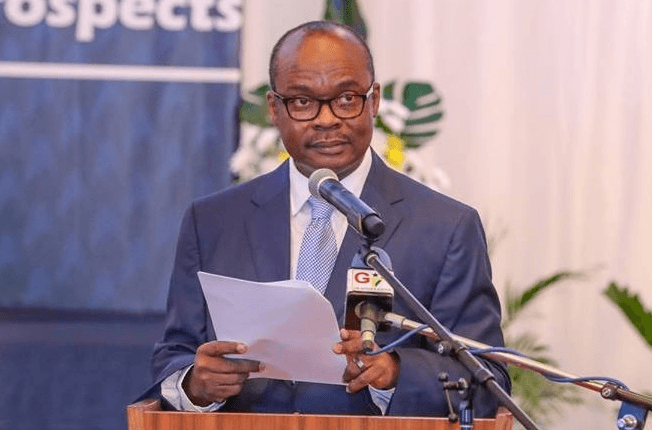

Governor of the Bank of Ghana says the clean-up of the microfinance sector is going to start in the second quarter of this year.

According to Dr Ernest Addison, the clean-up is expected to cost about GH¢700m.

He said “…in the financial sector, you also have the segment of SDI’s where there are ongoing difficulties with getting access to deposit and we have already announced that, that will be the next face and that we will be focusing on to look at ways in which the depositors there in that segment of the market could be taken care of.”

Dr Addison added “We’re working with the Ministry of Finance to raise the necessary resources to do that. I can assure you that hopefully during this quarter [second quarter] we will be able to bring that issue into fruition because we are close to obtaining the resources that we need to deal with the microfinance institution. The preliminary estimate that we have for microfinance institution is just under 700 million.”

About 319 microfinance institutions across the country have been licensed to operate and are in general compliance with the central bank’s guidelines, the Bank of Ghana said.

According to the list, the Greater Accra region has the highest number of licensed microfinance institutions with 211 with none licensed in the Upper East region.

Last year, Parliament ratified a $30-million World Bank credit facility agreement to implement the financial sector development programme.

The move is aimed at improving regulation of the MFI and rural banking sectors and making them more accessible to the banking public at the grass-roots level.

Source: Joy Business