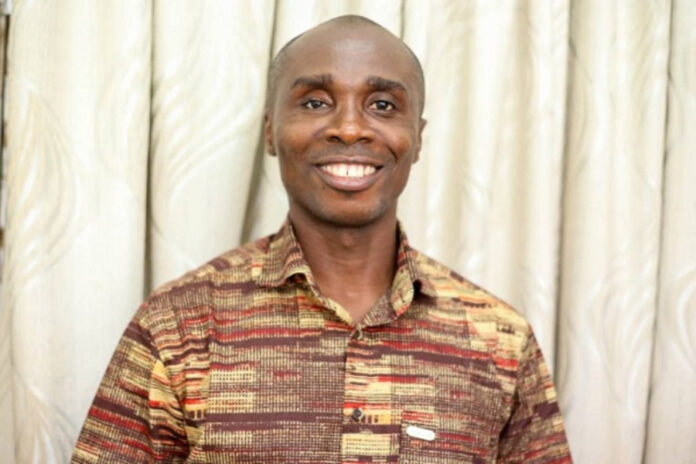

Economist, Patrick Asuming has suggested that the government revamp economic financing to halt cedi depreciation.

In an interview on Joy FM’s Midday News on Tuesday, August 6, he said the overreliance on foreign financing is a major factor contributing to the cedi’s extreme volatility, adding that the country needs to check some of its imports.

“I think we should think a little longer term in addressing the cedi depreciation rather than the shorter-term measures implemented which have not solved the problem. In the past, we have relied on foreign inflows, but now is the time to reform the whole economy in terms of how it is financed,” he said.

Dr Asuming’s comments come after the Institute of Statistical, Social and Economic Research (ISSER) in its 2024 Mid-Year Budget Review reported that Cedi depreciation has significantly impacted the country’s economic landscape, leading to labour agitations, the collapse of some businesses, and the relocation of others to more business-friendly countries.

According to the economist, businesses relocating and increasing labor agitations are not necessarily due to currency instability. However, “it is a reflection of the overall difficult economic environment.”

“In addition to the problems brought on by currency depreciation, we have seen in the last few years the rising cost of doing business, an increasing number of taxes, and the uncertainty generated in our tax laws – those are major parts of the argument.”

For this reason, he proposed making the business environment more friendly and predictable, including establishing stable regulations in the country.

He also emphasised that the economy must be grown on a more competent basis.