Ghana has been highlighted as one of the African countries with a majority of its external debt denominated in US dollars. This is according to the 2024 United Nations report on Unpacking Africa’s Debt.

The report reveals that over 80% of Ghana’s external debt is in dollars, leaving the country vulnerable to exchange rate volatility.

“Over half of Africa’s external debt is in US dollars, and countries like Angola, Ethiopia, Ghana, Nigeria, South Africa, and Zambia are more vulnerable to currency fluctuations, as more than 80% of their external debt is in US dollars,” the report emphasizes.

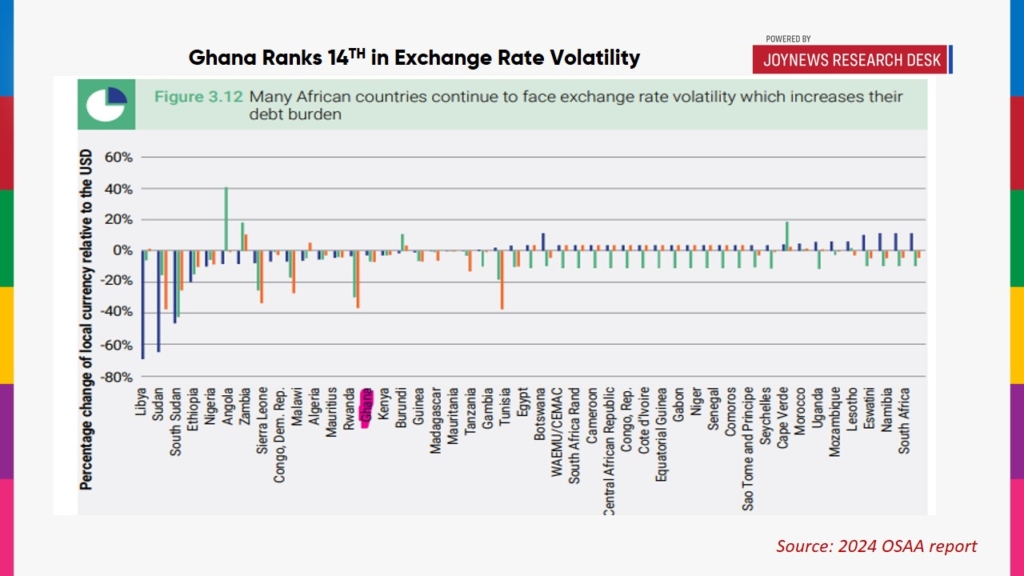

The report also indicates that Ghana ranks 14th in Africa for experiencing exchange rate volatility, which contributes to its growing debt burden.

Exchange rate volatility refers to how much a currency’s value—such as the Ghanaian cedi—changes relative to another currency, like the US dollar, over time.

This situation places Ghana in a difficult position, as fluctuations in the exchange rate between the Ghanaian cedi and the US dollar can significantly increase the cost of repaying these loans. When the cedi loses value against the dollar, Ghana must spend much more in its local currency to cover the same debt.

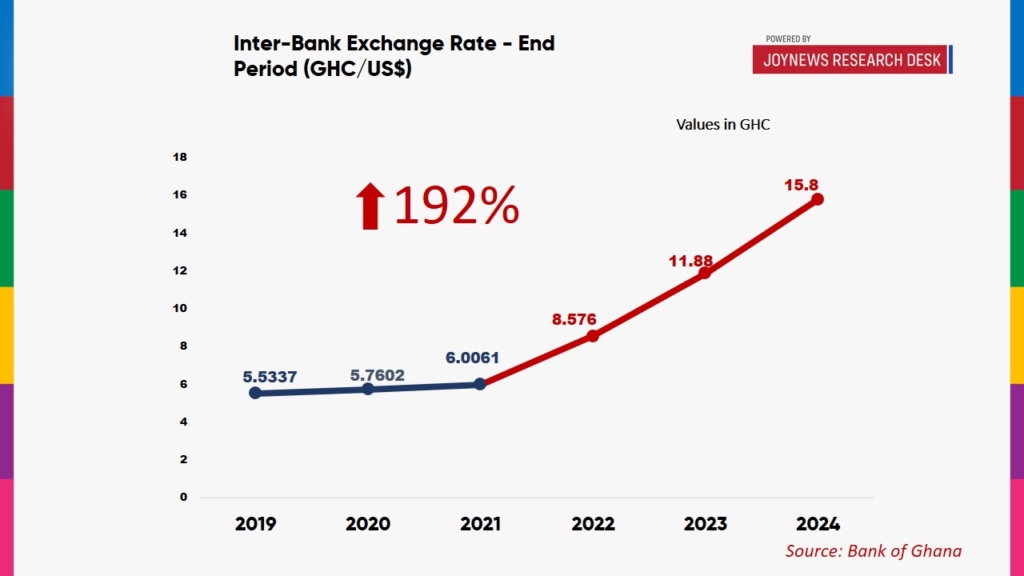

For example, a debt amount that cost GHS 5.5 billion in 2019 would now cost GHS 15.8 billion in 2024 due to the surging USD/GHS exchange rate. This sharp rise in debt servicing costs exerts significant pressure on government finances and limits available funds for critical sectors such as health and education.

As a result, it becomes increasingly difficult for the government to manage its finances, leaving less money for vital areas like health, education, and infrastructure. Ghana’s situation is part of a broader problem faced by many African countries that rely heavily on foreign currency-denominated loans.

With global financial conditions remaining uncertain, finding solutions to reduce these risks and manage debt more effectively is crucial for Ghana’s economy.

The demand for US dollars to meet debt obligations further exacerbates the exchange rate surge. Ghana must purchase dollars in the foreign exchange market to repay its loans, which drives up the USD/GHS exchange rate, particularly when the supply of dollars is limited.

Additionally, concerns over debt sustainability can prompt capital outflows, further weakening the cedi and compounding the issue.

As of September 2024, Ghana’s external debt stood at GHS 470 billion, with approximately 80% of this amount denominated in US dollars—equivalent to GHS 376 billion. At the start of the year, the exchange rate was 12.0356 GHS/USD, but it has since risen to 15.8 GHS/USD, an increase of 3.764.

This depreciation of the cedi has caused Ghana’s dollar-denominated debt to increase by 31.27% purely due to exchange rate fluctuations. A stronger US dollar globally has made Ghana’s dollar debt even more expensive.

This creates a vicious cycle where a weakening currency increases debt costs, leading to further borrowing and greater fiscal strain. Addressing this challenge requires Ghana to diversify its debt portfolio away from the dollar, strengthen its local currency through sound economic policies, and enhance its resilience to external shocks.

READ ALSO: