Majority of Ghanaians are said to have changed their behaviour towards the electronic transfer of funds since the E-Levy kicked in back in May this year.

According to a study, 83% of the populace felt compelled to do so in order to adjust to the limits introduced by the said levy as far as their livelihoods are concerned.

These were part of research findings on the effect of the new tax slapped on citizens geared towards shoring up revenue for the government.

The IMANI Digital Financial Services Research Project looked into the impact of the 1.5% tax on the coping mechanisms thereof.

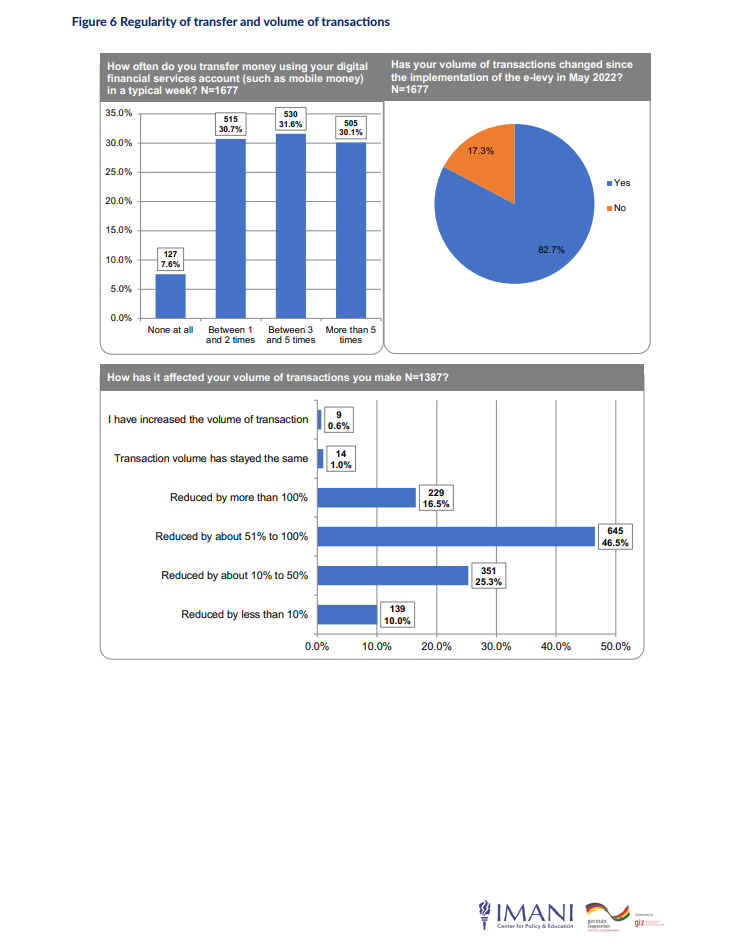

“To assess the impact of the e-levy on the use of digital financial services, we first assessed how often people use digital financial services accounts (such as mobile money) in a typical week and then asked further questions on how it has affected the volume of mobile money transactions they make.”

Highlights of the report revealed that out of the 83% who reassessed their electronic financial dealings nearly half of them reduced the rate at which they engaged in MoMo transactions.

“Of this number, about 47% indicated that they had reduced the number of mobile money transactions by about 51% to 100%,”

“Another 25% indicated that they had reduced their transactions by about 10% to 50%. Only about 1.6% of respondents indicated that their transaction volumes have stayed or increased their volume.”

Meanwhile, in terms of the regularity of transfers, the results were even.

The June 22 report also found that “about 31% of respondents indicated that they make between 1-2, 3-5 or more than five transfers per week.”

The study was conducted by IMANI Centre for Policy and Education in collaboration with Deutsche Gesellschaft für Internationale Zusammenarbeit.

ALSO READ: