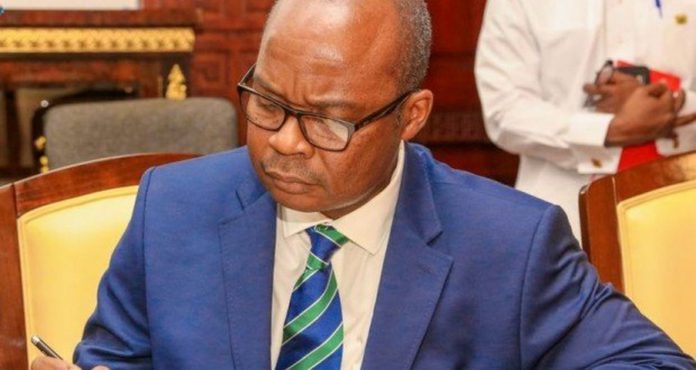

Governor of the Bank of Ghana, Dr Ernest Addison has said the absence of a deposit insurance scheme in the midst of bank failures could impose enormous strain on fiscal policy management.

Speaking at the 2019 International Association of Deposit Insurers (IADI) Africa regional committee technical assistance workshop in Accra, Dr Addison said “In the absence of an effective scheme, as has been the case in Ghana until now, the failure of banks and specialized deposit-taking institutions would suddenly place an enormous burden on taxpayers’, as the Government would be compelled to finance pay-outs to depositors in an attempt to forestall the potential for a bank-run and help contain threats to financial stability.”

He added that “to curtail the potential adverse effects of bank failures on state resources, and to enhance public confidence in the financial system, the established deposit protection schemes to protect depositors from losses in the event of the failure of a bank or specialized deposit-taking institution has become the norm.”

Dr Addison said, “Ghana does not wish to be left behind in this global drive to develop deposit insurance schemes to maintain financial stability and economic growth. Ghana’s Deposit Insurance scheme is long overdue. It is for this reason that the Ghana Deposit Protection Corporation (GDPC) was established by the Ghana Deposit Protection Act, 2016, (Act 931, as 5 amended) to protect small depositors against losses in the event of the materialization of an insured financial sector shock.”

He said the establishment of GDPC, therefore, comes as a big relief and a welcome addition to Ghana’s financial safety net apparatus,

He said it puts the nation in a state of readiness to better manage the failure of banks and deposit-taking financial institutions in the future.

The workshop is under the theme, “Deposit Protection – A Catalyst for Financial Stability.”