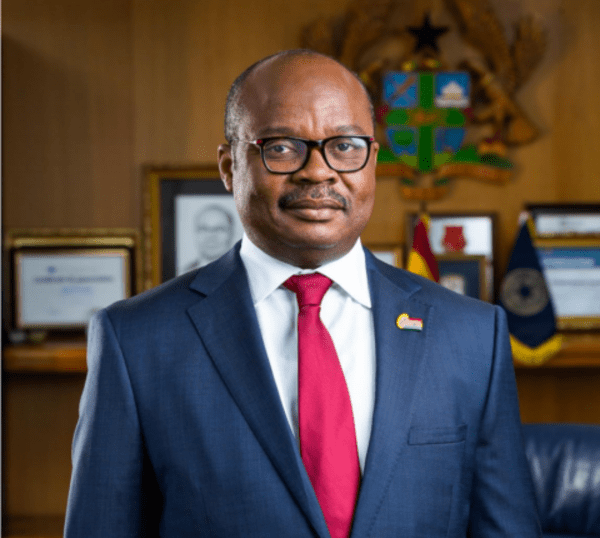

Governor of the Bank of Ghana (BoG), Dr Ernest Addison, has called for increased support for reforms by the International Monetary Fund (IMF) and the World Bank Group (WBG) to meet Africa’s need for resilient fiscal policies.

That should go hand-in-hand with speedy debt restructuring and reliefs, high concessional and flexible financing, as well as tailored and enhanced technical support.

Dr Addison said such collaborative support had become necessary as the continent continued to resolve its debt vulnerabilities, weak domestic revenue mobilisation, and limited access to international capital markets challenges.

He spoke at the 2024 Africa Caucus Meeting with the IMF’s Managing Director, Ms Kristalina Georgieva, at the IMF/WBG Annual Meetings in Washington DC, USA.

According to the African Development Bank (AfDB), the continent needs up to US$170 billion annually for infrastructure, with a financing gap of up to $108 billion.

However, it is faced with a rising ratio of interest payments to revenue since the early 2010s, affecting investment in essential services, and leaving about half of countries at high risk or already in debt distress by the end of 2023.

“Overcoming these challenges requires a multifaceted approach combining domestic reforms with stronger international support. The African Governors are committed to fiscal reforms, medium-term consolidation,” Dr Addison said.

The Central Bank Governor said it was crucial for the IMF to resume timely charging interest rates on Poverty Reduction and Growth Trust (PRGT funds) as most PRGT-eligible countries were still facing significant challenges.

“In this context, maintaining the high concessionality of the PRGT is critical while ensuring adequate financing through all possible options, such as gold sales,” he stated.

He urged the IMF and World Bank to ensure that programmes accounted for regional specificities to ensure sustainable and impactful reforms that did not disproportionately affect vulnerable populations.

He also said that specific regional technical assistance was a key prerequisite to addressing the underlying causes of fiscal challenges and other bottlenecks to achieve durable and inclusive economic growth in member countries.

To this end, there is a need for a stronger partnership between the IMF and the Africa Peer Review Mechanism, Dr Addison said.

The Central Bank Governor recommended that the Global Sovereign Debt Roundtable (GSDR) lead to swift, fair, and effective debt resolution under or outside the G20 Common Framework, focusing on providing timely debt relief for the most vulnerable countries.

Dr Addison stated that African governments on their part were improving public financial management, rebuilding fiscal buffers, and strengthening governance to bolster durable economic growth to overcome the fiscal challenges.

Apart from the African Caucus Meeting, the Central Bank also collaborated with the organisers of the DC Fintech Week 2024 and hosted a high-level leaders networking event.

It was to heighten global community collaboration with Ghana and Africa at large, aimed at harnessing the potential of financial technology (fintech) for sustainable development.

Dr Maxwell Opoku-Afari, first Deputy Governor of BoG led the discussions at the event, which had Hajia Alima Mahama, Ghana’s Ambassador to the United States of America as the Guest of Honour.

The meeting attracted senior policymakers, regulators, private sector representatives, and other key players in the US fintech community to discuss areas of mutual interest to both countries.