Recent data from the Ghana Statistical Service indicates a significant drop in the export value of cocoa beans for the second quarter (Q1) of 2024.

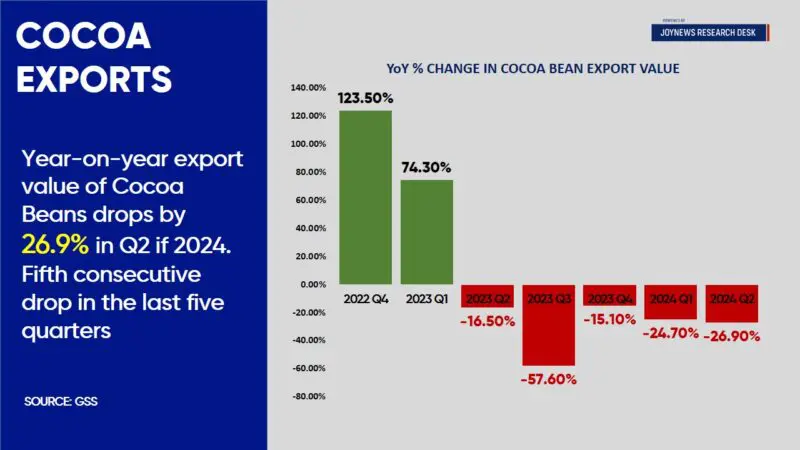

The export value fell from GH₵ 1.57 billion in the second quarter (Q2) of 2023 to GH₵ 1.15 billion in the second quarter (Q2) of 2024, marking a 26% decrease.

This decline is part of a continuing trend, with cocoa bean exports decreasing for the fifth consecutive quarter.

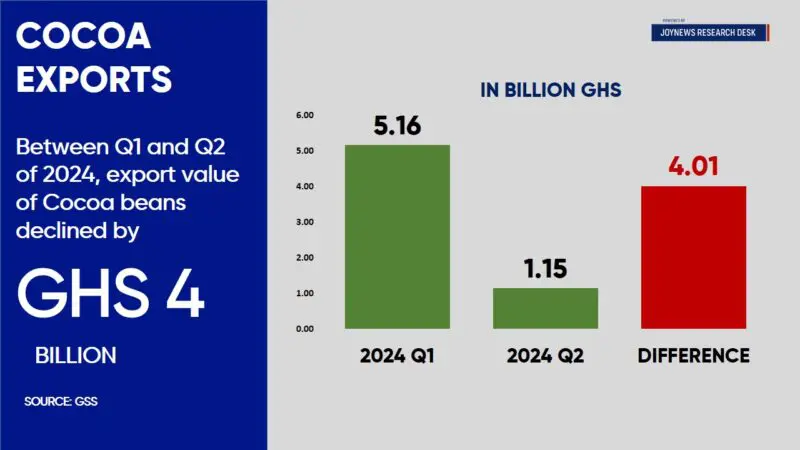

In the Q1 of 2024, the export value also dropped by 24.7% compared to Q1 of 2023. Notably, the quarterly decline between Q1 and Q2 2024 was even more drastic, with an 80% drop, equating to a GH₵ 4 billion reduction.

Production and Market Context

The reduced export values come amidst a challenging production season. By the end of June 2024, Ghana had produced about 429,323 metric tons of cocoa, less than 55% of the average production in previous years. This shortfall is expected to result in the lowest annual output in over two decades.

Supply and Price Dynamics

Poor harvests in Ghana and Ivory Coast have led to a four-year supply deficit in the global cocoa market, pushing up prices. Despite the increased global prices, Ghana has not reaped the benefits due to significant smuggling activities.

Low local prices and payment delays have driven farmers to sell to trafficking rings, resulting in a loss of over a third of Ghana’s 2023/24 cocoa output—approximately 160,000 metric tons.

Price Adjustments and Smuggling

In response to the crisis, Cocobod has increased the farm gate price by 45% for the 2024/25 season, raising it from GH₵ 2,070 to GH₵ 3,000 per 64-kilogram bag. Previously, Ghana’s prices were GH₵ 490 lower than Côte d’Ivoire’s, encouraging smuggling.

The new price is now GH₵ 440 higher than Côte d’Ivoire’s current rate, but Côte d’Ivoire has yet to announce its 2024/25 price, leaving the impact of Ghana’s price adjustment uncertain.

The decline in Ghana’s cocoa export value reflects broader issues of production shortfalls, market dynamics, and smuggling. While the farm gate price increase is a step towards addressing smuggling, its effectiveness remains to be seen, depending on regional pricing strategies.

Source: Anthony Manu

READ ALSO: