A recent currency performance ranking by Bloomberg has classified the Cedi as the worst-performing currency across the globe.

Bloomberg tracked the performance of 150 currencies in the world and the Cedi placed last in terms of performance since the beginning of the year.

In less than eight months, the Cedi has come under intense exchange rate pressure due to its continuous depreciation to some major international currencies such as the Dollar, Pound and Euro.

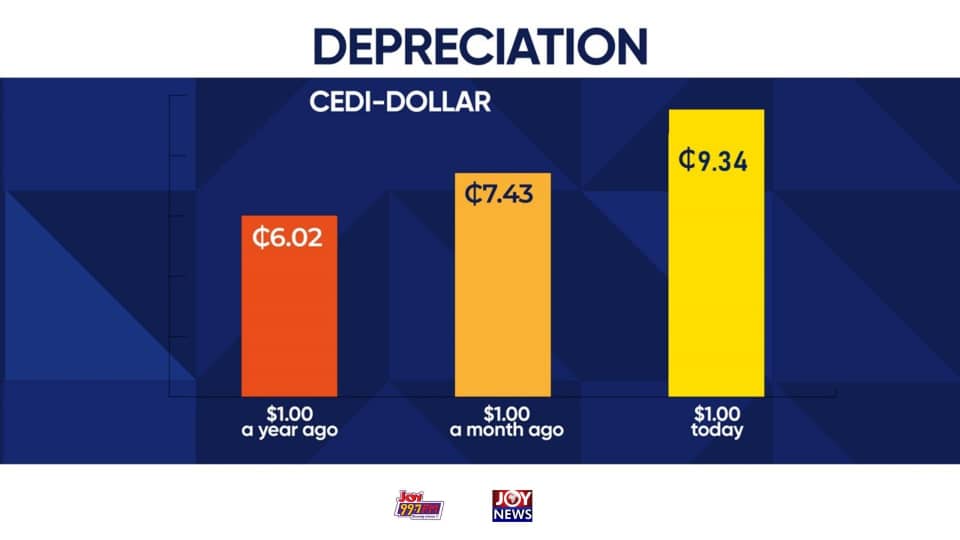

According to data put out by the Bank of Ghana, the Cedi began the year at $1.00 to GH¢6.02.

Just a month ago, one could exchange $1.00 for GH¢7.43, and in less than 20 days, traders needed an average of GH¢9.37 to buy $1.00.

This means the Cedi has lost more than GH¢3.30 of its value to the dollar in less done eight months.

To address the exchange rate problems, the Monetary Policy Committee is expected to meet today to “review recent developments in the economy,” according to a statement released by Bank of Ghana.

That’s after it left borrowing costs unchanged at 19% last month on expectations that inflation may be leveling off and to allow a cumulative 550 basis points of rate hikes since November to filter through the economy.

The Central Bank is the second in sub-Saharan Africa after the Bank of Uganda to hold an emergency meeting since Russia’s war with Ukraine erupted in February.

The meeting comes after regulators announced Monday that water and electricity tariffs will rise 22% and 27% respectively from next month.