The Ghana Education Trust Fund (GETFund) has clarified that a list of individuals circulating on social media and thought to be recent beneficiaries of scholarships awarded by the Fund, is old.

According to information shared on the GETFund website, the said list which was contained in the 2019 Audit Report, followed an “exercise to uncover the trends of scholarship awards from 2012 to 2018 and ensure efficiency and increase transparency in the administration of scholarships.”

“Management is therefore utterly surprised that these very listed scholars captured in the Audit Report have resurfaced on social media generating a discourse and making it look like a new matter that requires immediate attention,” the Fund indicated in the publication.

Excerpts from a 2018 Forensic Audit Report on awards of scholarships by Ghana Education which audit was initiated and paid-for by the Fund, and carried out by the Auditor-General’s Department, have been re-circulated on social media over the weekend.

The Audit Report made recommendations towards streamlining the awards of scholarships by the Fund.

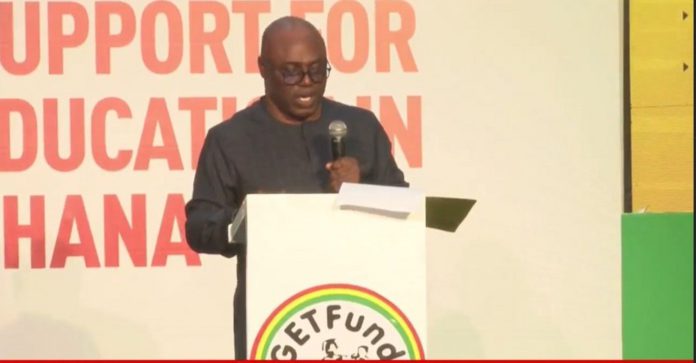

When the said Audit Report emerged in the public space in August 2019, the Administrator of the Fund, Dr. Richard Ampofo Boadu, engaged the media and explained the origination and the purpose of that Special Audit.

He mentioned during the interaction that the GETFund Board, through management, had also implemented the said recommendations, it noted.

Among the reforms, is the implementation of an end-to-end online process in the awards and the management of scholarships. “This has led to an enhanced, transparency, efficiency, and effectiveness in the administration of scholarships.”

It announced: “As part of the policies by the Fund to deepen stakeholder engagement, the month of November, in each year, has been earmarked for an open forum with all stakeholders.”

“The forum offers opportunity for the pubic to ask questions and for the Management to explain procedures and systems introduced to ensure prudent utilization of the taxpayers’ funds.”