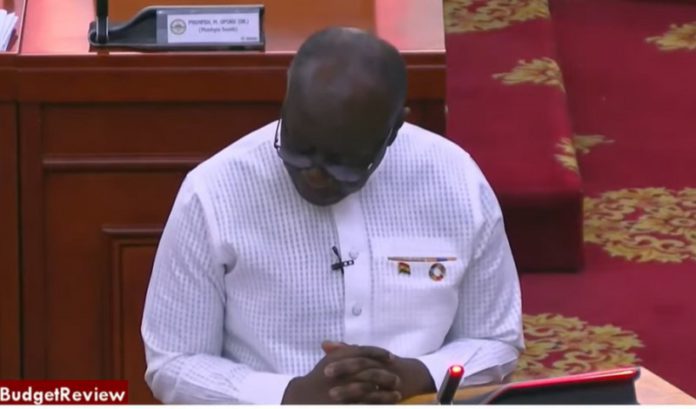

A lecturer at the University of Developmental Studies (UDS), Dr Michael Ayamga says that Finance Minister, Ken Ofori-Atta’s tax reliefs in the 2024 budget are unnecessary.

According to the Development Economist, the Minister of Finance did not do the essential tax cuts as the ones he targeted in his statement had no impact on the already harsh economy.

He accused the Minister of Finance of being cunning by including the e-levy, COVID-19 levy, and communication tax in the budget meant to bring relief to the people.

“There were new taxes but no tax relief in reality if you look at the midst of the aid that he has listed. For example, the first one is to extend the existing VAT which is listed as a new tax relief when in reality it already exists and wants to extend it,” he said on Thursday, November 16.

Speaking on the JoyNews’ AM show, he argued that tax relief on electric vehicles was inconsequential as most Ghanaians cannot afford electronic vehicles except a few.

According to him, there are more pressing and demanding matters that need to be tackled such as illegal mining and forest depletion, and not electronic vehicles tax relief.

“If you go to Savannah regions and the rest, are being degraded and we should be tackling these things not even cosmetic tax relief in the name of an electric vehicle”.

According to him, Ken Ofori-Atta’s budget lacked concrete steps to reduce the cost of businesses, boost domestic production, and decrease the cost of living.