The New Patriotic Party (NPP) flagbearer, Dr Mahamudu Bawumia, has delivered on his promise to create a business-friendly environment by including several announced policies in the 2024 NPP Manifesto.

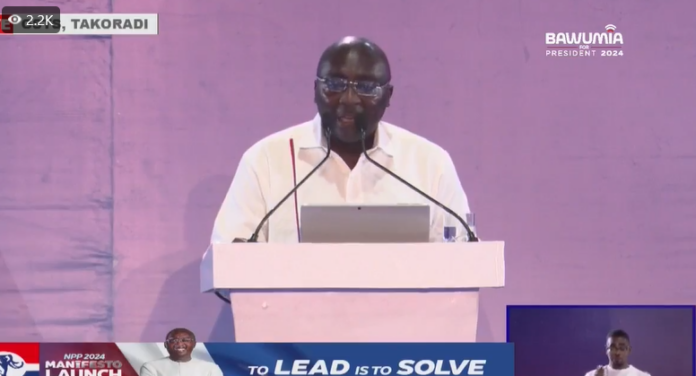

Delivering his address at the launch of the Manifesto in Takoradi on Sunday, Dr. Bawumia stressed on strong desire to support and expand businesses and the private sector through a new tax regime by his government, which he said, has been designed to aid businesses and also help the economy grow.

“To increase government tax revenue, we have to reform and refocus the Ghana Revenue Authority (GRA) towards broadening the tax base. Estimates suggest revenues amounting to 13% of GDP (or $24 billion in 2023) are not collected because people are outside the tax net,” he said.

“We want a tax regime that is easy to understand, easy to comply with and easy to enforce and that is not subject to so much discretion. Many individuals and businesses find our tax system cumbersome and confusing.

“My government will introduce a very simple, citizen and business-friendly flat tax regime. A flat tax of a % of income for individuals and SMEs, which constitute over 80 % of all businesses in Ghana, with appropriate exemption thresholds set to protect the poor. With the new tax regime, the tax return should be able to be completed in minutes. We will also simplify our complicated corporate tax system and VAT regime,” he added.

Dr Bawumia also announced that his government intends to reform the Value Added Tax regime by merging all levies into a single line-item levy and treating the merged levy as part of input and output VAT, to “eliminate the cascading effect in the current regime.”

Dr Bawumia also stressed that to start the new tax system on a clean slate, “my government will provide a tax amnesty, which is a complete exemption from the payment of taxes for a specified period and the waiving of interest and penalties up to a certain year to individuals and businesses for failures to file taxes in previous years so that everyone will start afresh.”

As part of the new tax regime, tax digitalization, Dr Bawumia noted, will be implemented across all aspects of tax administration.

“Everyone will be required to file a very simple tax return electronically through their mobile phone or computer. There will be no manual or paper filing of taxes. Faceless assessments will provide transparency and accountability. There will be no need for GRA to send officers to sit in shops. E-invoicing, as being implemented by the GRA will be extended to all companies.”

Source: Adomonline