The Ghana Revenue Authority (GRA) has found out that more than 10 million Ghana Card holders whose information has been migrated to its system are not registered as taxpayers.

Out of the 15.99 million Ghana Card records migrated from the National Identification Authority (NIA) database onto the GRA database, the tax authority has been able to link 3.08 million of its existing 5.74 million TIN numbers to the Ghana Cards as taxpayers.

This leaves a gap of 2.66 million existing taxpayers who could not be linked with their Ghana Card information.

The Commissioner-General of the GRA, Rev. Dr Ammishaddai Owusu-Amoah, told the Daily Graphic that the authority had an existing TIN record of more than 5.74 million, but only 3.08 million could be matched with the records it received from the NIA, leaving 2.66 million unmatched with TIN records.

“The unmatched TIN records have been distributed to their assigned Taxpayer Service Centres for the necessary compliance activities,” he said.

Context

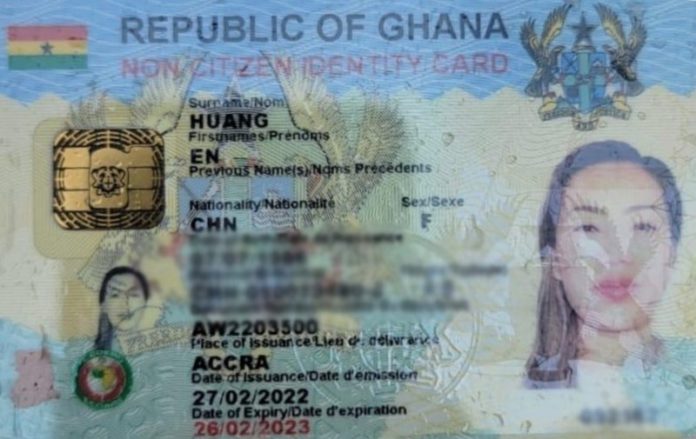

Following the government’s policy on the use of a unique identifier for all taxpayers, the Personal Identification Number on the Ghana Card (Ghana Card PIN) is to replace the Taxpayers Identification Numbers (TINs) of individuals for tax identification purposes.

Unmatched TINs

Responding to questions from the Daily Graphic for an update on some of the most crucial interventions of the revenue governing body, the Commissioner-General of the GRA, told the Daily Graphic that the authority had an existing TIN record of more than 5.74 million, but only 3.08 million could be matched with the records it received from the NIA, leaving 2.66 million unmatched with TIN records.

“The unmatched TIN records have been distributed to their assigned Taxpayer Service Centres for the necessary compliance activities,” he said.

He explained that there were concerns over 10 million Ghana Card holders who were yet to be registered with the GRA, “as our assumption is that they are income earners or potential income earners who have to be captured in our system to enable us to mobilise the needed revenue for development of the nation.”

Rev. Dr Owusu-Amoah explained that there were currently two approaches by which an individual TIN number could be linked to the Ghana Card, namely the automatic link and the manual link.

The automatic link occurred when the individual’s data transferred from the database of the NIA to that of the GRA were in sync and automatically linked by the integrated system, while the manual link occurred when an individual’s data transferred from the database of the NIA to the database of the GRA were not in sync.

To manually link the Ghana Card PIN and TIN, he said the GRA had made available three channels, comprising taxpayers visiting the GRA offices with required documents, using the Self-Service Portal to submit the TIN to the Ghana Card PIN link request via: https://myid.gra.gov.gh while taxpayers with no internet facility can use the USSD short code *299# to submit their TIN to the Ghana Card PIN link request.

Following the full integration of the TIN and Ghana Card PINs, he said taxpayers were notified of the status of their request via Email and SMS.

Validating tax returns

On the outcome of the electronic issuance of invoicing (e-VAT) project popularly known as the e-VAT, he said it had resulted in a change in taxpayer behaviour and resulted in improved voluntary compliance.

E-VAT has been piloted since October 1, 2022 with the aim of optimising revenue, while curbing abuses such as non-issuance of invoices, among others.

“Since its implementation, the Authority has been able to validate the accuracy of VAT returns submitted by taxpayers,” he said.

So far, he said, 43 out of the 50 selected companies for the pilot had successfully integrated their systems to the authority’s system, while the configuration for full integration were being finalised for the rest.

The introduction of the e-invoicing system, he said, had culminated in an improvement in revenue collection and “there has been positive variance with the companies that have integrated so far.

The 19 taxpaying companies sampled from the E-VAT system saw an increase in their monthly sales from GH¢222 million in November 2021 to GH¢720 million in November 2022.

In December 2021, the total monthly sales of GH¢284 million also saw a huge increase to GH¢1 billion in December 2022.”

He said a key challenge encountered during the implementation of the programme was the reluctance of taxpayers to integrate their system with GRA’s system.

Another challenge, Rev. Dr Owusu-Amoah said, had to do with the technical capacity of some taxpayers to configure their systems to integrate with that of the GRA.

“Taxpayers had fears that the system would disrupt their businesses.

With intensive engagements, coupled with series of testing, their fears were allayed,” he said.

The Authority’s technical team, he said, therefore provided support to taxpayers as a means of creating an enabling environment for taxpayers to understand the technical requirements for integration.

As part of measures put in place to ensure compliance, he said the Authority periodically undertook mystery shopping to ascertain the effectiveness of its programme and ensured that taxpayers did not go contrary to the law.