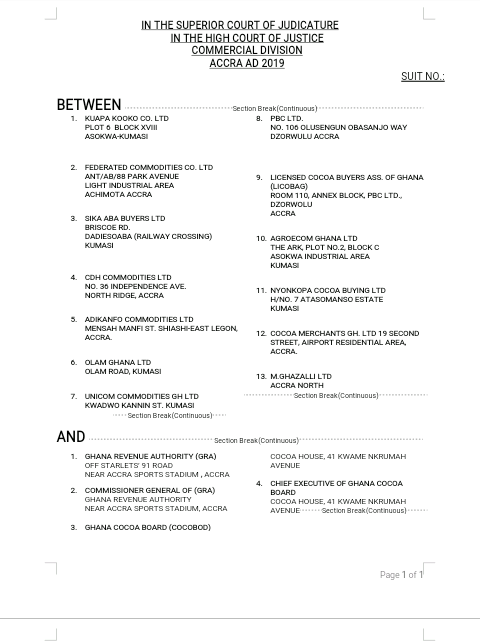

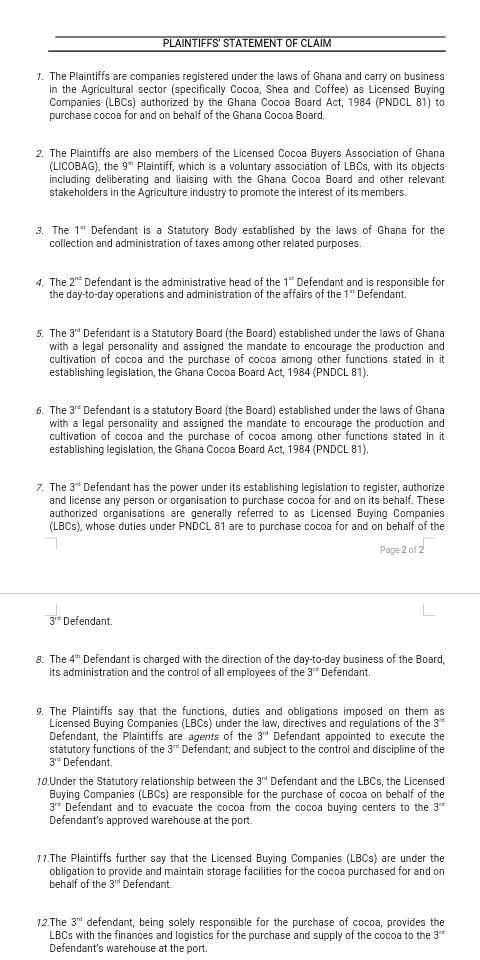

Some 13 Licensed Buying Companies (LBCs) have filed a lawsuit against the Ghana Revenue Authority (GRA) and Ghana Cocoa Board (COCOBOD).

READ THIS: Govt sets 2022 target to be self-sufficient in rice production

The law suit is to disallow the two statutory bodies from coercing LBCs into paying Value Added Tax (VAT).

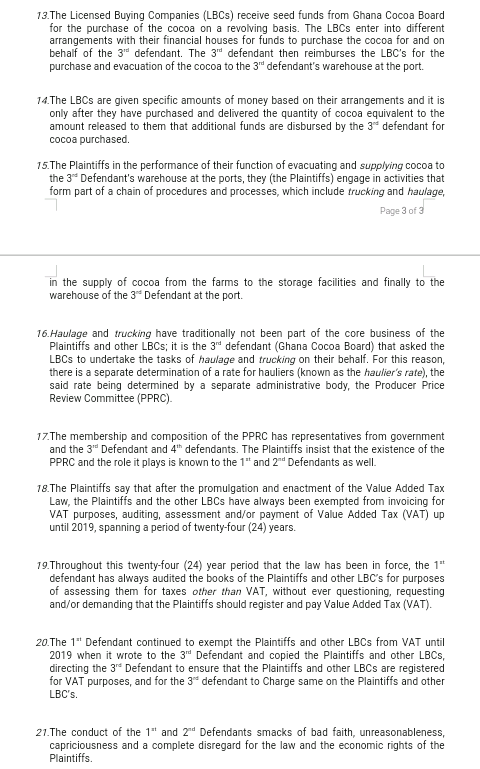

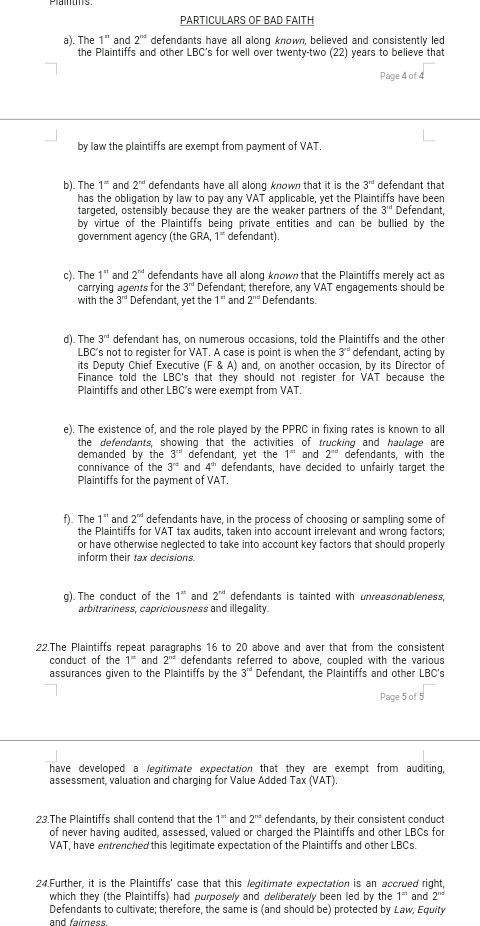

According to the LBCs, the two statutory bodies are fully aware of the VAT exemption enjoyed by LBCs after the promulgation and enactment of the VAT Act, 2013.

SEE THIS: Suzzy Willams was murdered – Mother alleges

The law exempts LBCs from invoicing for VAT purposes, auditing, assessment as well as the payments of VAT.

The LBCs said for the past 24 years which the law has been in force, the GRA has always audited LBC’s for purposes of assessing them for taxes other than VAT, without ever questioning, requesting or demanding LBCs’ register and pay VAT.

READ ALSO: NDC calls for the arrest, prosecution of Osafo Marfo

Hence, the decision of GRA to write to COCOBOD directing it to ensure that LBCs are registered and charged for VAT purposes, smacks of bad faith, unreasonableness and a complete disregard for the law and the economic rights of LBCs.

Read full suit below: