The government has announced a series of revenue measures to address the fiscal gap following the removal of key taxes, including the E-Levy and Betting Tax.

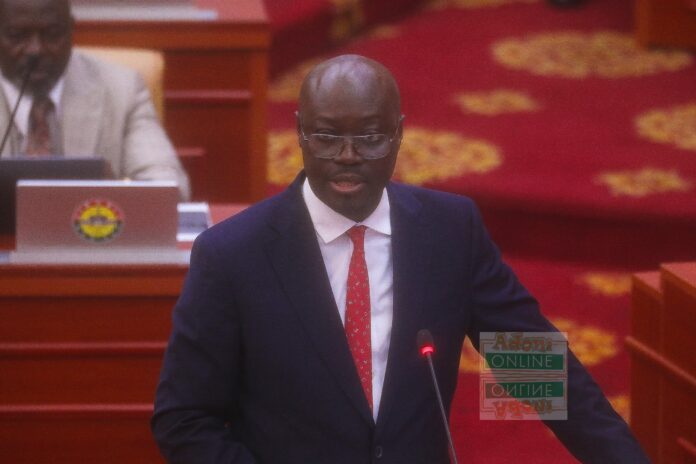

Addressing concerns about how the government will offset the revenue shortfall, Finance Minister Dr. Cassiel Ato Forson stated, “The answer is we have stopped the bleeding.”

He explained that some taxes were not being utilized for their intended purposes, making their removal a non-disruptive move for the economy.

To sustain revenue generation and ensure fiscal stability, the government has introduced alternative measures, including an increase in the mining levy, the reintroduction of road tolls, and the extension of the Special Import Levy.

Ghana has not fully benefited from the global rise in gold prices. To address this, the government proposes raising the Growth and Sustainability Levy on mining companies from 1% to 3% of their gross production, ensuring increased revenue from the booming gold market.

Additionally, road tolls will be reintroduced in 2025 under the Big Push Programme to enhance infrastructure development. This time, the government plans to implement a technology-driven collection system to ensure efficiency and minimize delays.

The government also intends to extend the Special Import Levy until 2028. Initially introduced as a temporary measure, the levy on imported goods will now remain in place to sustain revenue generation.

Another key strategy is reducing the tax refund ceiling from 6% to 4% of total revenue, a move expected to save the government GH¢3.8 billion in 2025 alone. This adjustment limits the amount set aside for businesses that qualify for tax refunds.

The Energy Sector Levies Act (ESLA) will also be reviewed to consolidate multiple levies—including the Energy Debt Recovery Levy, the Energy Sector Recovery Levy (Delta Fund), and the Sanitation & Pollution Levy—into a single levy. Proceeds will be used to address energy sector shortfalls and service inherited debt obligations.

Furthermore, the government plans to amend the Revenue Administration Act, 2016 (Act 915) to improve tax collection efficiency, targeting a net tax revenue increase of 2%, equivalent to 0.3% of GDP.

These measures are designed to help the government meet its IMF-supported target of increasing non-oil tax revenue by 0.6 percentage points annually while maintaining its commitment to providing tax relief for citizens.