Vice President Mahamudu Bawumia says in this era of fourth industrial revolution, digital technology is the most robust and efficient way to drive the economy forward.

He said it will fast track economic growth and prosperity, improve public administration, revenue mobilisation, trade facilitation and reduce unemployment and tackle corruption significantly.

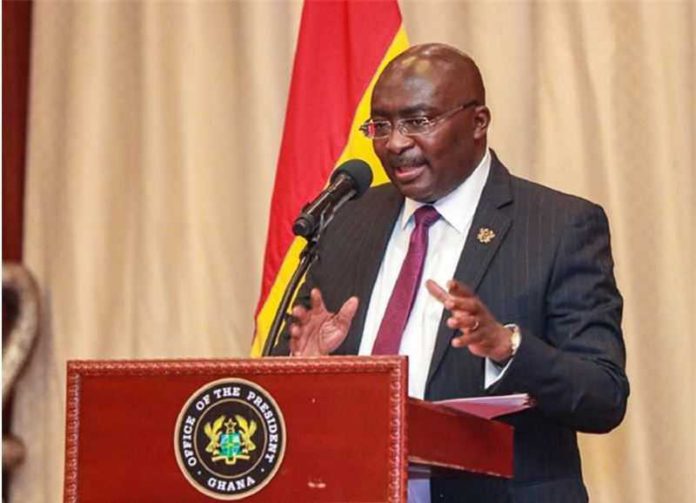

Dr Bawumia made the remarks when he delivered the address at the Standard Chartered Digital Banking, Innovation and FinTech Festival in Accra, on Wednesday.

The event is also meant to celebrate 125 years of Standard Chartered operation in Ghana being held on the theme: ‘Shaping the next phase of Ghana’s Financial Landscape.’

Vice President Bawumia stated that technology was becoming one of the key drivers of the productive capacity of economies worldwide from new ways of providing services, to new job models and to production in factories.

He noted that digital innovation was spearheading and expanding opportunities for economic growth in a way that had never been before.

“That is why we do not take this national responsibility lightly. The gains and rippling effects will be significant.

“We believe it is a more robust way to run this country and the vehicle that will accelerate the rate of growth.

“It is the hub of financial and technological progress in the sub-region,” the Vice President emphasised.

Mr Ken Ofori-Atta, the Minister of Finance, stated that Ghana was poised to be forefront of Africa’s digital economy and would leverage on digital platforms to accelerate economic growth.

He underscored the need for banks and financial institutions to commit a percentage of their financial resources towards developing entrepreneurial skills of the youth.

Dr Ernest Addison, the Governor of the Bank of Ghana, on his part, said the Central Bank passed the Payment Systems and Services Act 2019(Act 987) to regulate the digital financial ecosystem and deal with challenges that may come up.

He, therefore, urged the stakeholders in the financial sector to prepare themselves to embrace the digital financial ecosystems for financial inclusion.

Ms Mansa Nettey, the Chief Executive Officer of Standard Chartered, who doubles as the President of Ghana Association of Bankers, in her welcome remarks, said as part of the Bank’s corporate social responsibility had supported small and medium-scale enterprises (SMEs) and empowered the youth, women and virtually impaired persons with financial solutions.

The Bank, she said, had also provided advisory services to SMEs and its customers to equip them to take advantage of the digital economy to promote Ghana’s aspirations of becoming financial hub in the sub-region.