The Bank of Ghana’s (BoG) latest Quarterly Collateral Registry report has revealed that the share of secured loans granted by domestically owned banks increased significantly in the fourth quarter (Q4) of 2024.

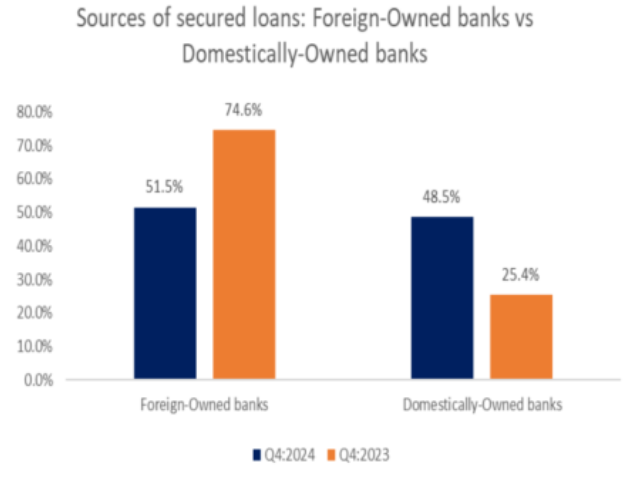

According to the report, domestically owned banks accounted for 48.5% of the total value of secured loans, up from 25.4% in Q4 2023.

Conversely, the percentage share of secured loans granted by foreign-owned banks in Ghana declined to 51.5% in Q4 2024 from 74.6% in Q4 2023.

“The share of the value of secured loans granted by domestically owned banks increased to 48.5% in Q4 2024 from 25.4% in Q4 2023,” the report highlighted.

Banks Record Lowest Average Lending Rate of 28.6%

The report also showed that the average lending rate for secured loans by banks stood at 28.6% in Q4 2024, the lowest across all lending institutions. This represented a slight reduction from 28.8% in Q4 2023.

Finance and leasing companies recorded an average lending rate of 33.1% in Q4 2024, down from 27.4% in Q4 2023. Rural and community banks posted an average lending rate of 33.5% in Q4 2024, a marginal decrease from 34.4% in Q4 2023. However, microcredit companies saw a slight increase in their lending rate to 49.5% in Q4 2024 from 47.7% in the same period of 2023.

Sectoral Distribution of Secured Loans

The Commerce and Finance sector remained the highest recipient of secured loans in Q4 2024, receiving 44.1% of the total value, up from 43.3% in Q4 2023. This was followed by the Construction sector with a share of 19.2% and the Services sector with 15.9%.

The Manufacturing sector accounted for 4.8% of the total secured loans, while the Information & Communications and Mining & Quarrying sectors received 3.9% and 2.9%, respectively.

The distribution of secured loans across other sectors was as follows:

- Agriculture, Forestry, and Fishing: 2.2%

- Electricity, Gas, and Water: 1.2%

- Cottage Industries: 0.2%

- Transport and Haulage: 0.9%

- Others: 4.8%

The BoG report indicates a notable shift in the lending landscape, with domestic banks playing a more dominant role in secured loan disbursement while foreign banks reduced their share.

Sectoral Distribution of Secured Loans

READ ALSO: