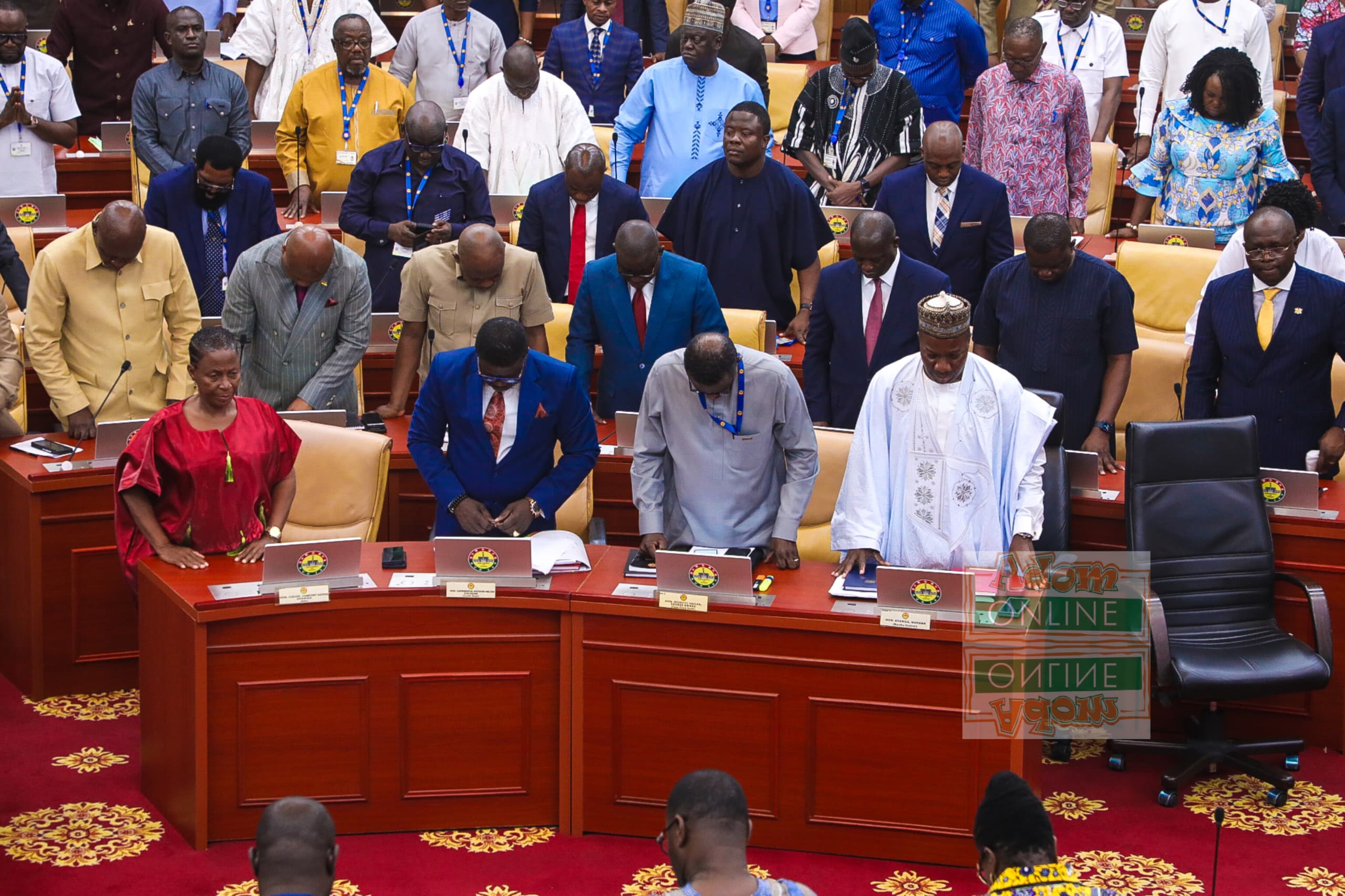

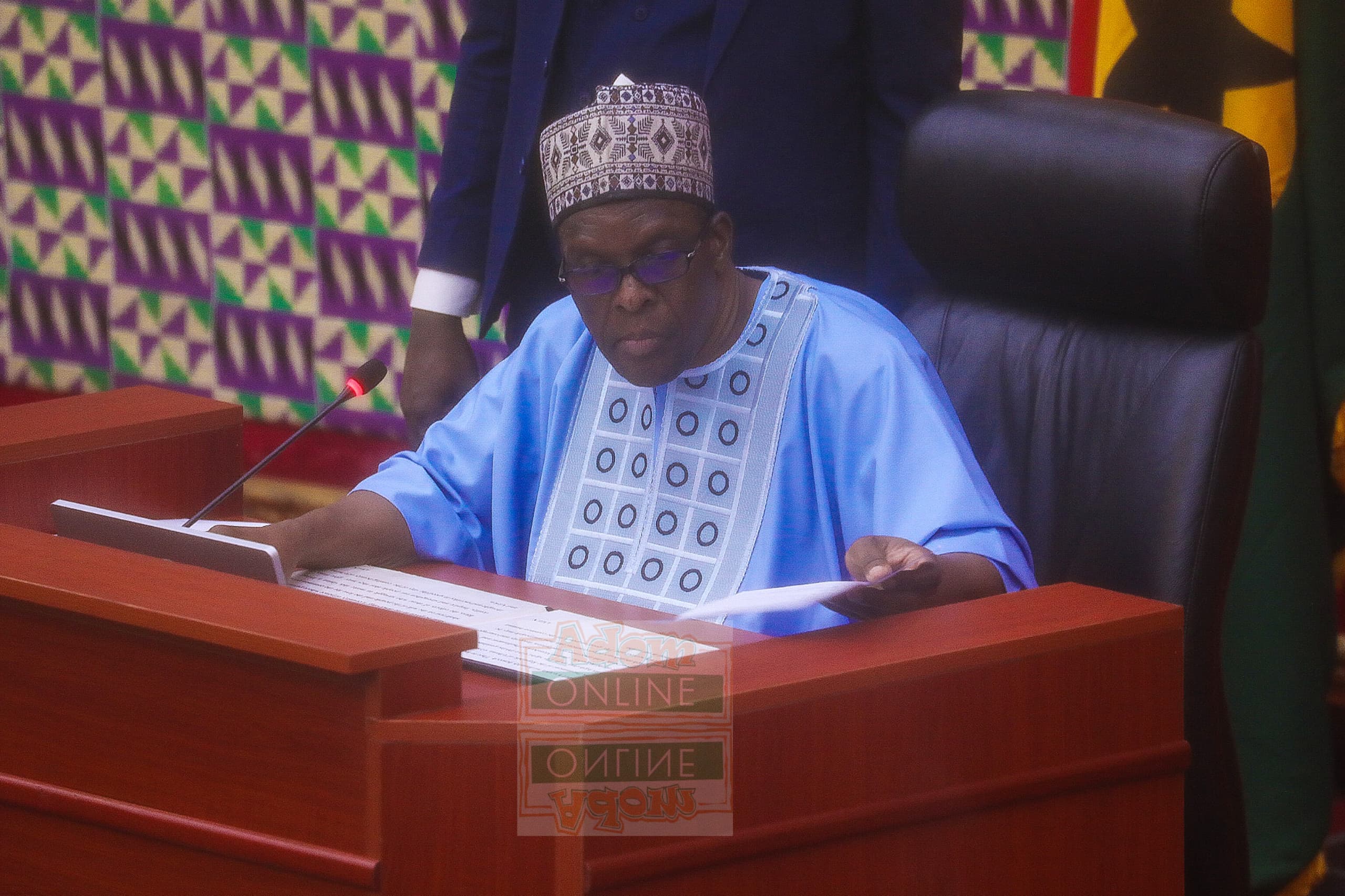

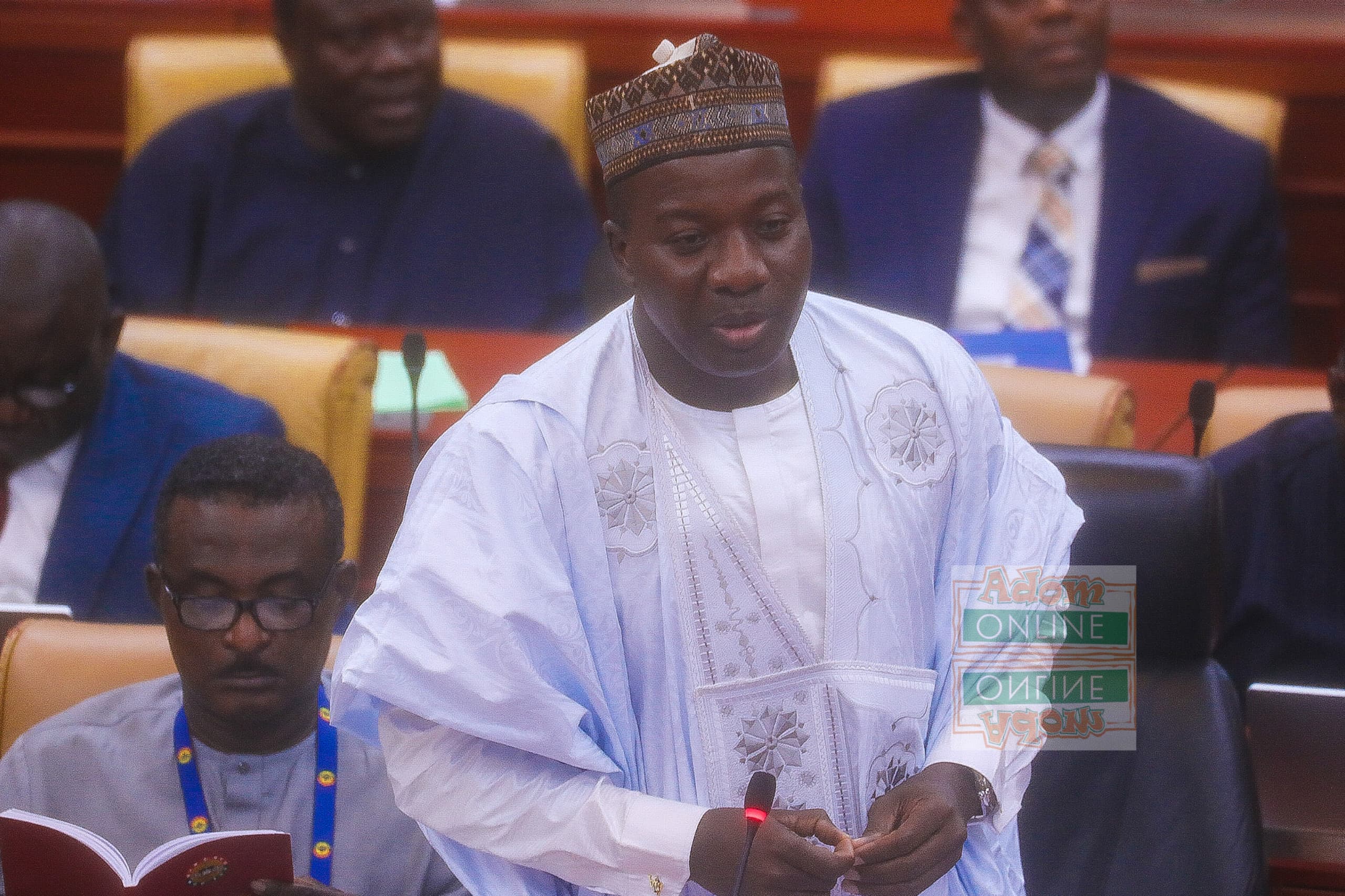

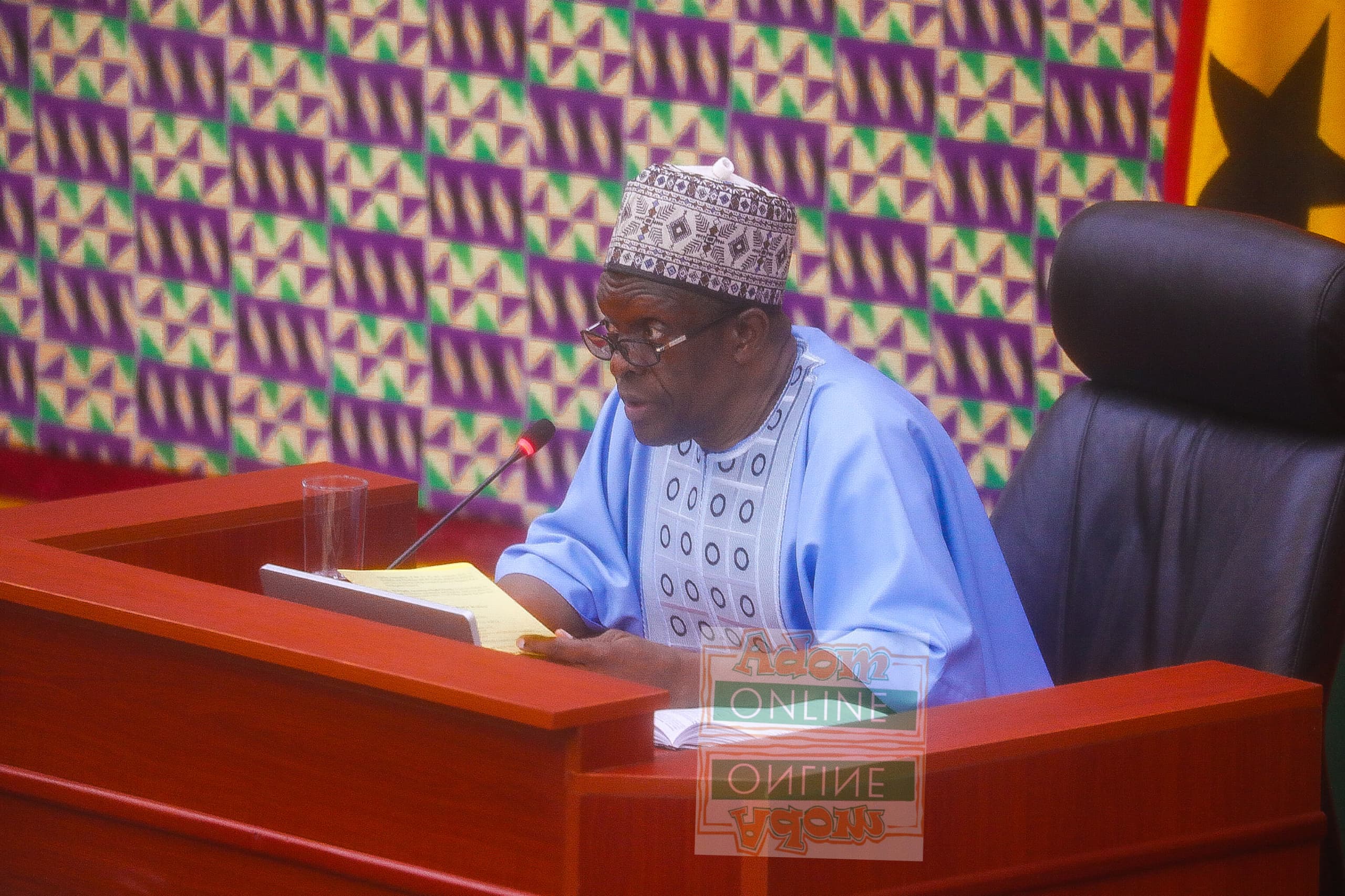

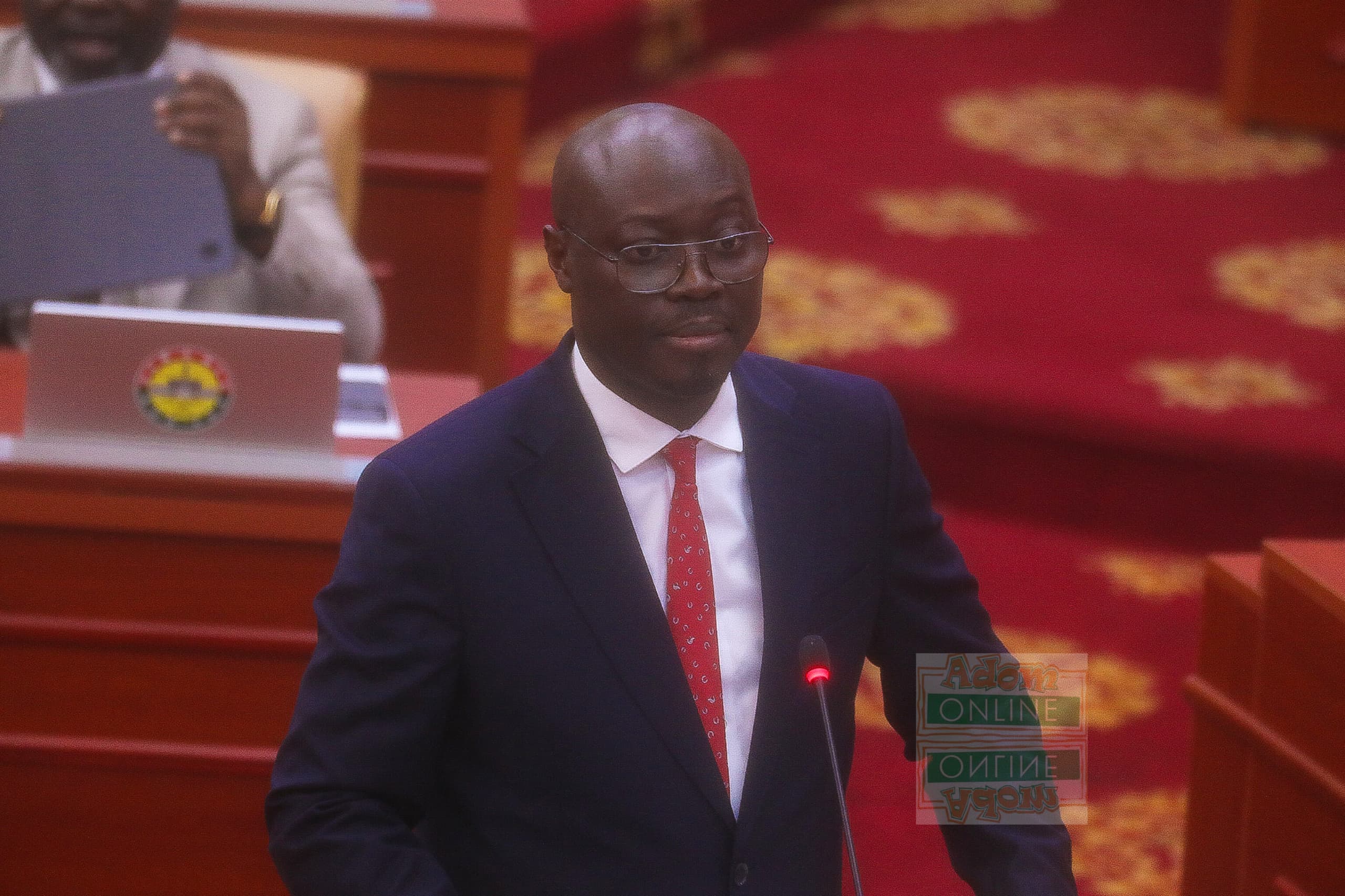

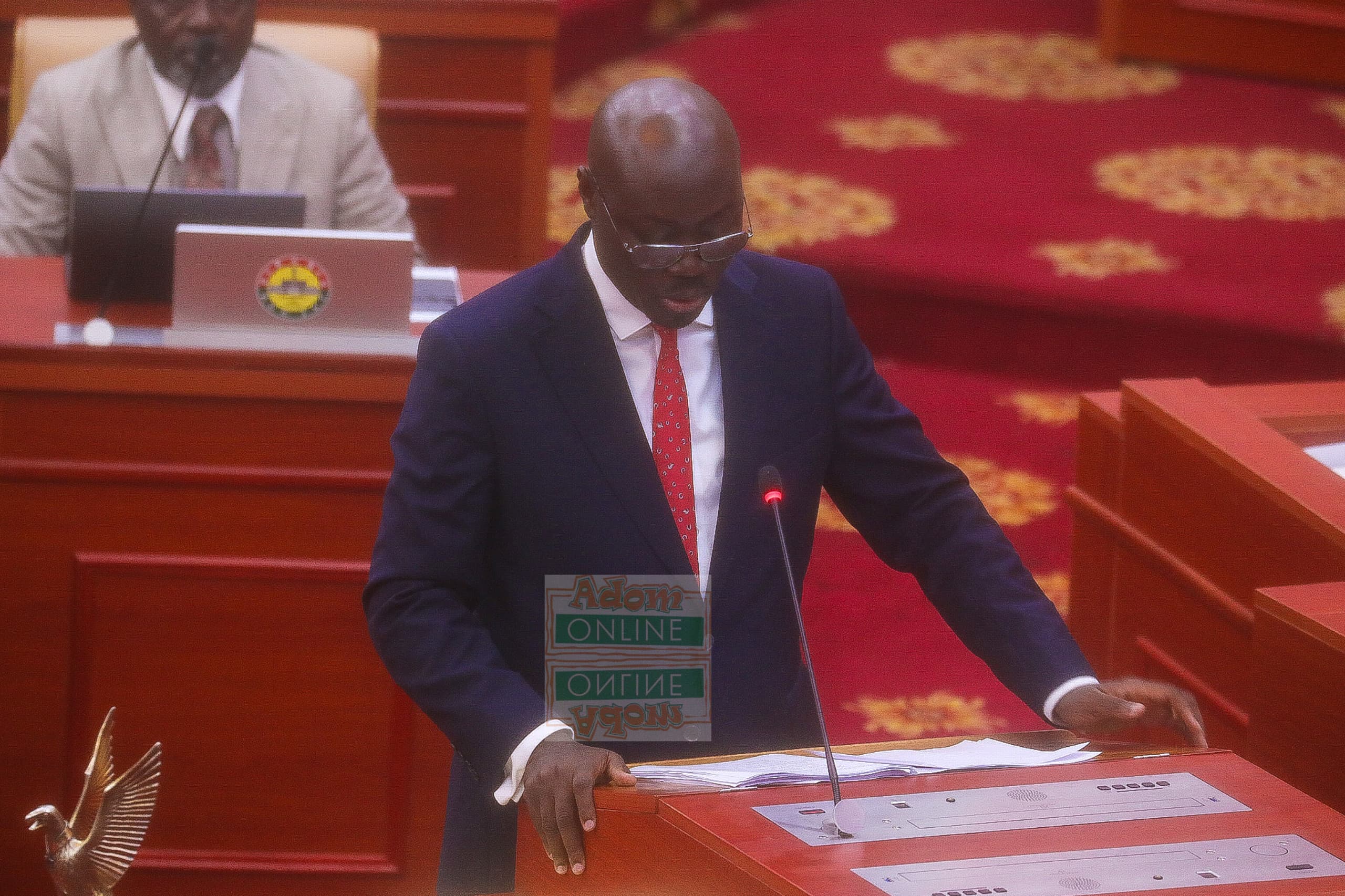

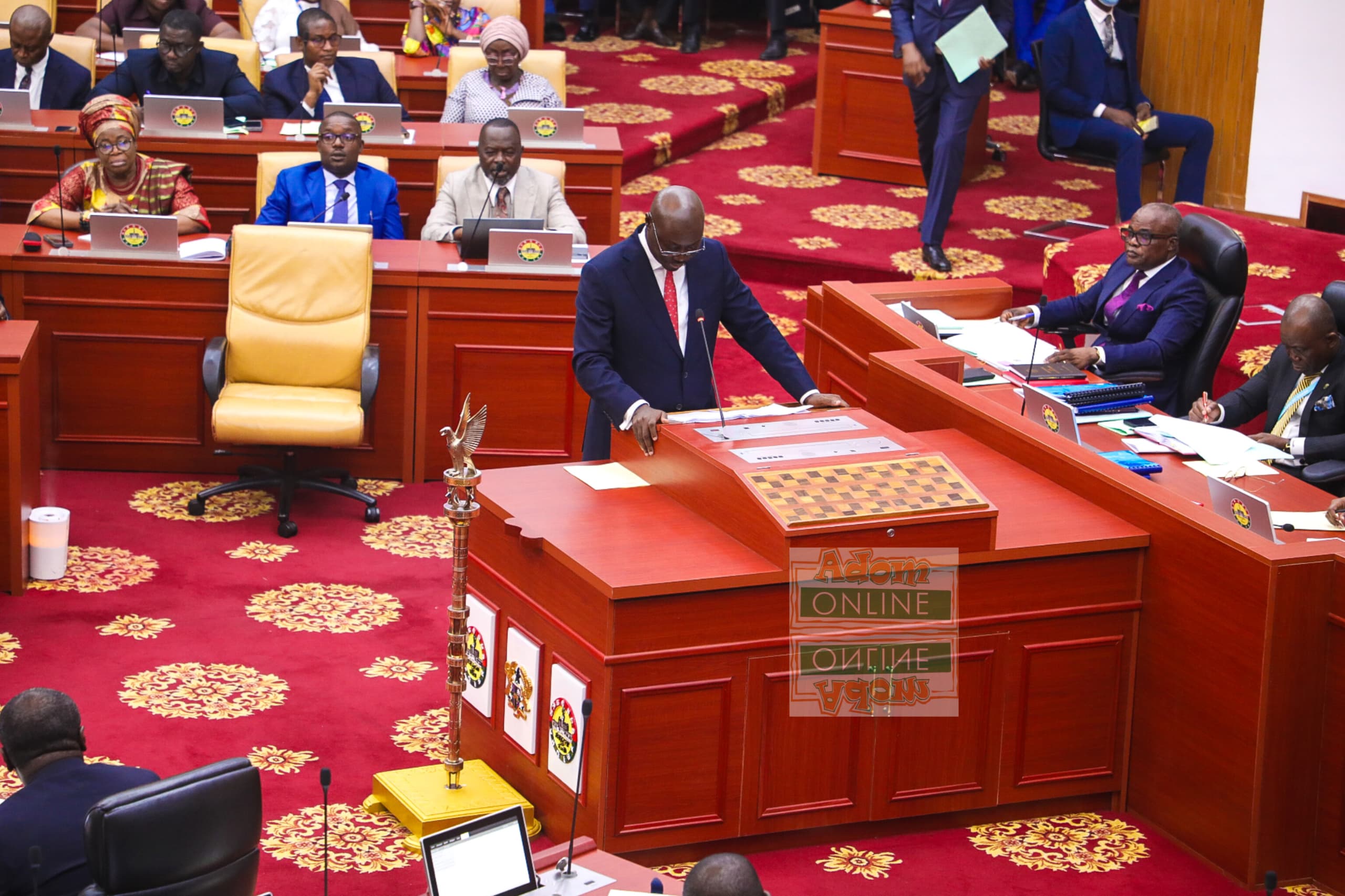

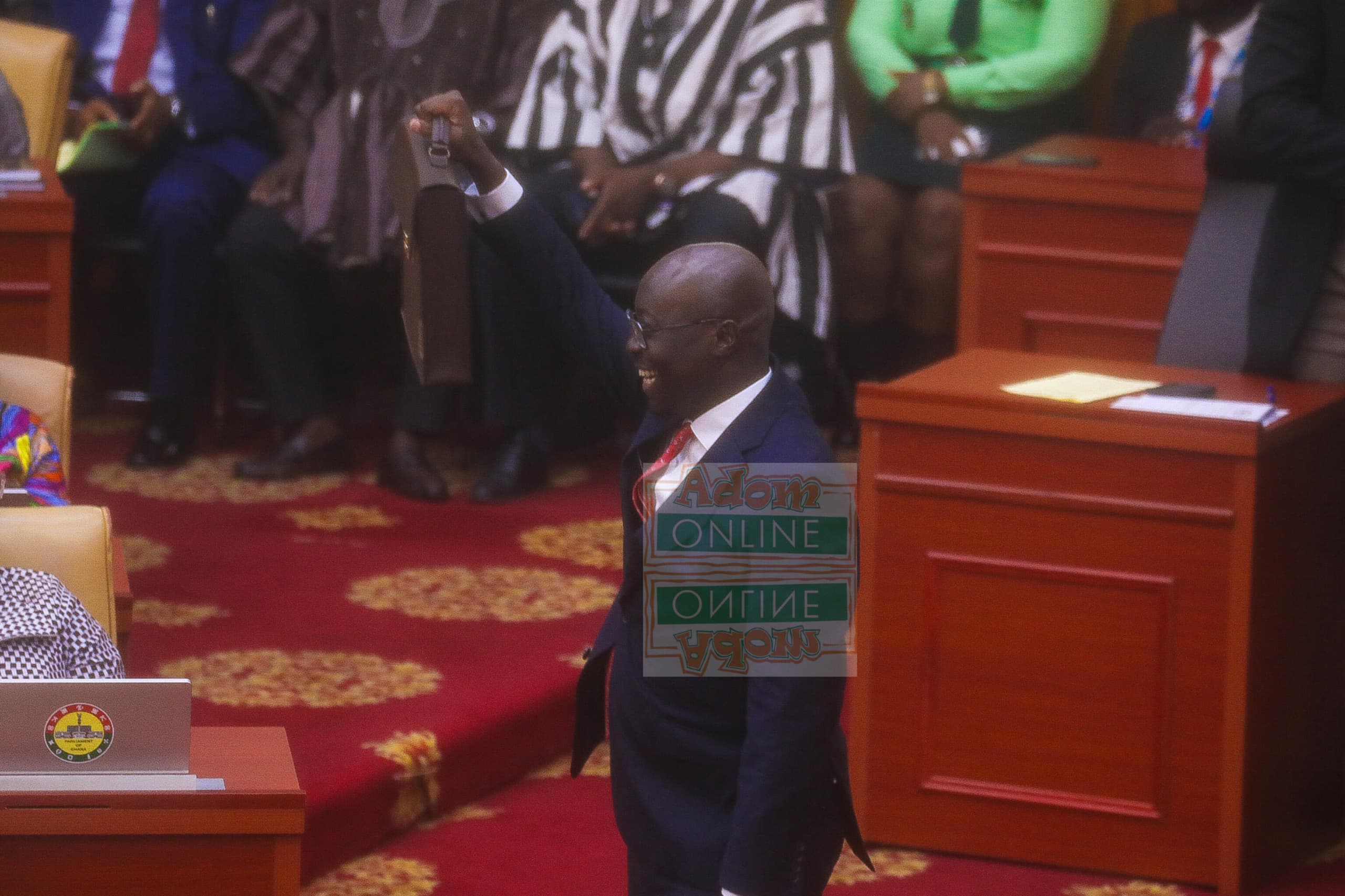

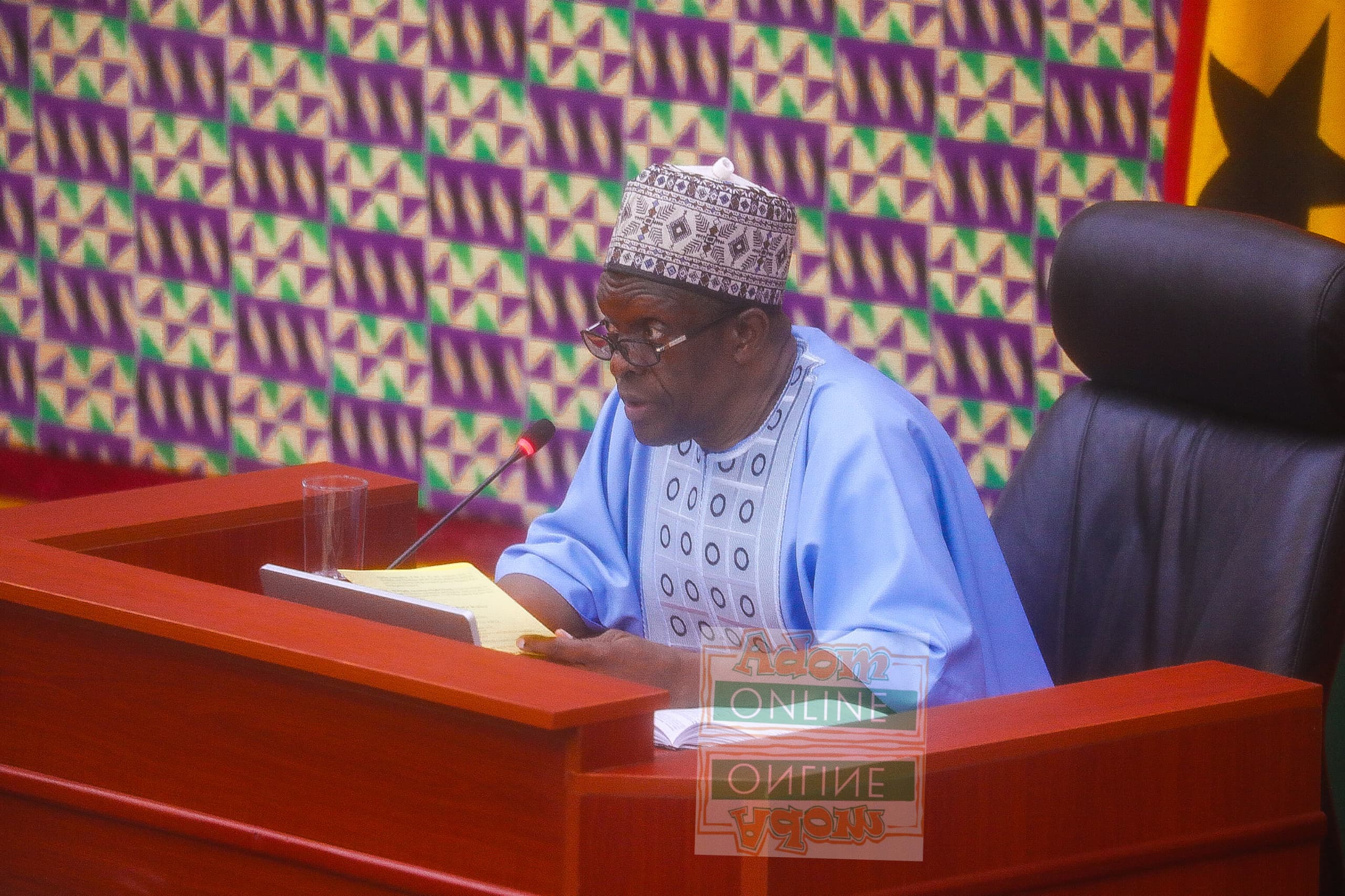

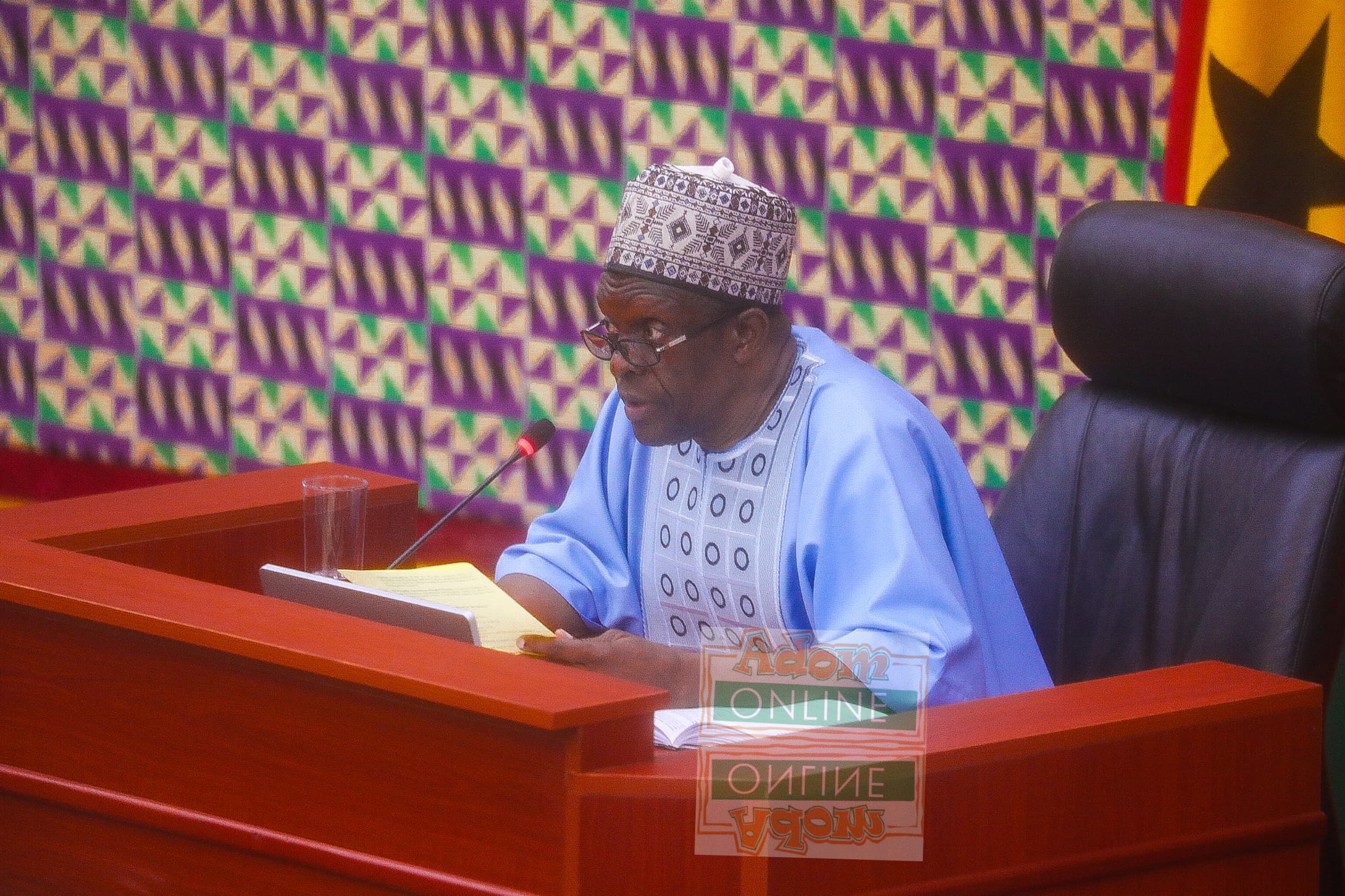

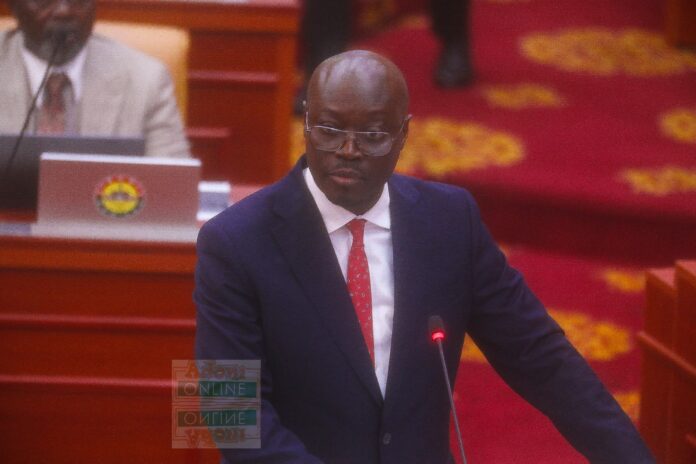

Finance Minister Dr. Cassiel Ato Forson on Tuesday, March 11, 2025, presented the 2025 Budget Statement and Economic Policy to Parliament.

This marks the first comprehensive financial roadmap introduced by the Mahama administration since taking office.

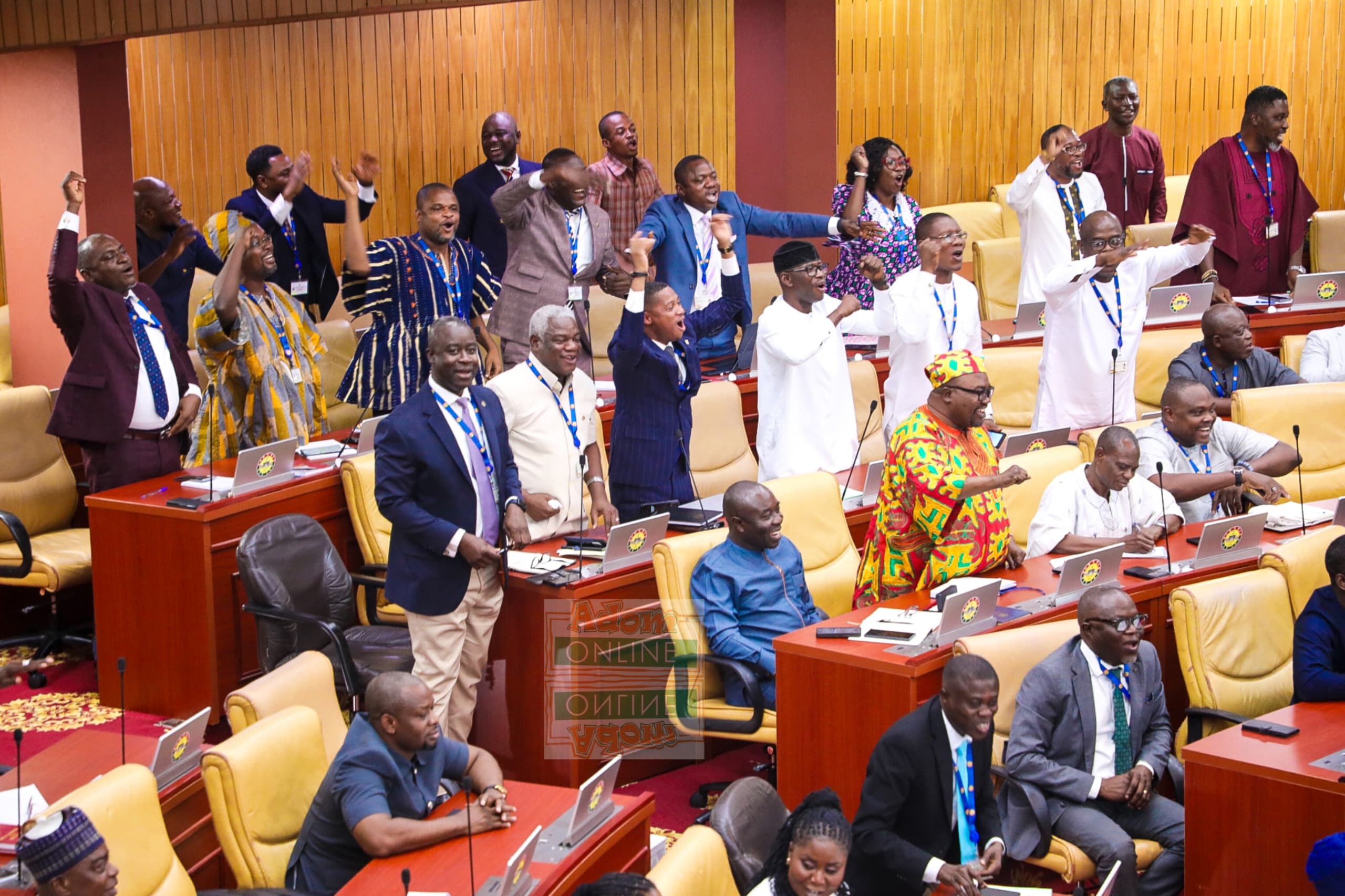

The highly anticipated budget includes significant policy measures aimed at stabilizing the economy, promoting growth, and addressing ongoing fiscal challenges.

Among the key announcements was the cancellation of several levies, including the Emissions Tax.

Dr. Forson also outlined plans to review the Value Added Tax (VAT) system, which will eventually lead to the abolition of the COVID-19 levy, though no specific timeline was provided.

He emphasized that the removal of several taxes aligns with the government’s manifesto commitments.

These include:

- Abolishing the 10% tax on lottery winnings

- Eliminating the 10% withholding tax on betting

- Removing VAT on motor vehicle insurance policies

- Scrapping the 1.5% withholding tax on processed gold for small-scale miners

“The removal of these taxes will ease the burden on households and improve their disposable income. It will support business growth and enhance tax compliance,” Dr. Forson stated.

He also addressed concerns about over 300 pharmacists who have not received their salaries since their employment by the state. He pledged immediate action to resolve the issue, stating that the 321 pharmacists employed since June 2023 deserve to be compensated for their services.

Furthermore, the Finance Minister highlighted financial allocations for various sectors in the 2025 budget, prioritizing education, infrastructure, social protection, and disaster relief. These allocations aim to support economic recovery, address urgent concerns, and lay a foundation for sustainable long-term growth.

A total of 19 key allocations were highlighted in the budget, including:

- Big Push Programme – GH¢13.85 billion (US$892.9 million)

- No-Academic-Fee Policy for First-Year Students in Public Tertiary Institutions – GH¢499.8 million (US$32.2 million)

- Distribution of Free Sanitary Pads to Female Students – GH¢292.4 million (US$18.9 million)

- Support for Victims of the Akosombo Dam Spillage – GH¢242.5 million (US$15.65 million)

- Support for Victims of the Tidal Wave Disaster in Ketu South – GH¢200 million (US$12.9 million)

- Free Secondary Education Programme – GH¢3.5 billion (US$225.8 million)

- Comprehensive Provision of Free Curricula-Based Textbooks – GH¢564.6 million (US$36.4 million)

- School Feeding Programme – GH¢1.788 billion (US$115.7 million)

- Capitation Grant – GH¢145.5 million (US$9.4 million)

- Teacher Trainee Allowances – GH¢203 million (US$13.1 million)

- Nursing Trainee Allowances – GH¢480 million (US$30.9 million)

- National Health Insurance Scheme (NHIS) – GH¢9.93 billion (US$640.6 million)

- Ghana Road Fund – GH¢2.81 billion (US$181.3 million)

- District Assembly Common Fund (DACF) – GH¢7.51 billion (US$484.5 million)

- Agriculture for Economic Transformation Agenda (AETA) – GH¢1.5 billion (US$96.8 million)

- Seed Fund for the Establishment of the Women’s Development Bank – GH¢51.3 million (US$3.3 million)

- National Apprenticeship Programme – GH¢300 million (US$19.4 million)

- ‘Adwumawura’ Programme – GH¢100 million (US$6.5 million)

- National Coders Programme – GH¢100 million (US$6.5 million)

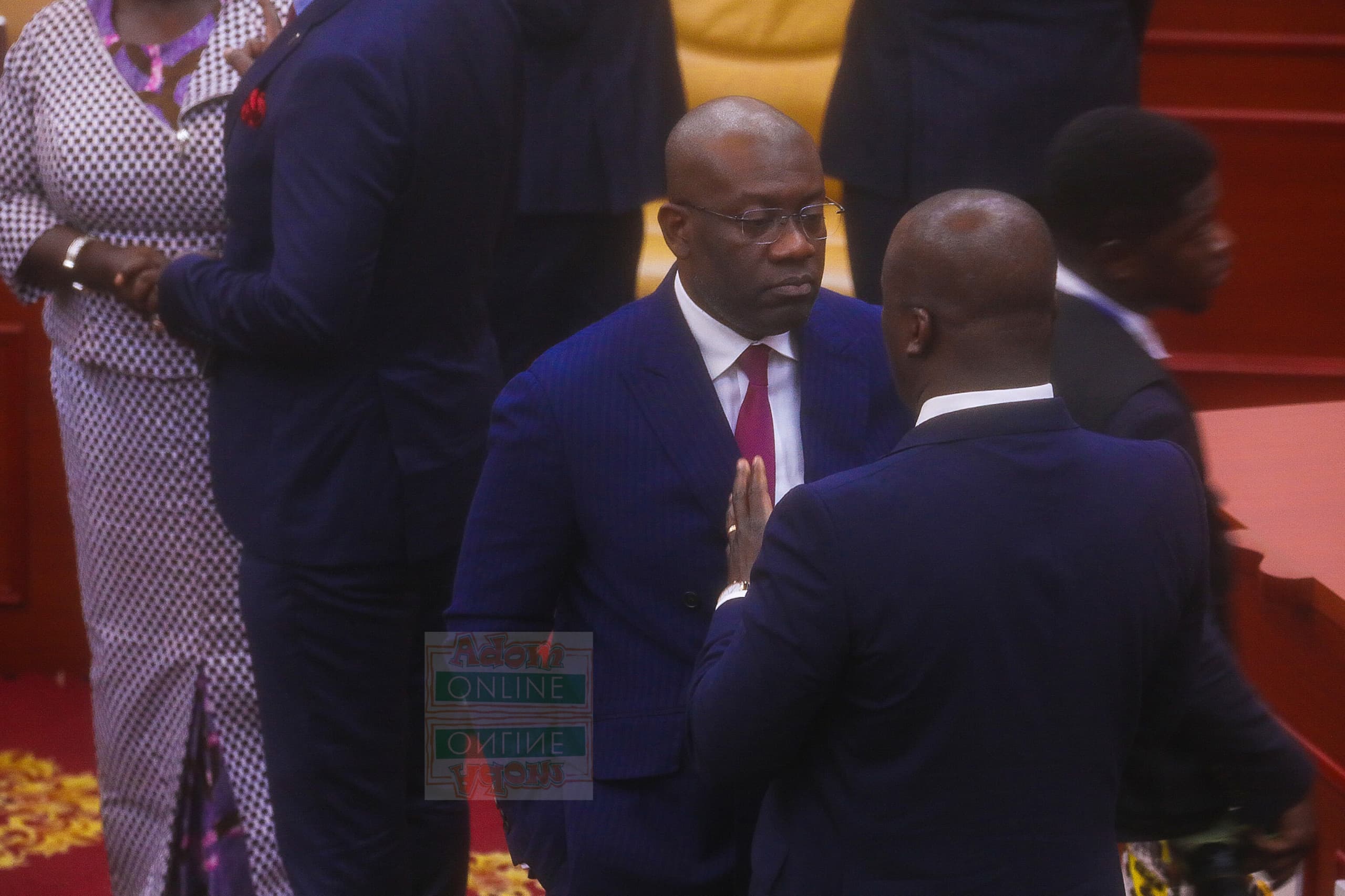

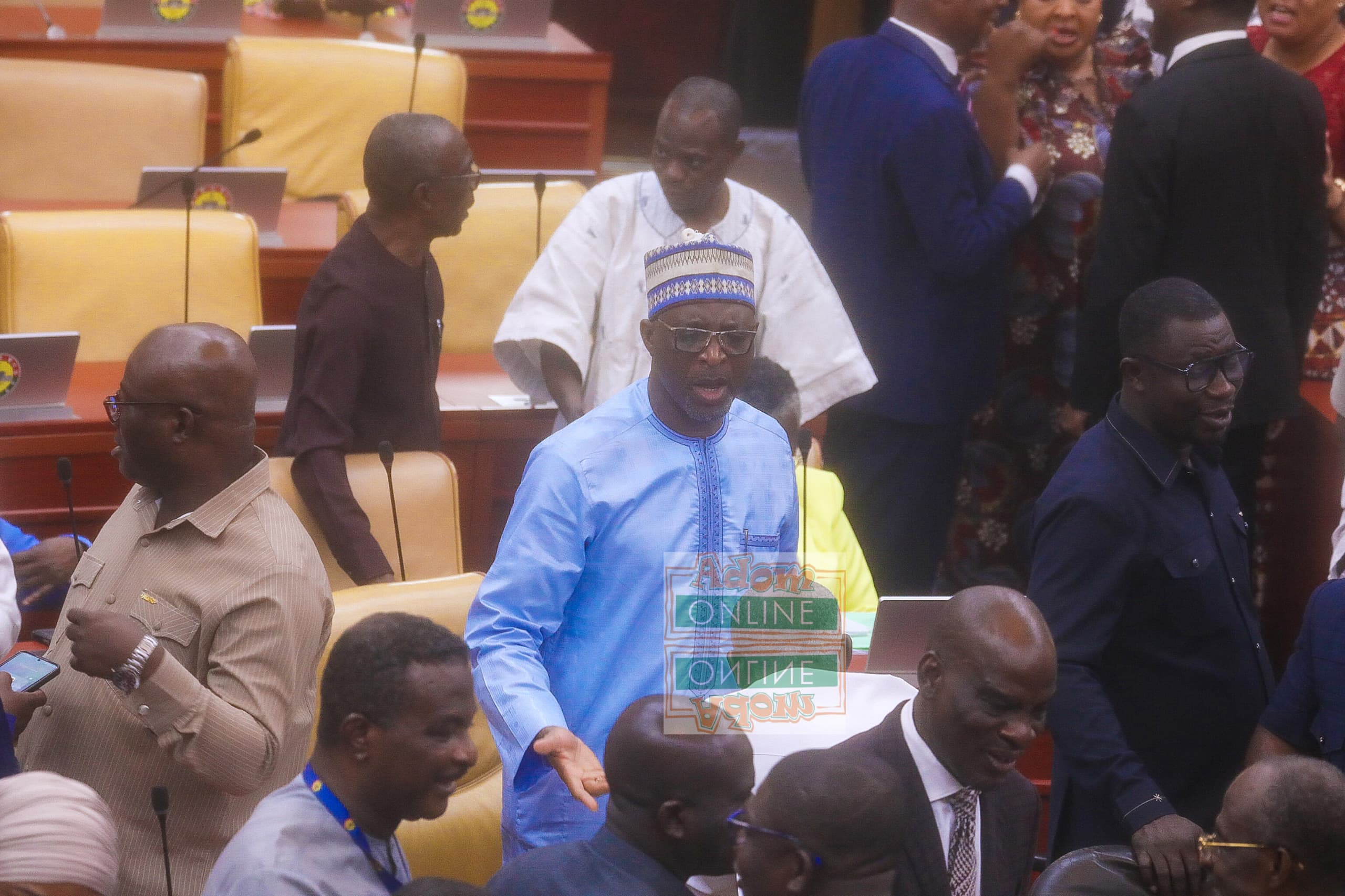

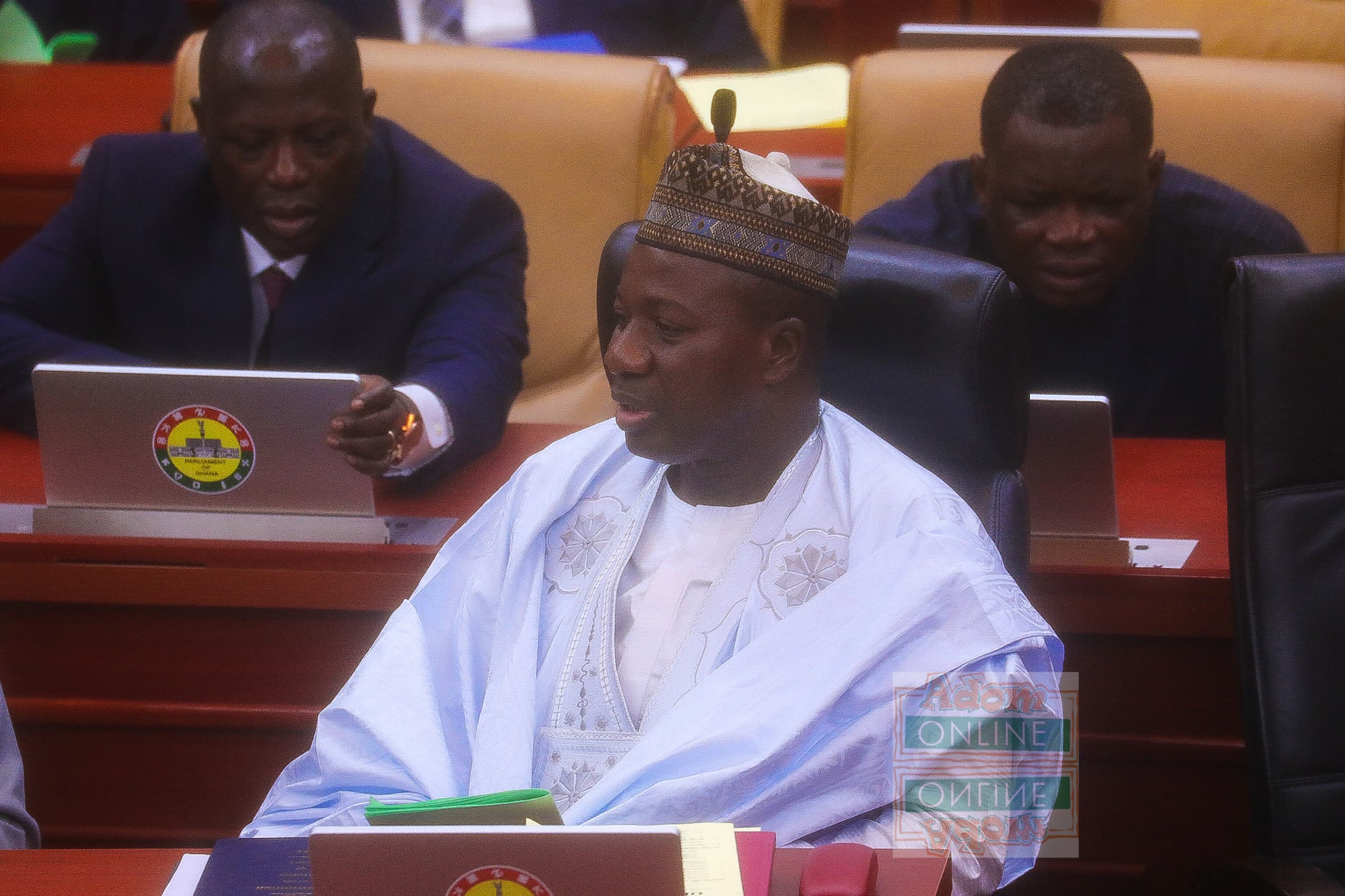

Adomonline’s photojournalist Joseph Odotei captured key moments from the budget reading.