The Ghanaian government has justified its proposed tax on revenues generated by large technology firms such as Google, YouTube, and Facebook within the country.

This move comes amid criticism that the tax may lead to these companies exiting the Ghanaian market.

Despite skepticism from financial analysts, who argue that implementing these taxes may be challenging due to global resistance, the government insists that it is crucial for tech giants benefiting from Ghana’s economy to contribute their fair share.

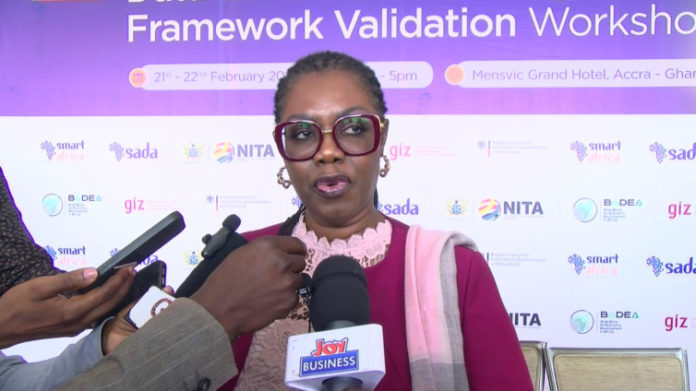

Speaking to JoyNews on Monday, the Minister for Communication and Digitalization. Ursula Owusu-Ekuful questioned, “How many of you make pure voice calls? Almost all of you are using data to make your calls and even international calls as well, so the revenue that we were getting from the international gateway is declining, and so how does the government also make up for these declining revenue sources?

“We have to look at new ways of getting some of the profits that are being made in these sectors, and none of them contribute to actually building the networks on which they deliver their services to the end consumer. Is that situation going to be allowed to continue?”.

When asked about the concern that multinational companies might relocate, the Communications Minister stated “They are never going to leave Africa, neither Facebook nor Google, nor YouTube nor WhatsApp nor Instagram, because a significant amount of people who use their services are on this continent, and it is growing.

“That is why I am saying we should not have the conversations as individuals, so they threaten to pull out of “A” country because that country has imposed some charges or levels on them.”

Meanwhile, the Ghana Revenue Authority has already started engaging these entities on the proposed taxes on their revenue earned from Ghana.

READ ALSO: