The Ministry of Finance has released a list of questions that are likely to be asked by members of the general public in respect of the Electronic Transactions Levy (e-Levy) and provided answers to them.

This follows the passage of the E-levy Bill on Tuesday by a Majority-sided House after members of the Minority walked out during the consideration stage.

It, thus, appears that all is set for the implementation of the tax policy even as President Akufo-Addo is yet to assent to the Bill.

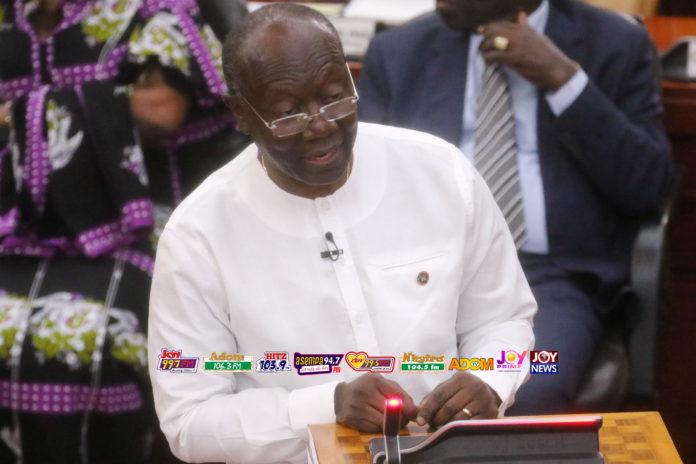

According to the Finance Minister, Ken Ofori-Atta, his outfit has had discussions with the Controller and Accountant General’s Department (CAGD) and the Ghana Revenue Authority (GRA) towards a smooth implementation of the policy.

Speaking in an interview with journalists in Parliament on Wednesday on the sidelines of the 2022 State of the Nation Address (SONA), Mr. Ofori-Atta said the CAGD and GRA “have indicated to us that, right at the beginning of May, they should be able to get their systems together.”

In the document made available on Social media therefore, the Ministry provided answers to pertinent questions such as; What is the E-levy?, What is the rate of the levy?, Why has government decided to levy electronic transfers? What will the revenue generated by the E-Levy be used for? and how will the levy be applied? among others.

Please read full document below: