With a trailing price-earning ratio (P/E ratio) of 41, Tullow Oil equity is highly valued by investors as a company that has the capability to grow its income streams to higher levels in the years ahead as investors anticipate higher growth in income.

This is particularly so given that, earnings recorded at the end of 2022 were retained by the oil company for re-investment into its operations as investors/shareholders received zero dividends despite an earnings per share of GHS 0.28.

The oil production company at the end of the first half of 2023 reduced its gross debt by $266m through bond buyback and amortisation.

Additionally, Tullow also recently surpassed 100,000 barrels of oil per day production milestone signaling an expected increase in revenue and net income. The company is projected to generate free cash worth $200m at an estimated oil price of $80 per barrel in the second half of the year.

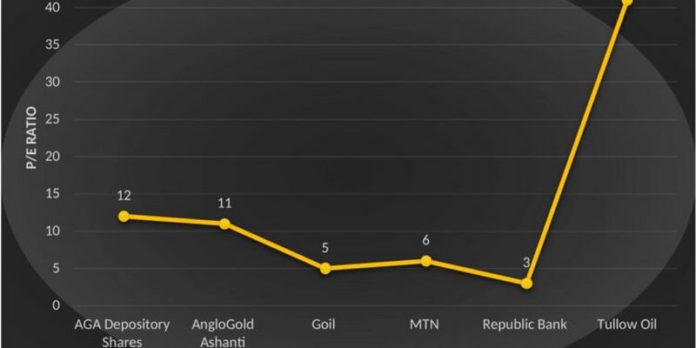

The Tullow equity has the highest P/E ratio on the GSE with the closest P/E ratio being 12 and 11 that are attributed to AngloGold Ashanti Depositary Shares and AngloGold Ashanti respectively.

Tullow Oil equity has a P/E ratio 11.7x the average P/E ratio of 3.5 of companies listed on the GSE. That notwithstanding, it cannot be said that Tullow Oil equity is “better” than other equities listed on the GSE as a comparison based on P/E ratios can only be done between companies operating in the same industry.

Comparing P/E ratios of Tullow Oil equity which is in the extractive sector with MTN equity which is in the telecommunication sector for instance, would be like comparing apples to oranges as both industries have different ways and timelines for earning their income and as such have different industry-average P/E ratios.

Hence comparing P/E ratios of Tullow Oil, Kosmos Energy and Eni would be more appropriate, unfortunately, the latter two companies are not listed on the Ghana Stock Exchange (GSE).

In as much as the high P/E ratio could signal investor or shareholder confidence in the company’s ability to grow its income level and post higher income growth, it can also signal the over-valuation of the equity.

Is Tullow Oil equity over-valued?

As noted earlier, although a high P/E ratio represents investors’ confidence in increased growth earnings by a company, it can also signal the overvaluation of the stock or equity.

The reverse is also true that a company with a low P/E ratio is indicative of investors’ low confidence in the ability of the company to grow its income stream and generate high growth incomes and hence can signal the under-valuation of the equity.

A company with high share price relative to low earnings can be described as being over-valued. Once again the reverse is true, a company with a low share price relative to earnings can be said to be undervalued.

In the case of Tullow Oil, the equity has a share price of GHS 11.92 with a total twelve months trailing (TTM) earnings per share of GHS 0.28. Hence, the equity can be said to be over-valued.

P/E ratio of 41 – what does it really mean?

Aside being an indicator of anticipated income growth or decline as well as the over or under-valuation of an equity, P/E ratios also tell how much cedis you need to pay or invest in the company in order to receive GHS 1 of the company’s earnings.

So for example, if a company is currently trading with P/E ratio of 20, then the interpretation is that an investor is willing to pay GHS 20 to receive GHS 1 of the earnings of the company when it makes a profit.

Hence in the case of Tullow Oil, with a P/E ratio of 41, it implies investors or shareholders are willing to pay GHS 41 to enjoy or receive GHS 1 in earnings from the company.

Effectively what this means is that, since the share price of the equity is GHS 11.92, a single share will not get an investor or shareholder the required or wanted GHS 1 earnings, but rather the purchase of roughly 3.5 shares (which amount to GHS 41.72) will get the investor or shareholder the required or wanted GHS 1 earnings of the company.

Additionally, the P/E ratio is indicative of the company’s prevailing market value. The P/E ratio of 15 for a pharmaceutical company for example, means that the current market value of the company is 15 times its annual earnings.

Hence if you were to buy 100% shares of the pharmaceutical company, it would take 15 years for you to earn back your initial investment through the company’s ongoing profits assuming the company never grew or expanded in the future.

In the case of Tullow oil, the P/E ratio of 41 implies that the current market value of the company is 41 times its current annual earnings.

Tullow Oil has a market capitalization of GHS 17.2bn on the Ghana Stock Exchange (GSE).

No single ratio can tell you all you need to know about a stock, before investing in a particular stock, it is wise to use a variety of financial ratios (dividend yield, P/B ratio, P/E ratio among others) to determine whether a stock is fairly valued and whether a company’s financial health justifies its stock valuation.