The Chief Executive Officer of the Ghana Chamber of Telecommunications, Dr. Ken Ashigbey, says since the implementation of the E-levy some 5 days ago, proceeds from the levy have been transferred to the Consolidated Fund.

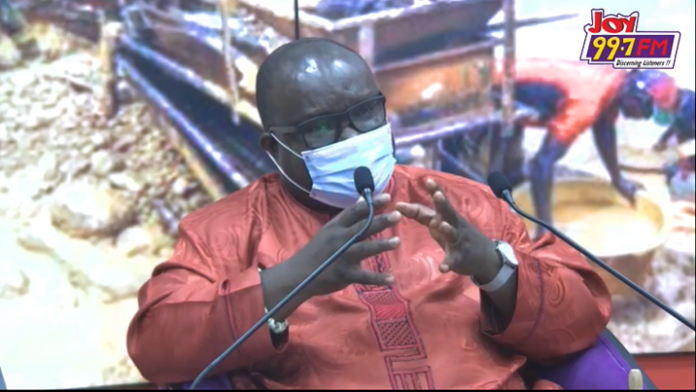

Dr. Ashigbey who made the revelation on JoyNews’ PM Express Business Edition while commenting on the need for government and other key players to intensify education on the e-levy noted that per government directive, funds from the e-levy are to be deposited into the Consolidated Fund after every two days.

He said, “Already there have been transfers that have been made to the government of the levy that has been collected. Yes, it’s two days. It’s after every two days. I don’t have the data but I know that the transfers have already been done after the first two days, 48 hours, you’re supposed to transfer the money into the Consolidated fund and that’s happened already. That’s the directive by the Commissioner General, that after 48 hours you transfer the money to Consolidated Fund.”

The E-levy is expected to generate a little above ¢4.5 billion by end of year.

Mobile money transactions in January 2022 was ¢76.2 billion, compared with ¢67.1 billion in January 2021.

In October 2021, November 2021 and December 2021, mobile money transactions stood at ¢80 billion, ¢86.1 billion and ¢82.9 billion respectively.

According to Ken Ashigbey, for government to reach its set target, there should be an intensification of education on how the levy is being implemented.

He explained that due to the insufficient information circulating on the implementation process it’s encouraging unscrupulous people to game the system.

He said some people have unnecessarily added the e-levy charge to the cost of items when that should not be so.

He said, “a typical example of people who when somebody is going to do a cash-in, to put money into his wallet, and we all know that cash-ins there’s no charge even from the EMIs on that and certainly there’s no e-levy on that.

“It’s the same thing that is happening when somebody is going to do a cash-out but some of the people are tempting to do that. Another example also is the situation where somebody goes to buy fuel; he uses a card to make the purchase.

“And so the person says he was buying 400 cedis, it is not for you the vendor to add the tax to it before you key it in. you key it in, if there’s going to be a charge – currently all mercvhants are exempt but you find some of them adding all of those to that

“So yes, we need to do a lot more, we need to step up on the education and if we had done massive education like the way we did with redenomination of the cedi definitely it would have been better but I think it’s still not late.”