The criteria for Small and Medium Scale Enterprises (SMEs) in the country to access government’s GHc 600 million soft loan has been outlined by Deputy Minister for Finance, Abena Osei Asare.

Revealing the requirements that needed to be satisfied by SMEs to access the stimulus package, the Deputy Minister for Finance said, a business or an individual must first be associated with a recognised trade group, have a Tax Identification Number (TIN) and also own either a bank account or a mobile money account.

READ:

Ghanaian nurse dies of Covid-19 [Video]

Bizarre: Lady allegedly kills hubby for breaking blood covenant

“There are three things that everybody who hopes to qualify for such relief should have.

“One is that you should belong to a recognised trade association; two is that you should have a TIN and then three you should have a bank account or a mobile money account. These are the three basic things that we will be looking out for,” she said.

“But the criteria for identifying these beneficiaries will be developed by NBSSI, so they will roll those out in conjunction with the rural banks. We think that to manage these things effectively or to implement it effectively, we should establish a steering committee chaired by both the Ministry of Finance and the Ministry of Trade and Industry,” she added.

ALSO:

Covid-19: Nurse’s final words before being put on ventilator

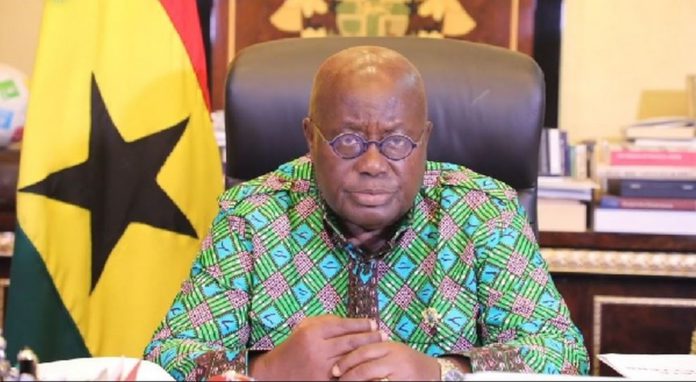

President Nana Akufo-Addo in his fifth address to the nation on measures adopted to help mitigate the corrosive effects of coronavirus on Ghanaian businesses and the economy at large, announced a GH¢ 600 million soft loan stimulus package for SMEs in the country.

The GH¢600m soft loan scheme will have a one-year debt moratorium and two years repayment plan, that is borrowers will enjoy a full year delay in debt payment before commencing their two-year-repayment of debt.