Background

The Ghana Revenue Authority (GRA), we understand, contracted SML to monitor petroleum liftings and assure that volumes lifted declared for tax purposes by Oil Marketing Companies (OMCs) are complete and accurate. An investigative report by the 4th Estate noted that the services provided by SML to GRA did not result in an increment in petroleum volumes and by extension increase in related tax revenue.

Similarly, some Civil Society Organisations (CSOs) including the African Center for Energy Policy (ACEP) and IMANI also performed some analysis using petroleum volumes lifting data from the National Petroleum Authority (NPA) and GRA/ESLA and concluded that SML’s services only resulted in marginal changes. On the other hand, Metro TV programme (Good Evening Ghana) provided analysis covering some pre and post-SML work and concluded that SML on monthly basis had closed the under declaration of liftings by 100 million litres. SML put out a release stating that from May 2020 to December 2023, its services resulted in closing under declarations of 9.0 billion litres and increasing tax revenues of about GH¢12.9billion.

The President of the Republic of Ghana, in a public release on January 2, 2024, appointed KPMG, a reputable audit, tax, and advisory firm to conduct an audit of the contracts and related transactions between GRA and SML. This followed a public discussion of the subject matter that the contracts may not have been in the interest of the State. On April 24, 2022, the President issued directives on KPMG’s report. The release noted that KPMG found among other things that the work done by SML resulted in closing a petroleum lifting volume of 1.7 billion litres and generating tax revenues of about GH¢2.45 billion for the period May 2020 – December 2023. The release also listed some legal and governance breaches in the award of SML’s contract.

The findings of KPMG contained in the President’s release have been challenged by the Civil Society Organisations who in their view, no increase in volumes were benefited from SML’s work and consequently no tax revenue was derived. The 4th Estate (Manasseh Azure Awuni) has also made statements echoing similar sentiments. On the other hand, SML has issued a statement strongly disagreeing with the findings of KPMG regarding the realised petroleum volumes and the tax revenue amongst others and in this particular statement claiming that their services have contributed to an incremental petroleum lifting volumes of 10.3 billion litres and incremental tax revenues of GH¢14.8 billion.

Issue of Contention

Since the release by the office of the President on the work of KPMG, the key issue of contention which forms the basis of this analysis are:

- Whether SML’s services has led to closing the gap between petroleum lifting report to

NPA for consumption analysis and those reported to GRA for tax purposes. - Whether the services from SML have led to increase in tax revenues as a result of

increase in declarations of petroleum volumes to GRA.

This publication is not dealing with other matters in the President’s release. Other matters will

be a subject of other subsequent discussions.

Different views on value Assessment

3.1 CSO – ACEP/IMANI/Bright Simmons

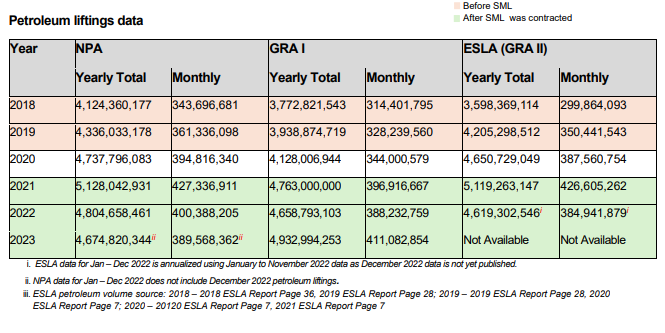

ACEP and IMANI examined data from GRA and NPA to determine if SML’s services led to increased petroleum liftings and related taxes. The GRA’s petroleum product data was extracted from its submissions to the Ministry of Finance for statutory reporting under the Energy Sector Recovery Act (ESLA) from 2018 to 2022. The NPA data, a longstanding industry data repository, was sourced from its own website spanning over two decades. A comparison of the NPA to GRA/ESLA volumes revealed some differences, although quite similar for the period 2018/2019 to 2021/2022 where NPA volumes were higher than volumes available to GRA.

The ACEP & IMANI report concluded that there are powerful exogenous factors that drive petroleum consumption and demand in Ghana and that these factors would have to be systematically eliminated before one can isolate the impact of SML’s intervention, if any.

The analysis, however, does not attempt to breakdown or propose a methodology to isolate the various exogenous effects in order to determine the impact of SML’s intervention, if any. That in my view would been a more objective analysis.

This article uses data available to the public to isolate the effect of the exogenous factors and attempt to determine the amount of incremental volume and revenue that may be attributable to SML.

3.2 Claims by SML

SML claimed that the commencement of its revenue assurance operations in the downstream sector has led to an incremental volume of 9 billion liters, translated into incremental tax revenue of GH¢12.9 billion for the period 1 May 2020 to 31 December 2023. While SML has released this to the public domain, it has not provided additional details of how it arrived on these numbers. Consequently, it is difficult to assess the accuracy of this claim.

With the observations noted above, I have set out to analyse the data between GRA and NPA for the period before SML was contracted i.e. 2018 and 2019 and the period after SML was contracted i.e. 2020 – 2023.

3.3. Sources of Data for Further Analysis

In the performance of this analysis, I have used data from three (3) sources;

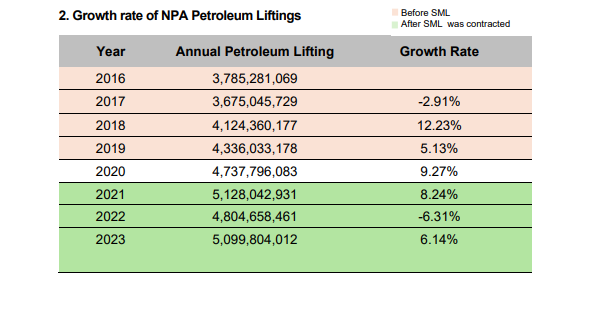

a. NPA – Reported petroleum volume liftings for consumptions.

