Prudent Management of Government Expenditure

Economic Independence is when an economy can achieve and sustain its citizens’ economic aspirations and prosperity without undue dependence on foreign capital, skills, and enterprise.

Economic independence is a worthwhile national objective by itself because it is economic independence that expresses our national sovereignty.

The six (6) pillars of economic independence are fiscal responsibility, currency stability, infrastructure, governance, growth, and social services.

This article aims to establish how critically important fiscal responsibility is to achieving economic independence as a national objective.

We will explore H.E. Dr. Mahamudu Bawumia’s proposals on fiscal responsibility to show they move us closer to achieving our economic independence.

(All references to the government in this article are generic, not specific, referring to all governments we have had in Ghana, not any specific government in particular. The challenge of economic independence has persisted since Ghana’s independence; it is systemic and non-partisan.)

Fiscal responsibility refers to the government’s practices and policies for ensuring sustainable budgeting and spending.

It involves managing government revenues and expenditures without compromising a country’s economic stability.

Fiscal responsibility is critical to achieving economic independence.

Ghana is currently debt-distressed and in an International Monetary Fund (IMF) program designed to help us achieve debt sustainability.

To pay off our debt, we need to reduce our expenditures and significantly increase our revenue.

This is currently the most important need of the nation, and any political program that does not speak directly to this should not be acceptable.

This is our seventeenth (17th) IMF program in sixty-seven years of Ghana’s independence. On average, we seek financial assistance from the IMF every four (4) years. We must make this our last.

We also need to find a way to ensure we do not return to debt distress. We should expect political programs to address this issue and propose mechanisms to enable us to stay solvent and to ensure and protect economic independence.

Fiscal responsibility often emphasizes the importance of government living within its means, where government expenditures match revenues because this minimizes the need for the government to borrow excessively.

Responsible public debt management ensures that government borrowing does not adversely affect the country’s financial stability or lead to unsustainable debt levels.

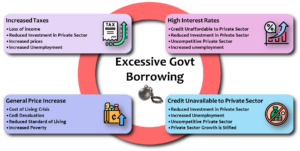

This approach helps to avoid excessive national debt. Excessive government borrowing is harmful in several ways.

Firstly, when the government borrows excessively, it has to offer successively higher interest rates to give a suitable return for what lenders see as increasing risk.

This increase in government interest rates has the effect of increasing general interest rates. This is because government debt is widely considered as safer than private debt.

Interest on private sector debt is generally calculated as the government interest rate plus a certain margin for the perceived higher risk of private sector lending.

This means that excessive government borrowing, by raising interest rates, makes borrowing expensive and often unaffordable to the private sector.

Secondly, excessive government borrowing has the effect of ‘crowding out’ the private sector from the credit market.

Given the finite amount of credit in the banking system, if the government borrows excessively, much less credit is available for the private sector.

This becomes a constraint on private sector investment, employment, and growth.

To the extent that the ‘private sector is the engine of growth’ in Ghana, excessive government borrowing stifles the engine and, therefore, growth.

Thirdly, excessive government borrowing is often inflationary, especially when spent on infrastructure and social services.

This means that private sector funds can no longer buy as much as they used to.

This effectively shrinks the purchasing power of private capital, reducing the private sector’s ability to invest to create jobs and growth.

Fourthly, after suffering the disadvantage of being unable to afford credit, being crowded out of the credit market, and suffering a diminution of private capital’s purchasing power, the private sector is eventually taxed to pay for the government borrowing, which caused the suffering in the first place.

It is important to note that government debt is repaid by the public, not the government, through tax revenue.

Excessive debt, therefore, often leads to excessive taxes. Excessive government borrowing is, therefore, a ‘quadruple whammy’ to the private sector.

Fiscal responsibility is not just about avoiding negative outcomes; it’s also about creating a positive environment for economic growth, stability, and the provision of public goods and services that improve the quality of life.

This approach helps ensure that current and future generations of Ghanaians enjoy a stable and prosperous economic environment.

Fiscal responsibility is, therefore, a necessary condition for economic independence.

H.E. Dr. Mahamudu Bawumia proposes to sustainably reduce the budget deficit and interest rates, enhancing fiscal discipline through an independent fiscal responsibility council enshrined in the Fiscal Responsibility Act, 2018 (Act 982).

He proposes amending the Fiscal Responsibility Act to add a fiscal rule that requires that budgeted expenditure in any year does not exceed 105% of the previous year’s tax revenue thereby capping the budget deficit more effectively.

Furthermore, Dr. Bawumia has proposed reducing public expenditures in furtherance of fiscal responsibility.

Apart from reducing the size of government to not more than fifty (50) ministers and deputies, he proposes outsourcing government projects such as roads, schools, hostels, and houses for the government to rent or ‘lease to own.’

Furthermore, the government will lease rather than purchase equipment, vehicles, etc., and resort to Public Private Partnership (PPP) road concession arrangements.

This will reduce government expenditure by 3% of GDP or approximately two (2) billion US dollars annually.

By reducing government expenditure, these practical measures would sharply reduce the government’s need to borrow to finance public expenditures.

With reduced government borrowing comes reduced interest rates, increased private-sector access to credit, increased private-sector investment, employment, and sustainable economic growth.

Ceding business opportunities worth approximately $ 2 billion annually will be a fillip to our private sector to kick-start the economy.

In conclusion, Dr. Bawumia’s proposals on achieving fiscal responsibility by reducing government expenditure will mean that for the first time in our economic history, we would be free from overdependence on foreign donors, foreign creditors, and foreign influence in organizing our economic affairs.

The private sector, unshackled by excessive government borrowing and its concomitant excessive taxes, would unleash its economic growth potential.

This would mean economic freedom for the private sector and economic independence for Ghana. With Dr. Bawumia Ghana’s Economic independence is indeed possible!

The writer, Mordecai Quarshie, is a seasoned Ghanaian politician with many years of experience in private life. You can reach him via mordecai.quarshie@gmail.com

OTHER ARTICLES BY MORDECAI QUASHIE: