Imagine a Ghanaian celebration without the unmistakable aroma of perfectly seasoned poultry wafting through the air – a scenario as unthinkable as a sorrowful feast.

From the festive ambiance of Christmas to the sombre moments of funerals, “Akokornam“, the affectionate local term for chicken, stands as the indispensable protein source, a fundamental element elevating routine meals into memorable occasions.

From the iconic Ghana Jollof with succulent chicken pieces to the classic ‘Angwamo‘ infused with rich poultry flavours, Ghanaians have embraced poultry as the heart and soul of their gastronomic adventures.

In 2022 alone, Ghanaians consumed an estimated 460,000 metric tonnes of poultry, equivalent to about 184 million chickens! In other words, every Ghanaian (young and old) ate 6 whole chickens in 2022. That is quite fascinating, right?

The narrative however changes if we begin to ask the bigger question as to how much of this demand is satisfied by local production. Be with me as I take you through the intricacies.

Demand against production

Presently, Ghana’s domestic poultry production stands at approximately 60,000 metric tonnes, as reported by the United States Department of Agriculture (USDA). In the context of the nation’s overall poultry demand, this figure barely exceeds 13%.

In simpler terms, Ghana can independently generate a mere 13.8% of the total poultry consumed domestically, with the substantial remainder being sourced from international markets.

To put it into perspective, picture a scenario where 7 out of every 8 whole chicken consumed in Ghana are brought in from foreign countries, underscoring the nation’s heavy reliance on poultry imports to meet its consumption needs.

Ghana’s import spending on Poultry

This poultry passion comes at a cost. Ghana’s poultry import bill reached $410 million in 2021, according to data from OEC, solidifying the nation’s position as one of the top poultry importers globally. The majority of poultry imports flood in from countries like Brazil, the United States, the Netherlands, Poland, and Argentina.

Poultry Production Challenges

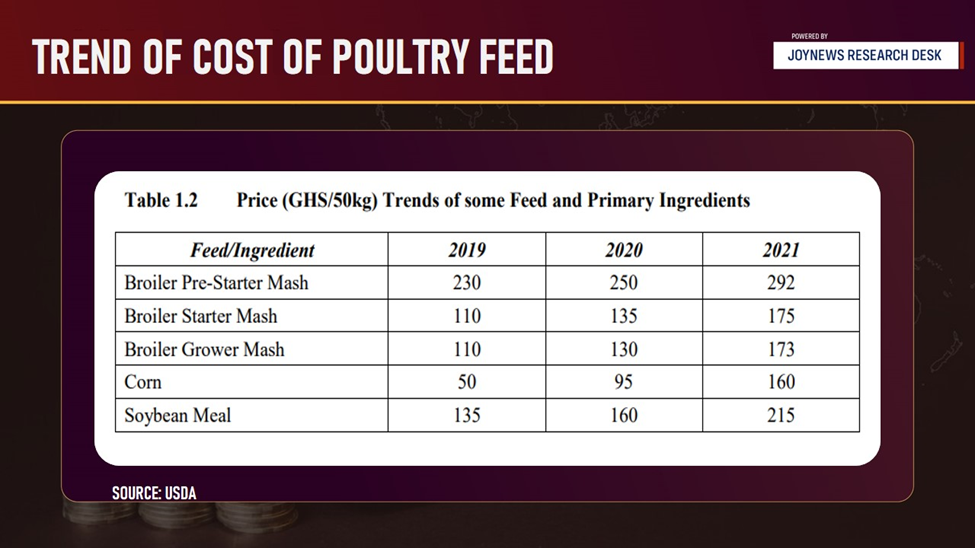

According to the USDA, some of the major difficulties faced by local producers is the feeding cost of poultry. The feeding cost is estimated to account for almost 80 percent of the total cost of poultry production. Recently, the prices of corn, the primary feed ingredient, has been on a sharp increase due to unforeseen shortages.

This has also been coupled with high demand from other countries, industries (especially breweries), as well as human consumption.

This phenomenon is translated to the price of domestic poultry in Ghana. As the prices of production increases, the price of domestic poultry meat increases, all other things being equal.

Government policies on poultry

Over the years, the government has implemented some policies with the goal of improving local production of poultry and cutting down on imports.

In 2013, the government implemented customs duties to bolster the local poultry industry. Another significant policy, the Broiler Revitalization Project in 2014, aimed to enhance production and achieve a local sourcing target of 40%. However, the objective of this policy remains unfulfilled.

Subsequently, the introduction of the “Planting for Food and Jobs” programme in 2017 sought to ensure food security, generate raw materials for agro-processing industries, and create employment, with a focus on reducing costs in the poultry sector.

Furthering this initiative, the “Rearing for Food and Jobs” campaign, launched in 2019 under the Planting for Food and Jobs initiative, aimed to cultivate a competitive livestock industry and diminish import reliance.

Additional endeavours encompassed investments in infrastructure, the provision of inputs like 20 tonnes of soya beans, and the exploration of alternative protein sources such as black soldier fly larvae.

These comprehensive efforts were geared toward revitaliisng the poultry industry and fostering increased local production.

Can Ghana afford an import restriction?

In simple terms, if the domestic industry is unable to meet the existing demand, an import restriction might lead to shortages, potentially affecting food security and consumer access to poultry products.

This means that unless there are proper structures in place to meet the demand, it will be suicidal for Ghana to impose restrictions on poultry meat. Does that also mean that we should depend on importation?

A lot has been said about the Government’s attempt at regulating what imports we allow to compound our forex situation, and overall, the decision to withdraw the L.I. is a good one.

In the light of Ghana’s persistent challenge in balancing poultry importation with local production, one must ponder over what innovative strategies and collaborative efforts can be undertaken to address this import-production paradox and propel the nation towards self-sufficiency in poultry.

The future of Ghana’s poultry industry awaits a transformative solution, one that aligns economic viability with sustainable agricultural practices.

What role do you envision stakeholders playing in shaping this trajectory?