwa Akufo-Addo is courting the support of Japan to help Ghana reach an agreement with the International Monetary Fund (IMF) Board for the three billion dollar balance of payment support.

According to President Akufo-Addo, Japan, which is a member of the Paris Club, has a major role to play in Ghana securing the IMF deal.

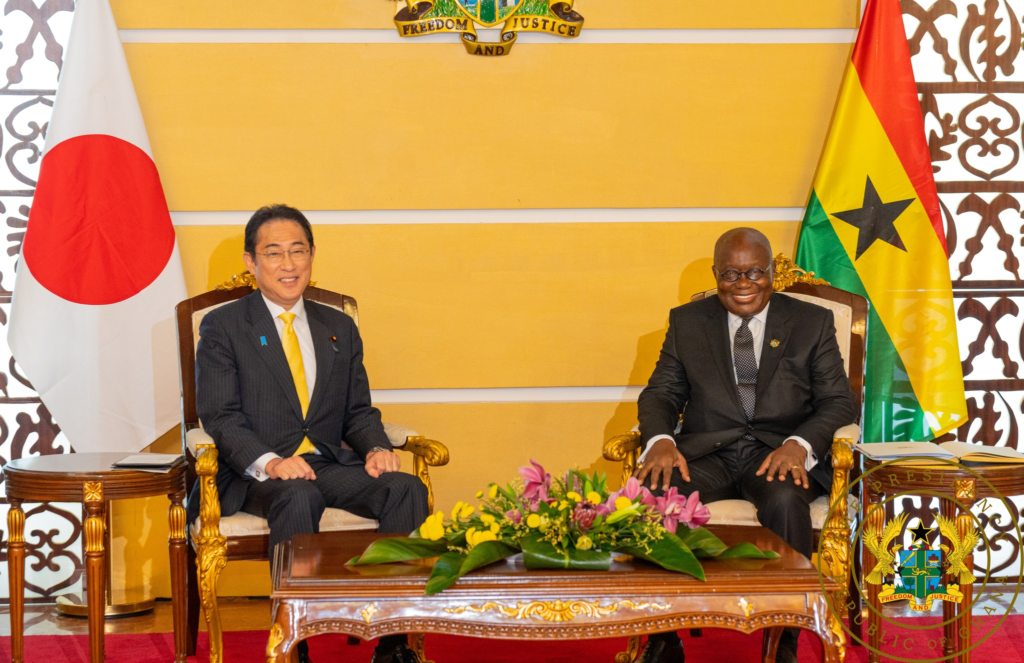

Speaking at a meeting with the Japanese Prime Minister, Fumio Kishida, who made a stopover at the Jubilee House Tuesday evening, President Akufo-Addo said Ghana will repay Japan’s support.

“Ghana is also counting on the support of Japan in reaching a favourable agreement with the International Monetary Fund which will pave the way for the robust recovery of Ghana’s economy,” President Akufo-Addo said.

In July 2022, Ghana requested for a three-year, US$3bn extended credit facility (ECF) from the IMF.

An arrangement was agreed with the IMF in December 2022, with the aim of restoring credibility among investors, building reserve buffers and improving fiscal and debt sustainability.

However, debt restructuring needs to be agreed upon with Ghana’s external creditors before the IMF’s Executive Board can sign off on the ECF.

Meanwhile, Ghana’s hope of securing an IMF board approval is expected to delay owing to prolonged external debt-restructuring negotiations, and the involvement of numerous stakeholders in the process, according to the Economic Intelligence Unit (EIU).

The EIU in its 2023 Country Report on Ghana, stated that it anticipates Ghana to secure restructuring agreements on its public external debt in 2023-24, involving official and private creditors alike.

It however, notes that, given the country’s pressing macroeconomic crisis, “the conclusion of a domestic debt-swap operation in February and increasing international attention on speeding up external debt restructurings, our core forecast remains that the IMF programme will be approved by mid-2023.

“We expect Ghana to secure restructuring agreements on its public external debt during 2023-24, involving official and private creditors alike. This will include a combination of write-offs, maturity extensions and reductions in interest rates. We expect official creditors to agree to a deal in 2023, and this, combined with the domestic debt restructuring that has already been secured, should provide enough reassurance to reduce Ghana’s risk of debt distress and allow the IMF to approve the agreed programme.”

“However, there is a material risk that IMF board approval will be delayed owing to prolonged external debt-restructuring negotiations, given the involvement of multiple stakeholders in the process,” it noted.