Vice President of Group Nduom, Nana Ofori Owusu, has clarified the situation of GN Savings and Loans compared to other local banks whose licenses were revoked by the Bank of Ghana in 2017.

He said, unlike other banks, GN Bank was converted to a Savings and Loans Institution and subsequently collapsed without ever receiving a bailout from the Central Bank.

This statement follows remarks made by Dr. Papa Kwesi Nduom, Chairman of Groupe Ndoum and owner of the defunct Gold Coast Fund Management Company. Dr. Nduom claimed over the weekend that the government still owes his companies and subsidiaries over GH¢7 billion.

To help revive his companies, Dr. Nduom has urged the government to reimburse contractors who had borrowed money from Groupe Ndoum.

He argued that, if the government had paid some of the contractors years ago, his companies would not be facing the current financial challenges.

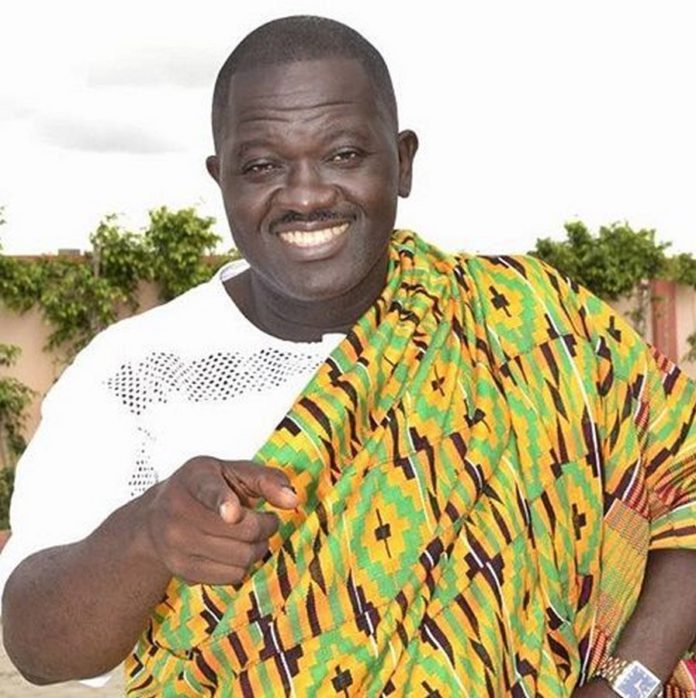

Speaking on Citi FM, Mr. Ofori Owusu stressed the uniqueness of GN Bank’s situation, distinguishing it from other cases in the banking sector.

“A statement was made that some people have been jailed in the banking sector, I want people to understand that this is not a ‘banku effect’; that everybody is the same. Somebody was jailed for taking a bailout from the Bank of Ghana and using it in a way that was not appropriate. With the GN bank matter, GN has never taken a bailout from the Bank of Ghana,” he stated.

The conversation around bailouts and financial misconduct in the banking sector was reignited by the recent imprisonment of William Ato Essien, the former CEO of the now-defunct Capital Bank.

On October 15, an Accra High Court, led by Justice Kyei Baffour, sentenced Mr Essien to 15 years of imprisonment with hard labour after he failed to repay GH¢90 million to the state as ordered by the court.

Mr Essien had previously struck a deal with the state under section 35 of the Courts Act, which allows for an accused person to plead guilty and make restitution for financial losses to the state, potentially avoiding a custodial sentence. Despite this agreement, he did not fulfil his financial obligations within the stipulated timeframe.

READ ALSO: