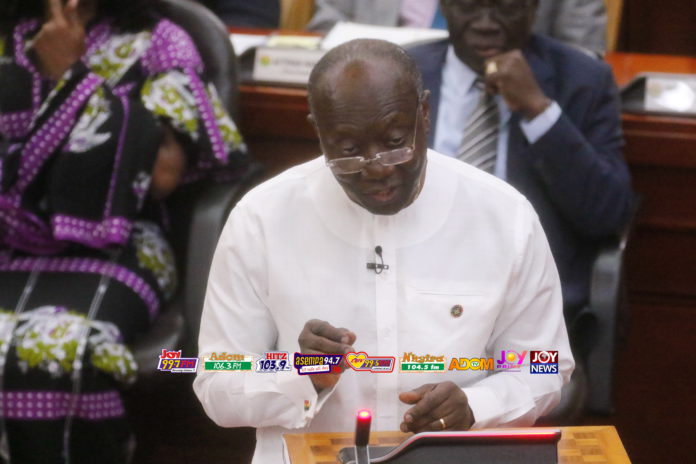

Finance Minister, Ken Ofori-Atta has indicated that the 2022 budget will be heavy on job creation and entrepreneurship.

According to him, government is committed to putting in place those measures that will help deal with the unemployment situation in the country as well as recent challenges with the employment of fresh graduates for the public sector.

The minister added that “I don’t think we can wait any longer, because the time is now on how to create an entrepreneurial state and deal with this issue once and all.”

“Certainly the issues of youth and jobs will be the center of this budget presentation,” the Minister added.

Mr. Ken Ofori-Atta noted that creating an entrepreneurial state has been a challenge for government, and he is hoping to use the 2022 budget to deal with this problem.

Asked whether he will remove taxes on petroleum products as expected, the Minister was tight-lipped about that question, only to highlight the current challenges facing government and the need to do everything to improve the revenue situation.

The 2022 Budget and other issues

Based on the 2022 -2025 Guildlines for presenting the budget, the Finance Ministry is projecting to spend about ¢128 billion, when it comes to revenue, government to mobilize about ¢89 billion.

However, we are learning that these targets have been revised.

This is because some new developments have come up since it was put out in May this year.

JoyBusiness is learning that the 2022 Budget will focus heavily on fiscal consolidation, empowering the Private Sector to employ more and widening the tax net.

However, one is not sure for now whether this “widening of the tax net” may result in government increasing some tax rates or putting in place some measures that will improve efficiency when it comes to collections.

Sources say the government may likely propose some review in the road tolls and also some taxes on prices of petroleum products.

This is because government wants to raise more revenue to finance or improve the bad road infrastructure and also look at raising more revenue when it comes to the petroleum taxes to finance the rising budget deficit.

The Minister is expected to announce some policy measures aimed at assisting businesses or let’s say the private sector to help deal with the unemployment situation in the country.

Introduction of new taxes?

We are learning that the Finance Minister could announce some new taxes in the budget.

He is also expected to reduce some taxes in some areas and even remove some as well.