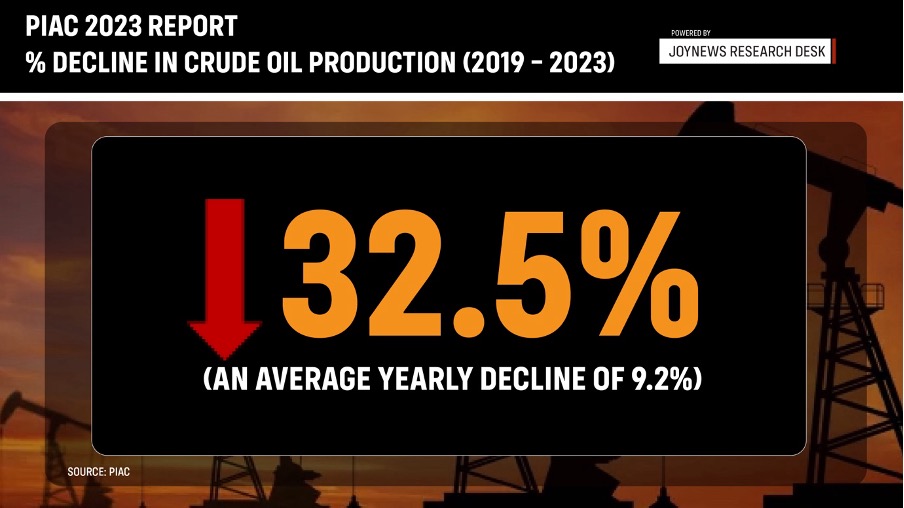

The Public Interest and Accountability Committee (PIAC) has released its 2023 report on the management and use of petroleum revenues, revealing a stark 32.5% decline in Ghana’s oil production since 2019.

This decline, coupled with other financial challenges, underscores the critical issues facing the country’s petroleum sector. Here are the key takeaways and the committee’s recommendations.

Crude Oil Production and Revenue

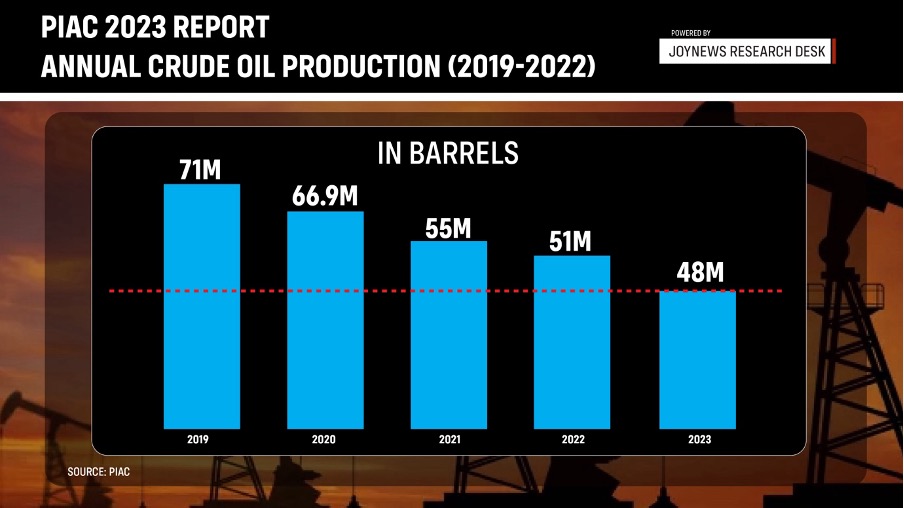

Ghana’s oil production peaked at 71 million barrels in 2019, but by 2023, output had fallen to 48 million barrels—a drop of 23 million barrels, or 32.5%.

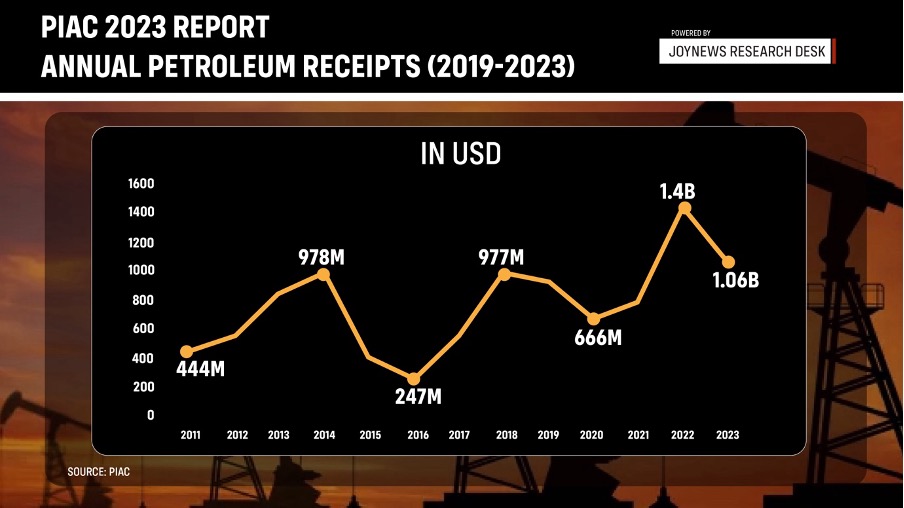

This decline has naturally led to a decrease in revenue, with annual petroleum receipts falling from $1.4 billion in 2022 to $1.06 billion in 2023.

The $340 million shortfall is particularly painful given that Ghana’s next tranche of IMF support is just $360 million. Unless production stabilizes or oil prices rise, Ghana’s revenue will continue to shrink, straining the broader economy.

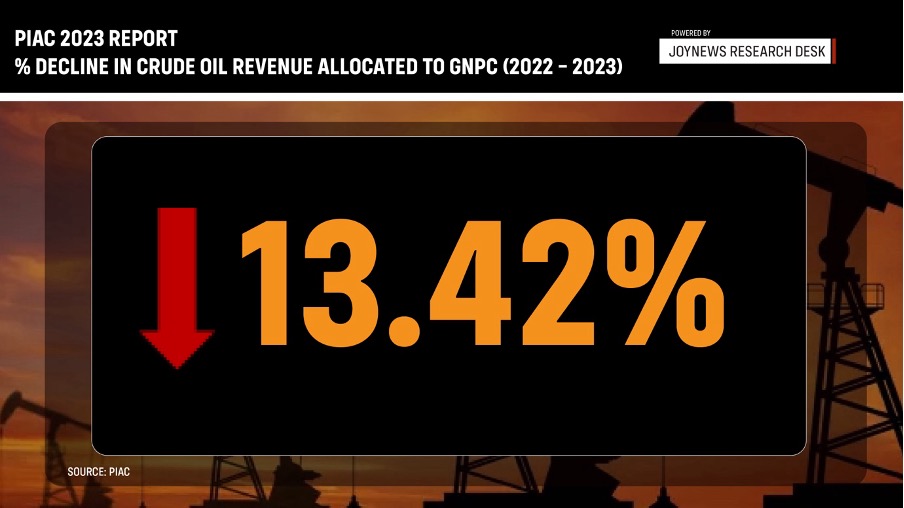

The Ghana National Petroleum Corporation (GNPC), which collects revenue from oil producers, experienced a 13.42% decline in its share of revenue, further squeezing its financial position.

Mismanagement of Petroleum Funds by the District Assemblies Common Fund (DACF)

