Government is set to introduce an Electronic Transaction Levy or E-Levy to increase tax revenues for the country.

The introduction of the E-Levy is occasioned by the surge in mobile money transactions during the Covid-19 pandemic of 2020.

According to the Finance Minister, Ken Ofori-Atta, the total transactions for 2020 were estimated to be over ¢500 billion compared to GH¢78 billion in 2016 just five years ago.

Delivering the 2022 Budget Statement on the floor of Parliament, November 17, the Minister stated that “it is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.”

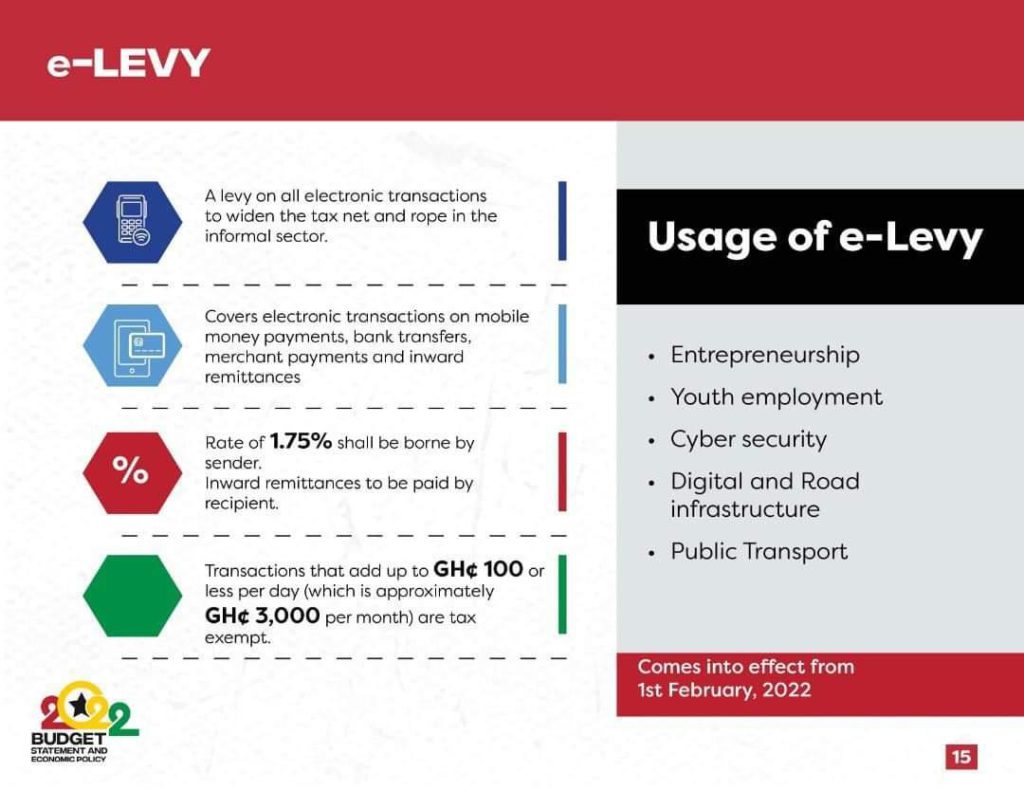

As such government is charging at an applicable rate of 1.75% all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances which will be borne by the recipient.

“Mr Speaker, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GH¢100 or less per day, which is approximately GH¢3,000 per month, will be exempt from this levy,” he stated.

According to the Minister, proceeds from the E-Levy will be used to support entrepreneurship, youth employment, cyber security, and digital and road infrastructure among others.

“Mr Speaker, this new policy also comes into effect once appropriation is passed from 1st January 2022. Government will work with all industry partners to ensure that their systems and payment platforms are configured to implement the policy,” he said.