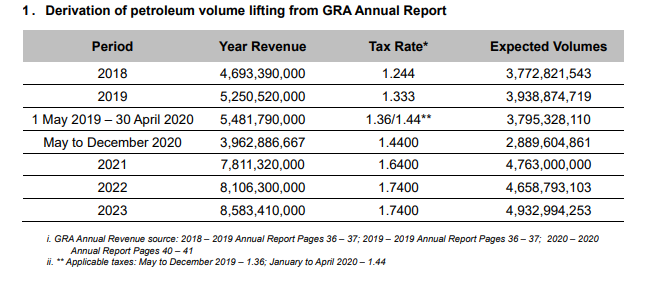

b. GRA I – Petroleum volume liftings derived from petroleum tax revenue reported by GRA in its annual reports.

c. ESLA (GRA II) – Reported petroleum liftings on which ESLA levies are paid to GRA.

The table below summarises the annual total and monthly average of the data sourced from the aforementioned sources.

NPA is assessed as the most complete data as it reflects volume liftings for consumption. To assess whether SML’s services increased lifted volumes for tax purposes, I have compiled the data for the periods before and after SML.

3.4 Period before SML

This period is limited to 2018 and 2019. When NPA data is compared to GRA I note that volumes reported

by GRA is lower than that of NPA by 351,538,634 for 2018 and 397,158,459 for 2019, respectively.

Similarly, when NPA data is compared to ESLA data the NPA data is higher than the ESLA data by

525,991,063 and 130,734,666 for 2018 and 2019, respectively. From the above analysis, it is evidently

clear that whether you use revenue data from GRA or ESLA, petroleum volume liftings reported by GRA

in the period before SML’s services were lower than NPA suggesting that there was a difference between

petroleum liftings reported for consumption (NPA) and those reported for tax purposes (GRA).

3.5 Period after SML

I have used 2021-2023 as the period after SML. When the three (3) datasets are compared there are

minimal differences between NPA and GRA data post the start of SML’s services.

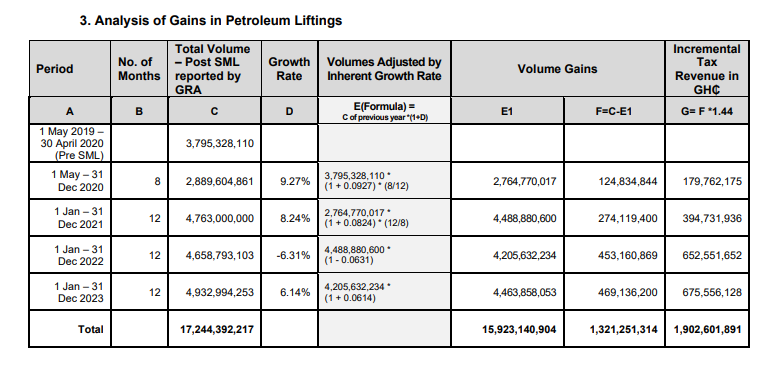

Admittedly, the increase in volumes, the closing of gaps includes factors such as new OMCs, growth in

economic activities and the monitoring services by SML. In order to isolate the other factors from the impact of SML’s services, I have determined the year-on-year growth using NPA as that is the most complete data. The growth rate is then used to adjust the before-SML GRA data to account for factors that leads to increase in consumption of petroleum products. Any differences that exist after such adjustments should reasonably represent the contribution by SML.

Conclusion

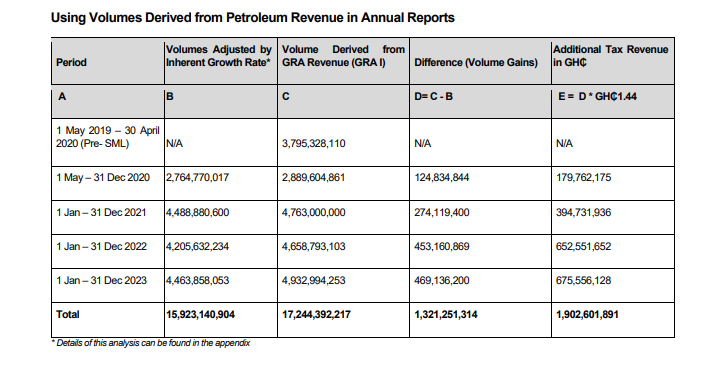

The results show that on a crude basis, when other factors that contribute to the consumption of petroleum liftings are taken care off, there is improved reported volumes to GRA by 1.32 billion litres and related revenue by GH¢1.9 billion. This analysis uses information that are available to the public.

This position could potentially change if data from ICUMS is analysed in a similar way. As this is not a publicly available data, I could not extend the analysis to cover that data. It is expected that the work done by KPMG should consider all available data including ICUMS. If this has not been considered by KPMG then, GRA must make this information available for further studies and analysis. It is, however, clear and evident from this analysis and study that SML’s contribution to tax revenue cannot be nil as determined by the CSOs and 4th Estate and it cannot also be 9billion litres and GHS12.9 billion as determined by SML.

In conclusion, this analysis and study has proven that there is some added value from the value of SML both on the volume of litres and also the tax revenue. This result, however, could potentially change if more refined data is obtained from GRA systems such as ICUMS which hold the current data for GRA.

Appendices