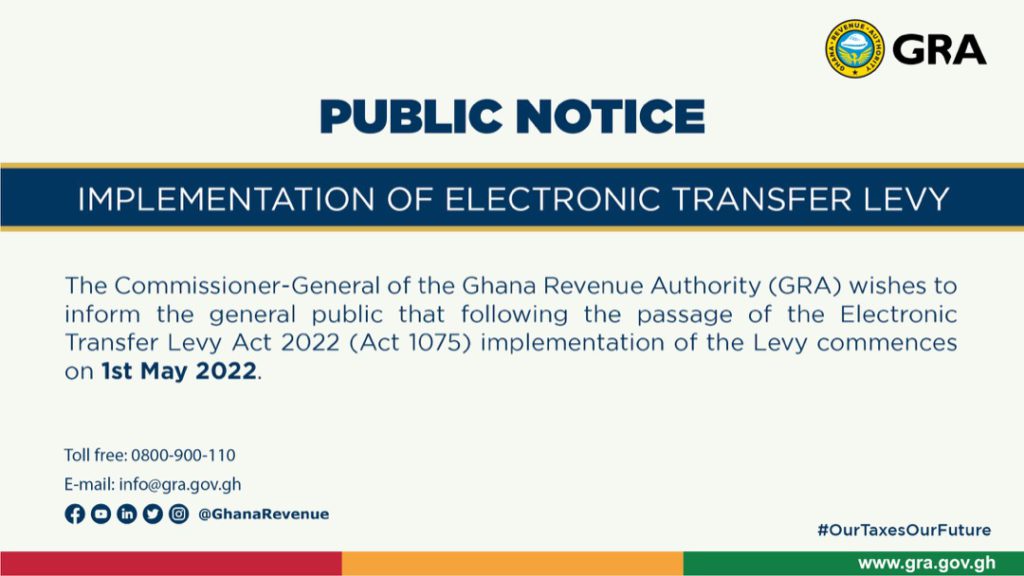

The Ghana Revenue Authority (GRA) has announced May 1st, 2022 as the implementation date for the Electronic Transaction Levy (E-Levy).

In a notice served by the GRA, it said the decision was influenced by the passage of the E-Levy bill by Parliament.

The E-Levy will impose 1.50% on all electronic transfers, as it will affect electronic transfer at the time transfer.

Areas of coverage

The levy will apply to mobile money transfers done between accounts on the same electronic money issuer and mobile money transfers from an account on one electronic money issuer to a recipient on another electronic money issuer.

Others are transfers from bank accounts to mobile money accounts and transfers from mobile money accounts to bank accounts

However, bank transfers on an instant pay digital platform or application originating from a bank account to an individual subject to a daily threshold will be determined by the Minister of Finance.

The E-Levy was introduced by the government in the 2022 Budget on basic transactions related to digital payments and electronic platform transactions.

The rate would apply to electronic transactions that are more than ¢100 daily. This is different from the percentage telecommunication companies charge on mobile money transactions.