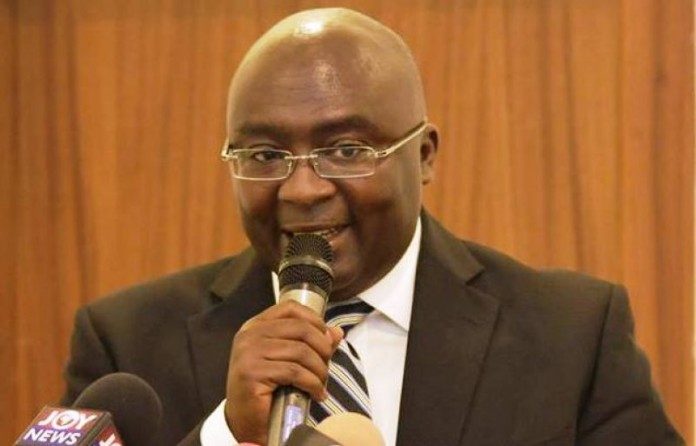

Minority Spokesperson on Finance, Casiel Ato Forson is the latest to wade into tasking the Vice President Dr. Mahamudu Bawumia to answer questions about the economy.

Prior to his unfortunate demise, former Veep Paa Kwesi Amissah Arthur had asked his successor, to answer the questions he posed to him while in office.

He wanted the former Deputy Governor of the Bank of Ghana (BoG) to concede that the country’s economy is struggling, despite efforts to revamp it.

ALSO: Pastor dies in fatal accident at Fomena

He said the economy under the governing New Patriotic Party (NPP) has not been any better than it was under the past government.

With the cedi struggling to find its feet and what the Minority describes as an economy that can do better, Mr. Forson has five questions for the Veep to answer.

Below are the questions the Minority spokesperson on Finance seeks answers to.

ALSO: Four freed in Asamoah Gyan extortion case

Question 1: Why would an independent central bank with focus on price stability decide to reduce the monetary policy rate against its own research findings that US policy normalization is strengthening the US dollar and causing investors to move funds away from emerging economies and that upward adjustment in domestic prices of petroleum products are likely to affect transport and utility prices?

Question 2: Why would an independent central bank, with a focus on price stability, decide to lower the policy rate in the face of dwindling net international reserves and a rising interest rate abroad?

Question 3: Why would an independent central bank with a focus on price stability decide to reduce the monetary policy rate in favour of growth, which has been projected to be higher than the previous year’s, while the local currency is under pressure?

Question 4: Why would an independent central bank with a focus on price stability decide to lower the policy rate in the face of excess liquidity in the banking sector emanating from banks increasing their minimum paid-up capital by over 100 per cent, while the local currency is fast depreciating?

Question 5: Clearly, an economy cannot be externally unstable and internally stable. How can a rapid exchange rate depreciation be accompanied with a single digit inflation rate as captured by the posted macroeconomic indicators?

Source: Myjoyonline.com