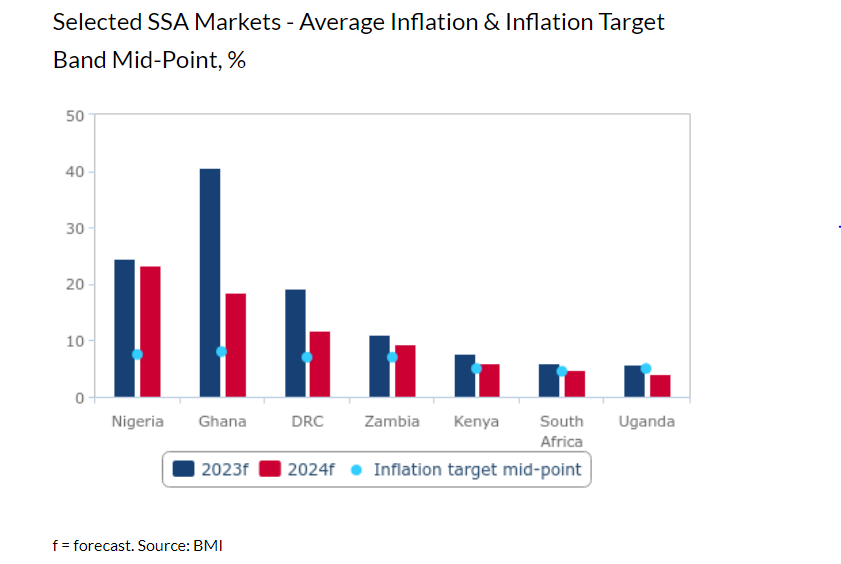

Ghana’s average inflation for 2024 is expected to hover around 18%, Fitch Solutions has revealed in its Sub-Saharan Africa Macro Key Themes for 2024.

“While price growth will remain above the long-term 2013-2022 average of 11.8%, we expect sustained disinflation to incentivise major SSA [Sub-Saharan Africa] markets to shift towards monetary easing, broadly in line with developed markets’ dovish pivot in H224 [second-half of 2024]”.

It forecasted that the US Federal Reserve will cut the policy rate by 100 basis points to 4.50%, while the European Central Bank will cut by 50 basis points to 4.00% in the second half of 2024.

This shift, it said, will give space to emerging markets (EMs), including Nigeria, Ghana, DRC, Kenya and Uganda, to commence monetary easing due to the diminishing risk of downside pressures on Emerging Markets currencies, caused by a narrowing real interest rate spread with developed markets.

BoG, others to implement policy rate cuts

Fitch Solutions also said the Bank of Ghana and other central banks in SSA will undertake policy rate cuts in 2024.

While it expect the majority of SSA markets to implement policy rate cuts, it believe there is limited scope for monetary easing in several markets such as Angola and Tanzania.

For example, Angola’s policy rate will remain on hold at 18.00% during 2024 due to persistent inflation and expectations of further depreciation of the kwanza as a result of faltering domestic oil production and elevated external debt payments to Mainland China-based creditors.

ALSO READ: