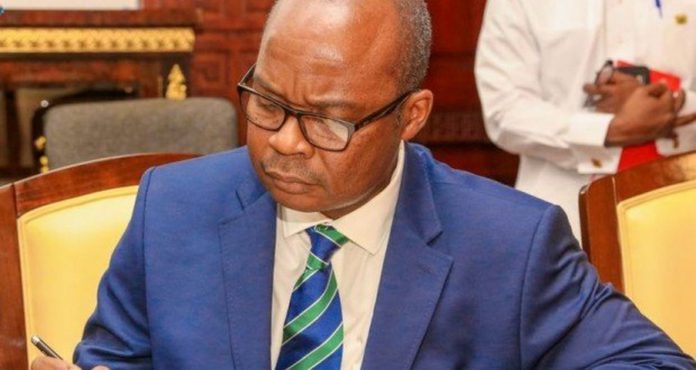

The Governor of the Bank of Ghana (BoG), Dr Ernest Addison has said the Deposit Insurance Protection Corporation (DIPC) would now be fully operational from October.

Speaking at a meeting with members of the Ghana Association of Bankers in Accra on Friday, he said this is expected to boost depositors confidence and lock-in the reform process.

“This is one of the key pillars in securing financial sector stability, as amended, in the Ghana Deposit Protection Act 2016 (Act 931),” he said.

The Act was later enacted to protect small savings from losses incurred as a result of the occurrences of an insured event such as the revocation of a deposit-taking institution’s license among others. The Act also supports the development of a safe, sound, stable and efficient market-based financial system.

How is DIPC going to work?

Dr Addison disclosed that in the process of operationalizing the DIPC, BoG has already sent letters to banks to begin a process of onboarding after agreeing on an annual premium of 0.3 to 1.5 per cent of insurable deposits with participating institutions.

The Bank of Ghana, which is the project implementation authority, will support the DIPC for three years to ensure sustainability.

The agreed payout in the event of bank failure and the revocation of licenses have been pegged at ¢6,250 per customer for banks and ¢1,250 per customer for Specialized Deposit-Taking Institutions.

Governor on discriminatory reforms

The Governor in his address also rejected assertions that recent minimum capital requirement has been discriminatory.

He stated that the banks that received support from government “met the qualifying criteria of being better governed and well managed”.

Dr Addison noted, “What is being perceived as discriminatory should rather be seen as the reward for better corporate governance and good management”.

Governor on Heritage Bank’s license revocation

Regarding recent reports that the central bank was not been fair over its handling of Heritage Bank license revocation, he said, “Heritage Bank did not have the initial ¢120 million capital required to obtain the Universal Banking license that was granted in 2016.”

The Governor maintained “In fact, the shareholders and directors of the Heritage Bank had round-tripped on a ¢30 million payment made by COCOBOD to Alive Industries, a related company belonging to the principal shareholder—bank statements and the transaction documents are available for those who are interested to review.”

Restoring Confidence after clean up

“We expect access to credit to be on a predictable and cost-effective term as part of the benefits of the reforms” the governor noted.

The Governor also announced that “this week we have met with every bank and discussed ways in which these results can be realized by the end of the year.”

Source: Joy business