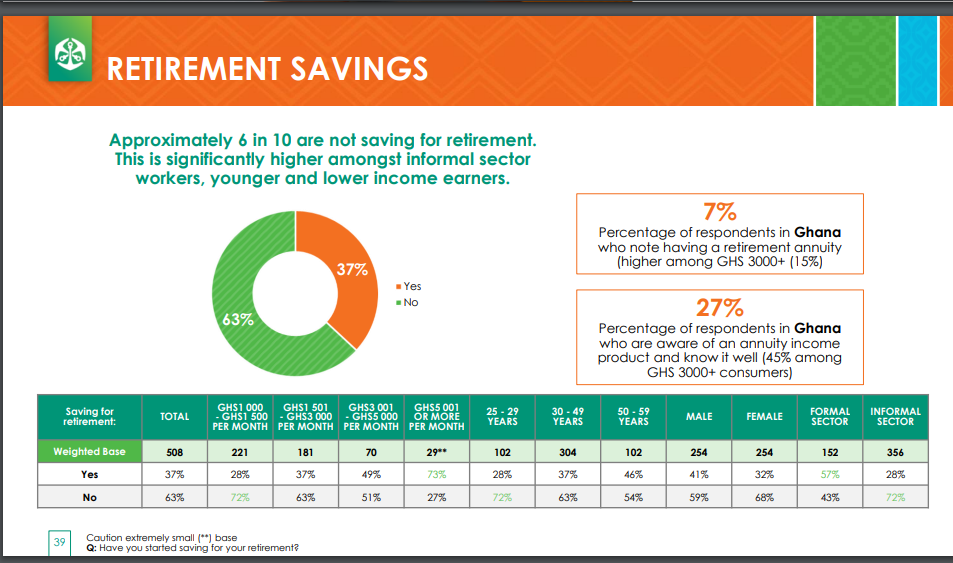

Approximately 6 out of 10 Ghanaians are not saving for retirement, according to the 2023 Old Mutual Financial Services Monitor.

This is significantly higher amongst informal sector workers, younger and lower-income earners.

The report also said only 18.0% are very confident that they have enough savings for retirement.

Only 37.0% of respondents have started saving for retirement.

Again, 7 out of 10 Ghanaians are hoping that their children may support them when they are old.

There are no significant differences across age and income levels. Significantly lower expectations amongst Ghanaians (11%) that the government will look after them when they are unable to support themselves.

For life cover, 88% of respondents said they do not currently have life cover.

In terms of the reasons for not having a life cover, 24% of the respondents pointed out that life cover is not a priority. Eighteen percent said they do not see the importance.

Meanwhile, consumers use a multitude of ways to save from formal to informal depending on needs.

The top savings channels mentioned are at a bank, Mobile money, Susu, or Unbanked cash.

ALSO READ:

Sam George reveals salary of GRA boss

Common core curriculum: Science students to skip Core Maths, Integrated Science

Video of Moesha Boduong lying motionless in hospital bed sparks concerns