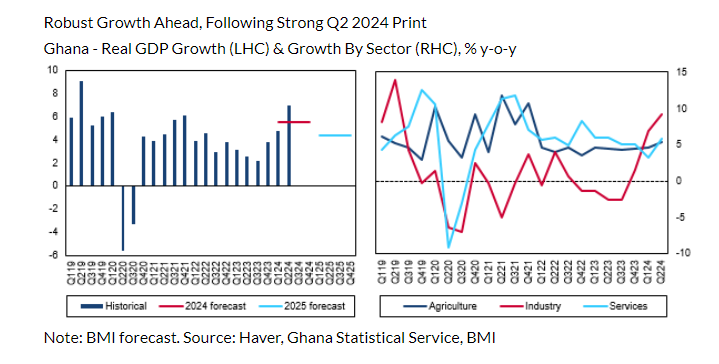

Fitch Solutions is forecasting an economic growth in Ghana to rise from 2.9% in 2023 to a three-year high of 5.5% in 2024.

The latest data from the Ghana Statistical Service shows that the economy expanded by a strong 6.9% year-on-year in quarter 2, 2024, building on the solid 4.8% recorded in quarter one.

According to the UK-based firm, the growth acceleration in quarter 2, 2024 was largely driven by stronger industrial output buoyed by mining and quarrying, as well as a continuing recovery in the construction sector.

In expenditure terms, stronger growth in quarter 2, 2024 was bolstered by an 8.5% increase in private consumption and a 12.6% rise in exports.

Turning to the second half of 2024, it said growth will remain strong, although it will decelerate from the high recorded in quarter 2, 2024.

This view is informed by two key assumptions, it added.

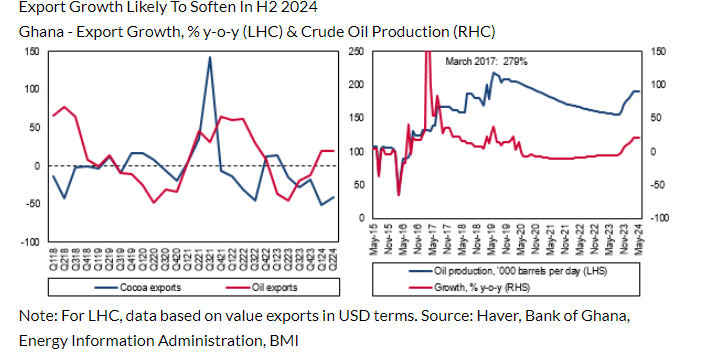

“First, we think that the strong export growth in quarter 2, 2024 is unlikely to be maintained over the second-half of 2024. The quarter 2 surge in exports was in part driven by solid growth in international oil sales, due to a robust recovery in crude production in first half of 2024. However, this recovery appears to have hit its peak, leading to moderating growth rates in the latter half of the year and thereby capping export growth”.

“Second, we think that private consumption growth will moderate over the remainder of the year. As a result of rapidly rising inflation, consumer activity ground to a halt in 2022 and started making a recovery in 2023. As private consumption expanded by a strong 18.7% and 19.2% year-on-year in quarter 3 and quarter 4 2023 respectively, this will create a high base from which to grow, resulting in lower growth rates in second-half of 2024”.

That said, it stressed that robust consumer fundamentals point to healthy spending ahead.

Data released by the Bank of Ghana (BoG) shows that the number of mobile money transactions grew by a robust 21.1% year-on-year in June 2024, alongside a 42.5% rise in new payment card issuances.

Source: Joy Business

READ ALSO: