Ghana has maintained its status as a high-risk, debt-distress country after first making it onto the infamous list of countries whose debt burdens had reached alarming levels in 2015.

In separate reports released in March and April, the World Bank and the International Monetary Fund (IMF) confirmed that the country was in a high risk of debt distress and now required aggressive strategies to slow down the debt growth and ease repayment constraints before they combine with other ailing fiscal indices to cripple the economy further.

By remaining on the list of high-risk distress countries, Ghana is now part of 18 other low-income countries (LICs) in Africa, where debt sustainability analyses (DSAs) by the IMF and the World Bank show protracted breach of debt or debt service thresholds.

This means that the country is now one step short of slipping into the danger zone — debt distress, which comprises countries already experiencing difficulties in servicing their debt and whose debt service indicators are in significant or sustained breach of thresholds.

It also means that the country’s risk of default is now high, a Professor of Economics and Head of the Economics Department at the University of Ghana, Legon, Prof. Peter Quartey, said in an interview.

“We should be concerned because when you have that risk, the interest you pay when you want to raise additional funding increases.

“It means we are a risky borrower and investors will factor in this risk element in determining our interest rates,” he added.

The DSA is based on a framework that was co-developed by the Bretton Wood institutions about a decade ago to serve as a guide in assessing the debt of LICs worldwide.

As of March this year, the results of the analyses showed that six countries were in debt distress, 25 were at high risk of debt distress, 27 were at moderate risk and 13 were at low risk of debt distress.

While admitting that various factors could push a country into the high risk debt distress category, an Economist and Senior Research Fellow at the Institute for Fiscal Policy (IFS), Dr Said Boakye, said in a separate interview that the amount of a country’s total revenues and grants used to service its debt was a key indicator.

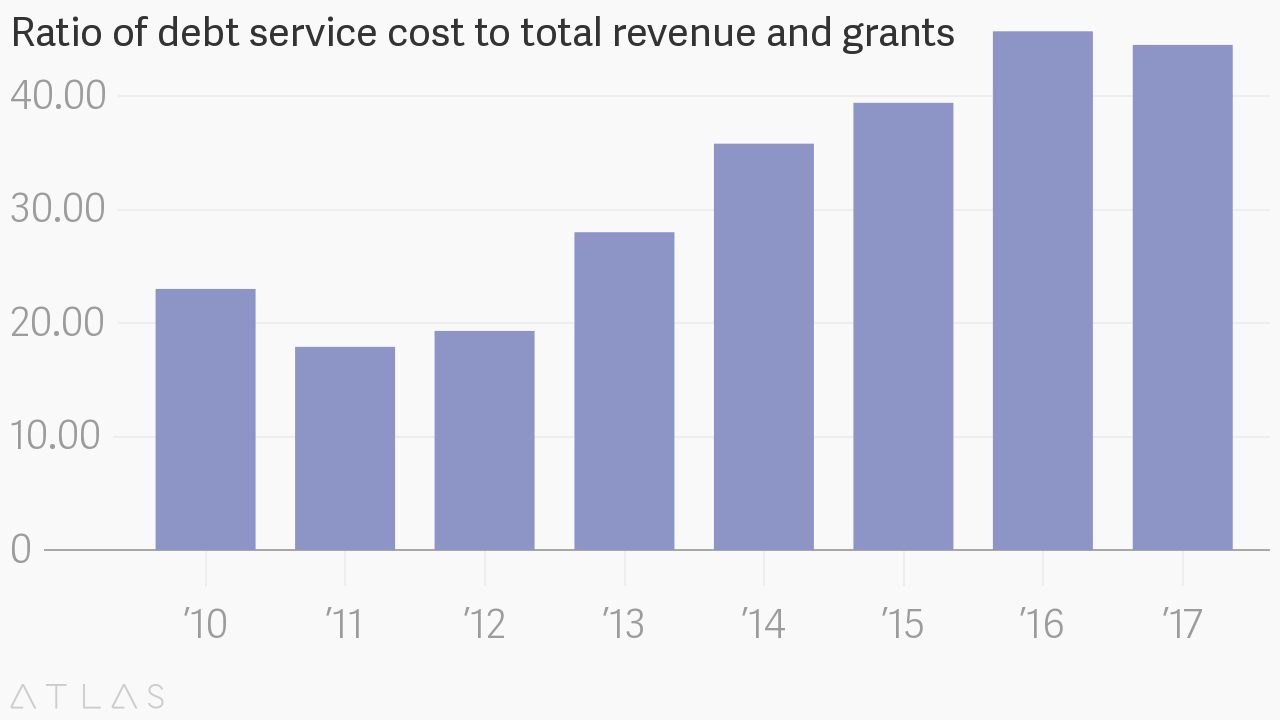

After ending 2000 at 72 percent, the ratio of debt service cost to total revenue and grants declined drastically to 17.9 percent in 2006, thanks to landmark debt forgiveness programme under the IMF and the World Bank’s HIPC and MDRI programmes, which helped to stabilise.

Since then, it has remained on the upward trajectory, peaking at 23 percent in 2010 before easing to 17.9 percent in 2011 when commercial oil production spiked national revenue to record levels.

In 2016, the ratio was 45.7 percent but declined modestly to 44.5 percent last year. This meant that of every GHȻ1 collected in revenues and grants, more than 44 pesewas was used to service debt.

“It means that we use more of our revenue to service debt and that leaves little room for investments. So generally, we should be very much concerned about that tag of a high-risk, debt-distress country,” Prof. Quartey added.

Debt journey

Since 2015, when the country first migrated from the status of a moderate-risk, debt-distress country to the high-risk category, soaring debt levels, strong debt-servicing costs and weak institutional response to revenue generations and debt have ensured that the country remains in that category.

From a debt stock of GHȻ76.1 billion, equivalent to 67.1 per cent of gross domestic product (GDP) in 2014, the national debt burden rose to GHȻ100.2 billion (71.6 per cent of GDP) in 2015 before settling at GHȻ122.6 billion (73.3 per cent of GDP) in 2016.

Although the debt-to-GDP ratio declined to 69.8 per cent in 2017, the debt stock firmed up to GHȻ142.5 billion.

Notwithstanding the strong growth over the years, recent developments have revealed a modest decline in the pace of the growth.

In presenting the 2018 budget to Parliament in November last year, the Finance Minister, Mr Ken Ofori-Atta, said the annual average rate of debt accumulation “of 36 percent over the last four years has declined over the last nine months to about 13.58 percent”.

“While the government is actively managing the public debt to ensure sustainability through its liability management programme, which among others is aimed at reducing the refinancing risk and cost of borrowing, we do not expect this initiative to add to the public debt stock beyond the net financing requirement for the year,” he added.