The majority of banks in Ghana will continue to record poor loan quality in 2024, reducing their incentive to increase lending and keeping their Loan to Deposit Ratio (LDRs), Fitch Solutions has disclosed.

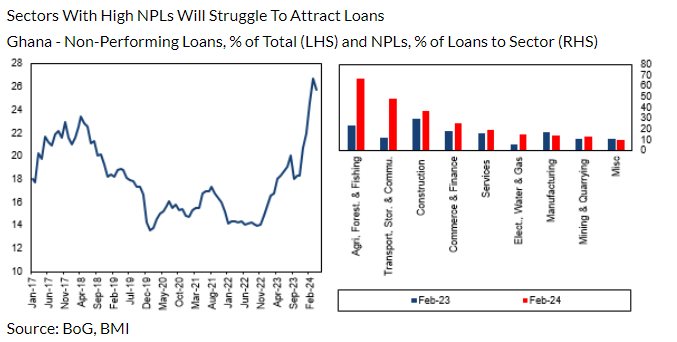

The industry Non-Performing Loan (NPL) ratio stood at 25.7% in April 2024, down slightly from a record high of 26.7% in the previous month, making lending very risky.

The London-based firm said this is affecting several sectors, such as Agriculture, Forestry, and Fishing, with an NPL ratio of 67.0% in February 2024, and Transport, Storage, and Communications, which had an NPL ratio of 48.0% for the same period.

“While we expect the robust performance of the agriculture sector to help reduce its NPL ratio, banks will remain hesitant to increase exposure to this and other sectors with high NPL ratios. We anticipate that loan quality will remain poor in H2 [second-half] 2024 and 2025, although we believe that the NPL ratio will peak soon, if it has not already”, it mentioned.

“Therefore, the overall impact on loan growth will be muted in 2024.”, it added.

On the one hand, it said loan growth will be supported by both a stronger economic outlook and some banks increasing loan growth due to both stronger demand and supply. However, very poor loan quality will weigh on credit extension, and some banks will be forced to ignore the new regime, doing little to change their LDR.

Deposit growth to record 25.5% growth

Additionally, it anticipates that deposit growth will remain robust in 2024, recording 25.5% year-on-year in February 2024, supported by an improving economic environment.

However, the slowing loan growth and strong deposit growth will make it harder for banks to reach the LDR of 55.0% required to obtain the lower Cash Reserve Ratio requirement (

Currently, the industry average LDR is 39.5% as of December 2023, which is the second-lowest ratio among the largest Sub-Saharan Africa (SSA) markets, just above Mauritius at 33.0%.

READ ALSO: