Despite the farmgate price of cocoa increasing by over 100% this year, Ghanaian farmers continue to face significant financial challenges due to high inflation and the rapid depreciation of the local currency.

With Ghana’s inflation averaging 25% and the cedi losing about 20% of its value against the dollar since the beginning of the year, the benefits of higher cocoa prices have been largely offset.

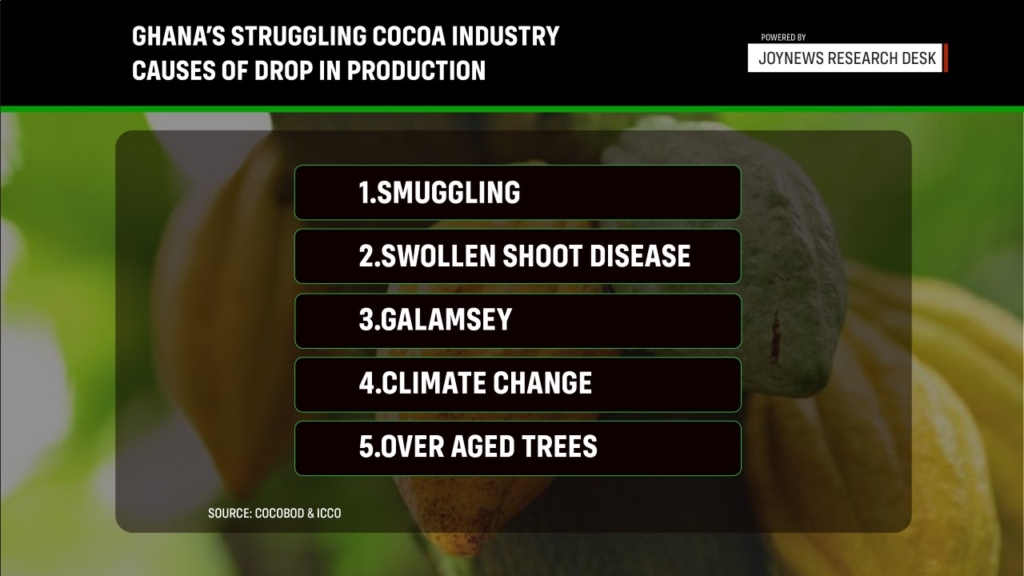

These economic pressures have reduced farmers’ purchasing power, prompting calls for even higher cocoa prices and leading to increased smuggling as farmers seek better prices in neighboring countries.

Already Ghana has made a commitment to the IMF that it will phase out certain “quasi fiscal spending of the Board [COCOBOD]” which will require announcement of the “termination of the road concession agreement with the Ministry of Roads, and discontinuation/rationalization of fertilizer/input subsidy programmes including Hi-Tech.”

In simple terms, the Black Star of Africa expects farmers to buy fertilizers and other inputs at a relatively high price. With commitment in full force, the Ghanaian cocoa farmer’s cost function has to make room for new expenditure line item(s) which will definitely whet their appetite for higher farmgate price.

Ghanaian authorities’ efforts to curb smuggling by considering paying farmers up to twice as much for their cocoa have been undermined by the country’s economic crisis, which has eroded the potential gains from such measures.

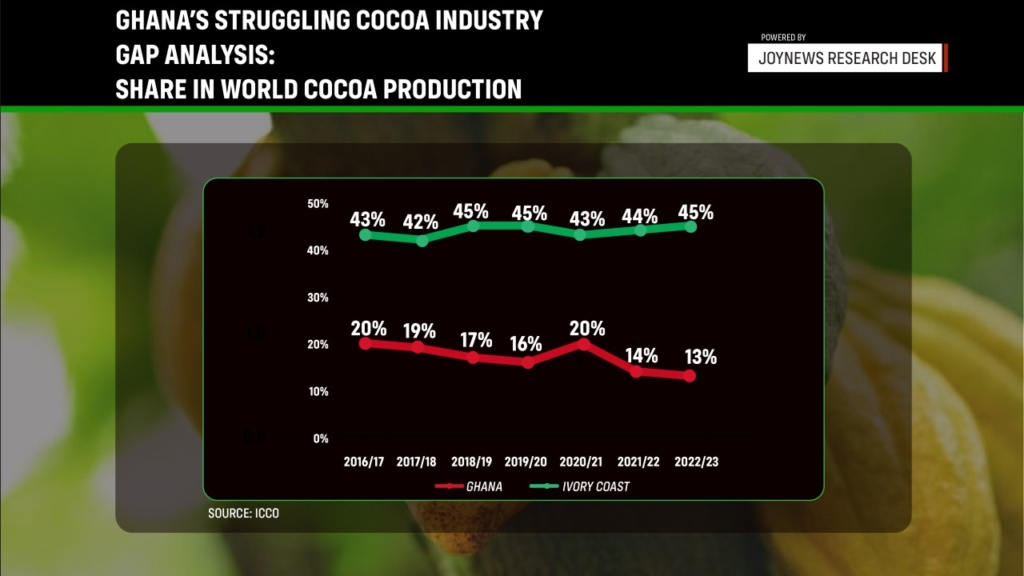

The industry regulator, Ghana Cocoa Board (COCOBOD), is aware that smuggling is significantly reducing the West African nation’s share of global cocoa production which has dropped from 20% to 13%.

People familiar with the workings of the industry project that Ghana may have lost approximately 250,000 tons of beans to smuggling in the current season, compared to an estimated 150,000 tons in 2023 put out by the regulator.

Alongside smuggling, adverse weather, disease, and a lack of fertilizers are affecting Ghana’s cocoa harvest, which is projected to drop to as low as 422,500 tons in 2023-2024, down from 650,000 tons in 2022-2023.

As a result, Ghana risks losing its position as the world’s second-largest cocoa producer to Ecuador, which is currently working to produce over 400,000 tons following setbacks in the last crop season.

The upcoming crop season looks challenging for Ghana, as illegal mining activities further threaten its projected yields. The sale of cocoa farmland to illegal miners, coupled with the pollution and destruction of water bodies and lands, jeopardizes Ghana’s cocoa yield for the 2024-25 season, which could fall below 400,000 tons.

For COCOBOD to secure its next cocoa syndicated loan, which fell below the usual $1 billion this year, it needs to prove to investors that it can produce more beans in the next season.

Ensuring the necessary bean production will be difficult, and one reliable way to prevent the smuggling of an additional 200,000 tons next season is to increase the farm gate price. However, this would impose a significant fiscal constraint on COCOBOD, which is already struggling to service its current debt obligations.

See what happened when Diana Hamilton bumped into Bawumia [Watch]