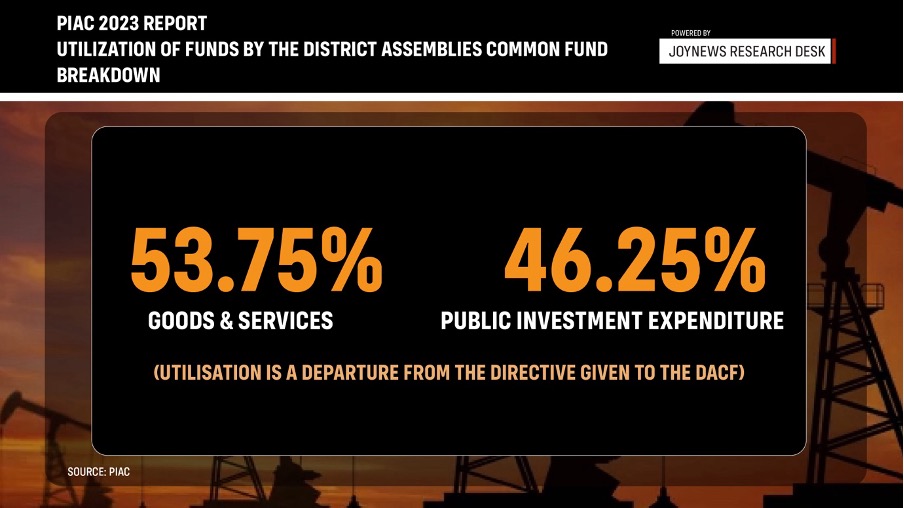

The PIAC report highlighted discrepancies in how the District Assemblies Common Fund (DACF) utilized its petroleum funds. Contrary to the Petroleum Revenue Management Act, which mandates that 70% of such funds be spent on public investment, the DACF spent 53.75% on goods and services and only 46.25% on public investment.

The committee has urged the Ministry of Finance to enforce compliance with the law.

Disbursement to Priority Areas

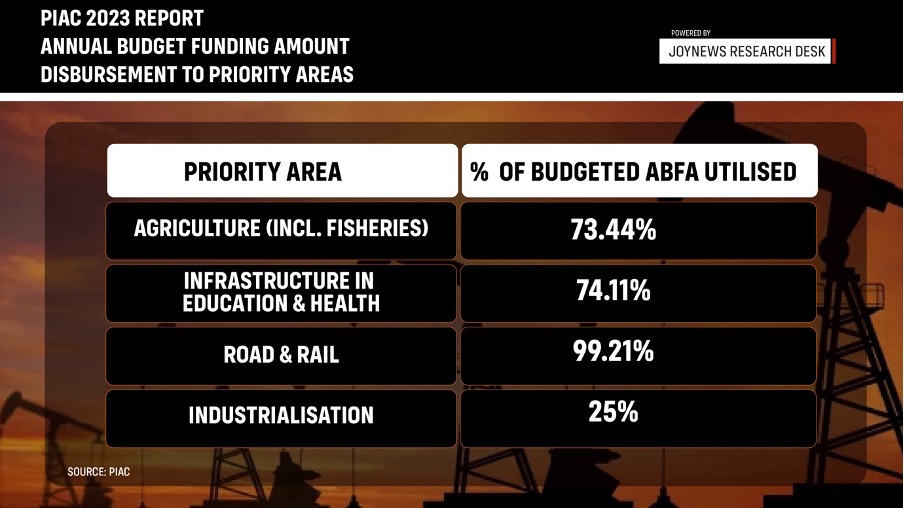

The Ministry of Finance biennially selects priority areas for petroleum fund expenditure. Until 2025, these areas are Agriculture, Infrastructure in Education and Health, Road and Rail, and Industrialization. However, the report found that only 25% of the budgeted funds for industrialization were utilised.

For an emerging economy like Ghana, underfunding industrialization is a critical oversight that could hamper long-term growth.

Financial Strains on Ghana Gas

The report revealed that Ghana Gas has cumulative outstanding receivables amounting to $954.5 million, including legacy debts.

Additionally, Ghana Gas owes the GNPC $604 million for raw gas purchases.

Despite implementing the Cash Waterfall Mechanism to address these debts, Ghana Gas’s liabilities continue to grow, threatening its operational viability.

Recommendations

PIAC made several recommendations to address these issues:

- The government should invest in unexploited oil fields to boost production.

- The Ghana Revenue Authority (GRA) needs to intensify efforts to recover arrears.

- The Ministry of Finance should ensure that petroleum funds are used in accordance with the Petroleum Revenue Management Act.

- The Ministry of Finance should prioritize the Industrialization Priority Area in Annual Budget Funding Amount (ABFA) disbursements.

These recommendations are aimed at improving the management of petroleum revenues and ensuring the long-term sustainability of Ghana’s oil sector and its broader economy.

By following these measures, Ghana can hope to reverse its declining oil fortunes and better harness its petroleum resources for economic development.

However, the path forward requires diligent oversight and strategic investment to mitigate the risks identified by PIAC and secure a stable financial future for the nation.

READ ALSO: